Mersana Therapeutics Provides Business Update and Announces Fourth Quarter and Full Year 2024 Financial Results

03 Março 2025 - 9:01AM

Mersana Therapeutics, Inc. (NASDAQ: MRSN), a clinical-stage

biopharmaceutical company focused on discovering and developing a

pipeline of antibody-drug conjugates (ADCs) targeting cancers in

areas of high unmet medical need, today provided a business update

and reported financial results for the fourth quarter and full year

ended December 31, 2024.

“We made significant progress advancing the clinical development

of Emi-Le in 2024,” said Martin Huber, M.D., President and Chief

Executive Officer of Mersana Therapeutics. “These efforts enabled

us to begin 2025 by announcing positive initial Phase 1 clinical

data, the initiation of expansion and a Fast Track designation for

HER2-negative breast cancer patients who have previously been

treated with at least one topo-1 ADC. With promising monotherapy

activity reported in patients across multiple tumors, including

those with heavily pretreated triple-negative breast cancer, as

well as a differentiated tolerability profile that may enable

combination approaches, we believe Emi-Le offers us unique

development opportunities that are unavailable to other B7-H4

ADCs.”

Emiltatug Ledadotin (Emi-Le; XMT-1660)In

January 2025, Mersana announced positive initial Phase 1 clinical

data for Emi-Le, the company’s lead Dolasynthen ADC candidate

targeting B7-H4, from 130 patients who were enrolled in dose

escalation and backfill cohorts as of a December 13, 2024 data

cutoff. The company also announced that Emi-Le had received a

second Fast Track designation from the U.S. Food and Drug

Administration (FDA).

The expansion portion of the company’s Phase 1 clinical trial

continues at a dose of 67.4 mg/m² administered every four

weeks in patients with TNBC who had received one to four prior

lines of therapy, including at least one topo-1 ADC. In parallel,

the company continues to explore higher doses in dose escalation

and backfill cohorts to identify a second dose for expansion.

In 2025, Mersana plans to initiate expansion enrollment at a

second dose in patients with TNBC who have received one to four

prior lines of treatment, including at least one prior topo-1 ADC.

The company also plans to present additional Phase 1 clinical data

from dose escalation and backfill cohorts in 2025.

XMT-2056Mersana has continued to advance the

dose escalation portion of its Phase 1 clinical trial of XMT-2056,

the company's lead Immunosynthen ADC candidate targeting a novel

HER2 epitope. GSK plc has an exclusive global license option to

co-develop and commercialize XMT-2056. Mersana plans to

continue enrolling patients in dose escalation and expects to

present initial clinical pharmacodynamic STING activation data for

XMT-2056 in 2025.

CollaborationsMersana continues to advance its

collaborations with both Johnson & Johnson (Dolasynthen

research collaboration) and Merck KGaA, Darmstadt, Germany

(Immunosynthen research collaboration).

Fourth Quarter 2024 Financial Results

- Cash, cash equivalents and marketable securities as of December

31, 2024 were $134.6 million. Mersana continues to expect that its

capital resources will be sufficient to support its current

operating plan commitments into 2026.

- Net cash used in operating activities for the fourth quarter of

2024 was $19.3 million.

- Collaboration revenue for the fourth quarter of 2024 was $16.4

million, compared to $10.7 million for the same period in 2023. The

year-over-year change was primarily related to increased

collaboration revenue recognized under Mersana’s collaboration and

license agreements with Johnson & Johnson, Merck KGaA,

Darmstadt, Germany and GSK.

- Research and development (R&D) expenses for the fourth

quarter of 2024 were $22.3 million, compared to $21.5 million for

the same period in 2023. Included in the fourth quarter of 2024

R&D expenses were $1.7 million in non-cash stock-based

compensation expenses. The year-over-year increase in R&D

expenses was primarily related to increased costs associated with

manufacturing and clinical development activities for Emi-Le and

XMT-2056, primarily offset by reduced costs related to clinical

development activities for UpRi, a discontinued ADC candidate.

