Quisitive Technology Solutions, Inc. (“Quisitive” or the

“Company”) (TSXV: QUIS; OTCQX: QUISF) is pleased to

announce its management information circular (the

“

Circular”) in connection with the Company’s

upcoming special meeting (the “

Meeting”) of the

holders (the “

Shareholders”) of common shares of

Quisitive (the “

Shares”) is now available under

Quisitive’s profile on SEDAR+ (http://www.sedarplus.ca) as well as

on Quisitive’s website at

https://quisitive.com/special-meeting-vote/. The mailing of the

Circular and related materials for the Meeting, to Shareholders,

has also commenced.

The Arrangement and Meeting

Details

At the Meeting, Shareholders will be asked to

consider a resolution (the “Arrangement

Resolution”) approving the Arrangement (as defined below).

On December 31, 2024, the Company entered into an arrangement

agreement (as amended on January 28, 2025, the “Arrangement

Agreement”) with 1517079 B.C. Unlimited Liability Company

(“1517079”), an affiliate of funds managed by

H.I.G. Capital, LLC (a private equity investment firm), in respect

of a proposed statutory plan of arrangement (the

“Arrangement”) under the Business Corporations Act

(British Columbia). On January 28, 2025, 1517079 and Irving Parent,

Corp. (the “Purchaser”) entered into an assignment

agreement pursuant to which the Arrangement Agreement was assigned

by 1517079 to the Purchaser. The purpose of the Arrangement is to,

among other things, permit the acquisition by the Purchaser of all

of the issued and outstanding Shares. Under the terms of the

Arrangement Agreement, Shareholders will receive cash consideration

of C$0.57 for each Share held (the

“Consideration”), other than Shares held by those

Shareholders exchanging a portion of their Shares for an interest

in an affiliate of the Purchaser (the “Rollover

Shareholders”) and any Shareholder who has validly

exercised its dissent rights.

Quisitive will hold the virtual-only Meeting on

Friday, February 28, 2025, at 10:00 a.m. (Toronto time) online via

audio webcast at https://www.meetnow.global/MX6W2PF with the

ability for participation electronically in the virtual Meeting as

explained further in the Circular.

The Board of Directors of Quisitive

unanimously recommends that Shareholders vote IN

FAVOUR of the Arrangement Resolution.

Reasons for the

Arrangement and Board Recommendation

The following is a summary of the principal

reasons for the unanimous determination of the board of directors

of Quisitive (excluding an interested director) (the

“Board”) and the special committee of the Board

(the “Special Committee”) that the Arrangement is

in the best interests of Quisitive and the unanimous recommendation

of the Board that Shareholders vote FOR the

Arrangement Resolution.

-

Extensive Sale Process. The Arrangement is the

result of an extensive and rigorous seven-month sale process that

was initiated after the Company successfully divested its payments

division and involved the Company’s financial advisor contacting

189 potential buyers. The sale process was conducted under the

supervision of the Special Committee, which received advice from

its financial and legal advisors, during the course of the

process.

-

Strategic Review. The Arrangement is the result of

a strategic review process carried out by the Company and overseen

by the Special Committee, which was conducted over the course of

the last year and included the Company divesting BankCard and

PayiQ. The Special Committee, following discussion with the

Company’s financial advisor, concluded that the value of C$0.57 per

Share offered to Shareholders under the Arrangement is more

favourable (and can be achieved with less risk) than the value that

might have been realized through pursuing a number of other

strategic alternatives reasonably available to the Company,

including carrying on its business on a stand-alone basis, given

the Special Committee’s assessment of the current and anticipated

future opportunities and risks associated with the business

operations, assets, financial condition and prospects of the

Company should it pursue such other strategic alternatives.

-

Significant Premium. The value of the

Consideration offered to Shareholders under the Arrangement

represents a 57.1% premium to the 20-day volume-weighted average

price per Share on the TSX Venture Exchange for the period ending

on December 31, 2024, and a 52.0% premium to the closing price on

December 31, 2024.

-

Certainty of Value and Liquidity. The

Consideration being offered to Shareholders under the Arrangement

(other than the Rollover Shareholders) is payable entirely in cash,

which provides immediate liquidity and certainty of value to

Shareholders at a significant premium to the trading price of the

Shares on December 31, 2024, and removes the risks and volatility

associated with owning securities of the Company as an independent,

publicly traded company.

Additional details with respect to the

Arrangement, the reasons for the unanimous recommendation of the

Board and Special Committee, as well as its potential benefits and

risks are described in the Circular.

