NBT Bancorp Inc. Receives Regulatory Approval, Evans Bancorp, Inc. Shareholders Approve Merger

20 Dezembro 2024 - 5:00PM

NBT Bancorp Inc. (“NBT”) (NASDAQ: NBTB) announced that it has

received regulatory approval to complete the proposed merger (the

“Merger”) of Evans Bancorp, Inc. (“Evans”) (NYSE American: EVBN)

with and into NBT and Evans Bank, N.A. (“Evans Bank”) with and into

NBT Bank, N.A. (“NBT Bank”). The Office of the Comptroller of the

Currency approved the merger of Evans Bank with and into NBT Bank,

and NBT received a waiver from the Federal Reserve Bank of New York

for any application with respect to the merger of Evans with and

into NBT.

On December 20, 2024, the shareholders of Evans voted to approve

the Merger. Evans reported over 75% of the issued and

outstanding shares of Evans were represented at a special

shareholder meeting and over 96% of the votes cast were voted to

approve the Merger.

“We are pleased that we have received the necessary regulatory

approvals to proceed with the Merger and that Evans shareholders

have demonstrated strong support for the partnership that will

bring NBT and Evans together,” said NBT President and CEO Scott A.

Kingsley. “Team members from NBT and Evans have been working

closely to plan for a smooth transition in the second quarter of

2025, and we look forward to continuing to build on the

relationships Evans has established with their customers,

communities and shareholders as we extend NBT’s footprint in

Upstate New York into the attractive Buffalo and Rochester

markets.”

“These approvals are important milestones in the merger process,

and we are grateful that Evans shareholders have so positively

endorsed this strategic partnership,” said David J. Nasca, Evans

President and Chief Executive Officer. “Joining the NBT family will

benefit our customers and communities as they will continue to be

served by a combined organization upholds our shared culture and

values, maintains our relationship-focused approach, and offers an

elevated suite of financial products and services.”

On September 9, 2024, NBT, Evans, NBT Bank and Evans Bank

entered into an Agreement and Plan of Merger pursuant to which

Evans will merge with and into NBT in an all-stock transaction, and

immediately after, Evans Bank will merge with and into NBT Bank.

This Merger will bring together two highly respected banking

companies and extend NBT’s growing footprint into Western New York.

The Merger is expected to close in the second quarter of 2025 in

conjunction with the system conversion, pending customary closing

conditions.

About NBT Bancorp Inc.NBT Bancorp Inc. is a

financial holding company headquartered in Norwich, NY, with total

assets of $13.84 billion at September 30, 2024. NBT primarily

operates through NBT Bank, N.A., a full-service community bank, and

through two financial services companies. NBT Bank, N.A. has 155

banking locations in New York, Pennsylvania, Vermont,

Massachusetts, New Hampshire, Maine and Connecticut. EPIC

Retirement Plan Services, based in Rochester, NY, is a national

benefits administration firm. NBT Insurance Agency, LLC, based in

Norwich, NY, is a full-service insurance agency. More information

about NBT and its divisions is available online at:

www.nbtbancorp.com, www.nbtbank.com, www.epicrps.com and

https://www.nbtbank.com/Insurance.

About Evans Bancorp, Inc.Evans is a financial

holding company headquartered in Williamsville, NY, with total

assets of $2.28 billion at September 30, 2024. Its primary

subsidiary, Evans Bank, N.A., is a full-service community bank with

18 branches providing comprehensive financial services to consumer,

business and municipal customers throughout Western New York. More

information about Evans is available online at www.evansbancorp.com

and www.evansbank.com.

Forward-Looking StatementsThis communication

contains forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements about NBT and Evans and their industry involve

substantial risks and uncertainties. Statements other than

statements of current or historical fact, including statements

regarding NBT’s or Evans’ future financial condition, results of

operations, business plans, liquidity, cash flows, projected costs,

and the impact of any laws or regulations applicable to NBT or

Evans, are forward-looking statements. Words such as “anticipates,”

“believes,” “estimates,” “expects,” “forecasts,” “intends,”

“plans,” “projects,” “may,” “will,” “should” and other similar

expressions are intended to identify these forward-looking

statements. Such statements are subject to factors that could cause

actual results to differ materially from anticipated results.

Among the risks and uncertainties that could cause actual

results to differ from those described in the forward-looking

statements include, but are not limited to the following: (1) the

businesses of NBT and Evans may not be combined successfully, or

such combination may take longer to accomplish than expected; (2)

the cost savings from the merger may not be fully realized or may

take longer to realize than expected; (3) operating costs, customer

loss and business disruption following the merger, including

adverse effects on relationships with employees, may be greater

than expected; (4) the possibility that the merger may be more

expensive to complete than anticipated, including as a result of

unexpected factors or events; (5) diversion of management’s

attention from ongoing business operations and opportunities; (6)

the possibility that the parties may be unable to achieve expected

synergies and operating efficiencies in the merger within the

expected timeframes or at all and to successfully integrate Evans’

operations and those of NBT; (7) such integration may be more

difficult, time consuming or costly than expected; (8) revenues

following the proposed transaction may be lower than expected; (9)

NBT’s and Evans’ success in executing their respective business

plans and strategies and managing the risks involved in the

foregoing; (10) the dilution caused by NBT’s issuance of additional

shares of its capital stock in connection with the proposed

transaction; (11) changes in general economic conditions, including

changes in market interest rates and changes in monetary and fiscal

policies of the federal government; and (12) legislative and

regulatory changes. Further information about these and other

relevant risks and uncertainties may be found in NBT’s and Evans’

respective Annual Reports on Form 10-K for the fiscal year ended

December 31, 2023 and in subsequent filings with the Securities and

Exchange Commission.

Forward-looking statements speak only as of the date they are

made. NBT and Evans do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements. You are cautioned not to place

undue reliance on these forward-looking statements.

|

Contacts |

NBT Bancorp Inc. |

Evans Bancorp, Inc. |

| |

|

|

| |

Scott A. KingsleyPresident and

Chief Executive Officer |

David J. NascaPresident and

Chief Executive Officer |

| |

|

|

| |

Annette L. BurnsEVP and Chief

Financial Officer |

John B. ConnertonEVP and Chief

Financial Officer |

| |

|

|

| |

607-337-6589 |

716-926-2000 |

| |

|

|

| |

|

Evans Investor

RelationsDeborah K. Pawlowski, Alliance

Advisorsdpawlowski@allianceadvisors.com716-843-3908 |

| |

|

|

This press release was published by a CLEAR® Verified

individual.

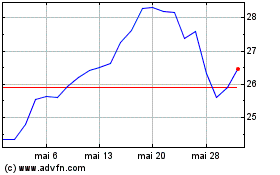

Evans Bancorp (AMEX:EVBN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

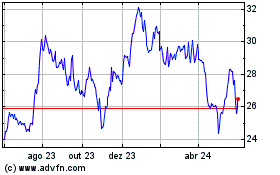

Evans Bancorp (AMEX:EVBN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025