- General and administrative (G&A) expenses for the fourth

quarter of 2024 were $8.9 million, compared to $10.1 million during

the same period in 2023. Included in the fourth quarter of 2024

G&A expenses were $1.7 million in non-cash stock-based

compensation expenses. The year-over-year decline in G&A

expenses was primarily related to reduced employee compensation

expense following the company’s 2023 restructuring and reduced

consulting and professional services fees.

- Net loss for the fourth quarter of 2024 was $14.1 million, or

$0.11 per share, compared to a net loss of $19.5 million, or $0.16

per share, for the same period in 2023.

Full Year 2024 Financial Results

- Net cash used in operating activities for full year 2024 was

$82.3 million.

- Collaboration revenue for full year 2024 was $40.5 million,

compared to $36.9 million for 2023. The year-over-year increase was

primarily related to incremental milestone payments associated with

the company’s Johnson and Johnson collaboration and license

agreement.

- R&D expenses for full year 2024 were $73.0 million,

compared to $148.3 million for the full year 2023. Included in 2024

R&D expenses were $8.9 million in non-cash stock-based

compensation expenses. The decline in R&D expenses was

primarily related to reduced costs associated with manufacturing

and clinical development activities for UpRi, reduced employee

compensation expenses following the company’s restructuring in

2023, and reduced consulting and professional services fees,

partially offset by increased costs for clinical development

activities for Emi-Le.

- G&A expenses for full year 2024 were $40.8 million,

compared to $59.5 million for the full year 2023. Included in 2024

G&A expenses were $7.6 million in non-cash stock-based

compensation expenses. The year-over-year decline in G&A

expenses was primarily related to reduced consulting and

professional services fees and reduced employee compensation

expense following the aforementioned restructuring.

- Net loss for full year 2024 was $69.2 million, or $0.56 per

share, compared to a net loss of $171.7 million, or $1.48 per

share, for the full year 2023.

Conference Call ReminderMersana will host a

conference call today at 8:00 a.m. ET to discuss business updates

and its financial results for the fourth quarter and full year of

2024. To access the call, please dial 833-255-2826 (domestic) or

412-317-0689 (international). A live webcast of the presentation

will be available on the Investors & Media section of the

Mersana website at www.mersana.com, and a replay of the webcast

will be available in the same location following the conference

call for approximately 90 days.

About Mersana TherapeuticsMersana Therapeutics

is a clinical-stage biopharmaceutical company focused on the

development of novel antibody-drug conjugates (ADCs) and driven by

the knowledge that patients are waiting for new treatment options.

The company has developed proprietary cytotoxic (Dolasynthen) and

immunostimulatory (Immunosynthen) ADC platforms that are generating

a pipeline of wholly-owned and partnered product candidates with

the potential to treat a range of cancers. Its pipeline includes

Emi-Le (emiltatug ledadotin; XMT-1660), a Dolasynthen ADC targeting

B7-H4, and XMT-2056, an Immunosynthen ADC targeting a novel epitope

of human epidermal growth factor receptor 2 (HER2). Mersana

routinely posts information that may be useful to investors on the

“Investors & Media” section of its website

at www.mersana.com.

Forward-Looking StatementsThis press release

contains “forward-looking” statements and information within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements may be identified by words such as “aims,”

“anticipates,” “believes,” “could,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “plans,” “possible,”