Shareholders are encouraged to read the Circular

and vote their shares as soon as possible ahead of the proxy voting

deadline on Wednesday, February 26, 2025 at 10:00 a.m. (Toronto

time).

Shareholder Questions

Shareholders who have any questions or require

assistance with voting may contact Laurel Hill Advisory Group,

Quisitive’s proxy solicitation agent and Shareholder communications

advisor:

Laurel Hill Advisory Group

Toll Free: 1-877-452-7184 (for Shareholders in

North America)International: +1 416-304-0211 (for Shareholders

outside Canada and the US)By Email: assistance@laurelhill.com

About Quisitive

Quisitive a premier, global Microsoft partner

leveraging the power of the Microsoft cloud platform and artificial

intelligence, alongside custom and proprietary technologies, to

drive transformative outcomes for its customers. The Company

focuses on helping enterprises across industries leverage the

Microsoft platform to adopt, innovate, and thrive in the era of AI.

For more information, visit www.Quisitive.com and follow

@BeQuisitive.

For additional information, please

contact:

Matt Glover and John YiGateway

GroupQUIS@gateway-grp.com949-574-3860

Tami AndersChief of

Stafftami.anders@quisitive.com972.573.0995

Forward-Looking Information

Certain statements included in this press

release may constitute “forward-looking statements” within the

meaning of applicable Canadian securities legislation. More

particularly and without limitation, this press release contains

forward-looking statements and information regarding, among other

things, the impact of the Arrangement and expected benefits to

Shareholders, the anticipated Meeting date and completion of

mailing of the Circular and Meeting materials. Except as may be

required by Canadian securities laws, the Company does not

undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Forward-looking statements, by their very nature, are

subject to numerous risks and uncertainties and are based on

several assumptions which give rise to the possibility that actual

results could differ materially from the Company’s expectations

expressed in or implied by such forward-looking statements and that

the objectives, plans, strategic priorities and business outlook

may not be achieved. As a result, the Company cannot guarantee that

any forward-looking statements will materialize, or if any of them

do, what benefits the Company will derive from them.

In respect of forward-looking statements and

information concerning the anticipated benefits and completion of

the Arrangement, the Company has provided such statements and

information in reliance on certain assumptions that it believes are

reasonable at this time, including assumptions as to the ability of

the parties to receive, in a timely manner and on satisfactory

terms, the necessary regulatory, court, stock exchange and

Shareholder approvals; the ability of the parties to satisfy, in a

timely manner, the other conditions for the completion of the

Arrangement, and other expectations and assumptions concerning the

proposed Arrangement. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct, that the proposed Arrangement will be

completed or that it will be completed on the proposed terms and

conditions. Accordingly, investors and others are cautioned that

undue reliance should not be placed on any forward-looking

statements.

Risks and uncertainties inherent in the nature

of the proposed Arrangement include, without limitation, the

failure of the parties to obtain the necessary Shareholder,

regulatory, stock exchange and court approvals or to otherwise

satisfy the conditions for the completion of the Arrangement;

failure of the parties to obtain such approvals or satisfy such

conditions in a timely manner; the Purchaser’s ability to complete

the anticipated debt and equity financing as contemplated by

applicable commitment letters or to otherwise secure favourable

terms for alternative financing in connection with the Arrangement;

significant transaction costs or unknown liabilities; the ability

of the Board to consider and approve, subject to compliance by the

Company with its obligations under the Arrangement Agreement, a

superior proposal for the Company; the failure to realize the

expected benefits of the Arrangement; and general economic

conditions. Failure to obtain the necessary Shareholder,

regulatory, stock exchange and court approvals, or the failure of

the parties to otherwise satisfy the conditions for the completion

of the Arrangement or to complete the Arrangement, may result in

the Arrangement not being completed on the proposed terms or at

all. In addition, if the Arrangement is not completed, and the

Company continues as an independent entity, there are risks that

the announcement of the Arrangement and the dedication of

substantial resources by the Company to the completion of the

Arrangement could have an impact on its business and strategic

relationships, including with future and prospective employees,

customers, suppliers and partners, operating results and activities

in general, and could have a material adverse effect on its current

and future operations, financial condition and prospects. The

Company does not intend, and disclaims any obligation, except as

required by law, to update or revise any forward-looking statements

whether as a result of new information, future events or

otherwise.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

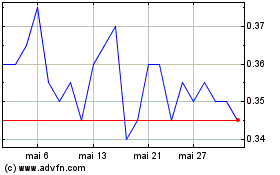

Quisitive Technology Sol... (TSXV:QUIS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Quisitive Technology Sol... (TSXV:QUIS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025