“potential,” “seeks,” “will” and variations of these words or

similar expressions, although not all forward-looking statements

contain these words. Forward-looking statements in this press

release include, but are not limited to, statements concerning

Mersana’s plans regarding the clinical development of Emi-Le and

XMT-2056, including with respect to the progress and design of the

clinical trials of these product candidates; the potential clinical

benefits of Emi-Le; Mersana’s efforts to identify an additional

dose for investigation in the expansion portion of its Phase 1

clinical trial of Emi-Le; Mersana’s planned data presentations,

including with respect to its Phase 1 clinical trial of Emi-Le and

to clinical pharmacodynamic STING activation data related to

XMT-2056; Mersana’s collaborations with third parties; the

development and potential of Mersana’s product candidates,

platforms, technology and pipeline of ADC candidates; and Mersana’s

expected cash runway. Mersana may not actually achieve the plans,

intentions or expectations disclosed in these forward-looking

statements, and you should not place undue reliance on these

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

these forward-looking statements as a result of various factors,

including, among other things, uncertainties inherent in research

and development, in the advancement, progression and completion of

clinical trials and in the clinical development of Mersana’s

product candidates, including Emi-Le and XMT-2056; the risk that

Mersana may face delays in patient enrollment in its Phase 1

clinical trials of Emi-Le and XMT-2056; the risk that outcomes of

preclinical studies may not be predictive of clinical trial

results; the risk that initial or interim results from a clinical

trial may not be predictive of the final results of the trial or

the results of future trials; the risk that clinical trial data may

not support regulatory applications or approvals; the risk that

Mersana may not realize the intended benefits of its platforms,

technology and collaborations; the risk that Mersana's projections

regarding its expected cash runway are inaccurate or that the

conduct of its business requires more cash than anticipated; and

other important factors, any of which could cause Mersana’s actual

results to differ from those contained in the forward-looking

statements, that are described in greater detail in the section

entitled “Risk Factors” in Mersana’s Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission (“SEC”) on

November 13, 2024, as well as in other filings Mersana may make

with the SEC in the future. Any forward-looking statements

contained in this press release speak only as of the date hereof,

and Mersana expressly disclaims any obligation to update any

forward-looking statements contained herein, whether because of any

new information, future events, changed circumstances or otherwise,

except as otherwise required by law.

| |

|

Mersana Therapeutics, Inc. |

|

Selected Condensed Consolidated Balance Sheet

Data |

|

(in thousands and unaudited) |

| |

| |

|

December 31, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Cash, cash equivalents and

marketable securities |

|

$ |

134,620 |

|

|

$ |

209,084 |

|

| Working capital(1) |

|

|

74,446 |

|

|

|

150,420 |

|

| Total assets |

|

|

144,663 |

|

|

|

226,060 |

|

| Total stockholders' (deficit)

equity |

|

|

(9,509 |

) |

|

|

36,904 |

|

| |

|

|

|

|

| (1) The

company defines working capital as current assets less current

liabilities. |

|

Mersana Therapeutics, Inc. |

|

Condensed Consolidated Statement of

Operations |

|

(in thousands, except share and per share data, and

unaudited) |

| |

| |

|

Three months ended |

|

Twelve months ended |

|

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue |

|

$ |

16,361 |

|

|

$ |

10,701 |

|

|

$ |

40,497 |

|

|

$ |

36,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

22,286 |

|

|

|

21,495 |

|

|

73,020 |

|

|

148,269 |

|

| General and

administrative |

|

8,886 |

|

|

|

10,134 |

|

|

40,813 |

|

|

59,543 |

|

| Restructuring expenses |

|

- |

|

|

|

499 |

|

|

- |

|

|

8,713 |

|

| Total operating expenses |

|

31,172 |

|

|

|

32,128 |

|

|

113,833 |

|

|

216,525 |

|

| Total other income, net |

|

694 |

|

|

|

1,883 |

|

|

4,562 |

|

|

8,000 |

|

| Loss before income taxes |

|

(14,117 |

) |

|

|

(19,544 |

) |

|

(68,774 |

) |

|

(171,670 |

) |

| Income tax expense |

|

- |

|

|

|

- |

|

|

(418 |

) |

|

- |

|

| Net loss |

|

$ |

(14,117 |

) |

|

$ |

(19,544 |

) |

|

$ |

(69,192 |

) |

|

$ |

(171,670 |

) |

| Net loss per share — basic and

diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.56 |

) |

|

$ |

(1.48 |

) |

| Weighted-average number of

common shares — basic and diluted |

|

123,558,203 |

|

|

|

120,614,350 |

|

|

122,539,598 |

|

|

116,112,891 |

|

Contact:Jason

Fredette617-498-0020jason.fredette@mersana.com

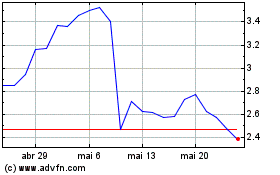

Mersana Therapeutics (NASDAQ:MRSN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Mersana Therapeutics (NASDAQ:MRSN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025