false

0001442836

0001442836

2025-03-03

2025-03-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 3, 2025

MERSANA THERAPEUTICS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38129 |

|

04-3562403 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

840

Memorial Drive

Cambridge,

Massachusetts |

|

02139 |

(Address of Principal Executive Offices)

|

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (617) 498-0020

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, $0.0001 par value |

MRSN |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On March 3, 2025,

Mersana Therapeutics, Inc. (the “Company”) issued a press release announcing business updates and financial results for

the fiscal quarter and year ended December 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this

Current Report on Form 8-K.

The information furnished

in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

such information be deemed incorporated by reference in any filing by the Company with the Securities and Exchange Commission (the “SEC”)

under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation

language contained in such filing, except as expressly set forth by specific reference in such a filing.

| Item 7.01 |

Regulation FD Disclosure. |

On March 3, 2025,

the Company posted an updated corporate presentation on the Company’s website. To access

the presentation, investors should visit the “Events & Presentations” page under the “Investors &

Media” section of the Company’s website at ir.mersana.com.

The information furnished

under this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject

to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing by the Company with the

SEC under the Securities Act or the Exchange Act, regardless of any general incorporation language contained in such filing, except as

expressly set forth by specific reference in such a filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MERSANA THERAPEUTICS, INC. |

| |

|

|

| Date: March 3, 2025 |

By: |

/s/ Brian DeSchuytner |

| |

|

Brian DeSchuytner |

| |

|

Senior Vice President, Chief Operating Officer and Chief Financial Officer |

Exhibit 99.1

Mersana Therapeutics Provides Business Update

and Announces

Fourth Quarter and Full Year 2024 Financial Results

| · | Announced positive initial Phase 1 clinical data and an additional Fast Track designation for Emi-Le |

| · | Initiated first expansion cohort in patients with triple-negative breast cancer (TNBC) previously treated with at least one topoisomerase-1

inhibitor (topo-1) ADC |

| · | Plan to present additional clinical data from dose escalation and backfill cohorts in 2025 |

| · | Conference call today at 8:00 a.m. ET |

CAMBRIDGE,

Mass., March 3, 2025 – Mersana Therapeutics, Inc. (NASDAQ: MRSN), a clinical-stage biopharmaceutical company

focused on discovering and developing a pipeline of antibody-drug conjugates (ADCs) targeting cancers in areas of high unmet medical need,

today provided a business update and reported financial results for the fourth quarter and full year ended December 31, 2024.

“We made significant progress advancing the clinical development

of Emi-Le in 2024,” said Martin Huber, M.D., President and Chief Executive Officer of Mersana Therapeutics. “These efforts

enabled us to begin 2025 by announcing positive initial Phase 1 clinical data, the initiation of expansion and a Fast Track designation

for HER2-negative breast cancer patients who have previously been treated with at least one topo-1 ADC. With promising monotherapy activity

reported in patients across multiple tumors, including those with heavily pretreated triple-negative breast cancer, as well as a differentiated

tolerability profile that may enable combination approaches, we believe Emi-Le offers us unique development opportunities that are unavailable

to other B7-H4 ADCs.”

Emiltatug Ledadotin (Emi-Le; XMT-1660)

In January 2025, Mersana announced positive initial Phase 1 clinical

data for Emi-Le, the company’s lead Dolasynthen ADC candidate targeting B7-H4, from 130 patients who were enrolled in dose escalation

and backfill cohorts as of a December 13, 2024 data cutoff. The company also announced that Emi-Le had received a second Fast Track

designation from the U.S. Food and Drug Administration (FDA).

The expansion portion of the company’s Phase 1 clinical trial

continues at a dose of 67.4 mg/m2 administered every four weeks in patients with TNBC who had received one to four prior lines

of therapy, including at least one topo-1 ADC. In parallel, the company continues to explore higher doses in dose escalation and backfill

cohorts to identify a second dose for expansion.

In 2025, Mersana plans to initiate expansion enrollment at a second

dose in patients with TNBC who have received one to four prior lines of treatment, including at least one prior topo-1 ADC. The company

also plans to present additional Phase 1 clinical data from dose escalation and backfill cohorts in 2025.

XMT-2056

Mersana has continued to advance the dose escalation portion of its

Phase 1 clinical trial of XMT-2056, the company's lead Immunosynthen ADC candidate targeting a novel HER2 epitope. GSK plc has an exclusive

global license option to co-develop and commercialize XMT-2056. Mersana plans to continue enrolling patients in dose escalation and

expects to present initial clinical pharmacodynamic STING activation data for XMT-2056 in 2025.

Collaborations

Mersana continues to advance its collaborations with both Johnson &

Johnson (Dolasynthen research collaboration) and Merck KGaA, Darmstadt, Germany (Immunosynthen research collaboration).

Fourth Quarter 2024 Financial Results

| · | Cash,

cash equivalents and marketable securities as of December 31, 2024 were $134.6 million.

Mersana continues to expect that its capital resources will be sufficient to support its

current operating plan commitments into 2026. |

| · | Net

cash used in operating activities for the fourth quarter of 2024 was $19.3 million. |

| · | Collaboration

revenue for the fourth quarter of 2024 was $16.4 million, compared to $10.7 million for the

same period in 2023. The year-over-year change was primarily related to increased collaboration

revenue recognized under Mersana’s collaboration and license agreements with Johnson &

Johnson, Merck KGaA, Darmstadt, Germany and GSK. |

| · | Research

and development (R&D) expenses for the fourth quarter of 2024 were $22.3 million, compared

to $21.5 million for the same period in 2023. Included in the fourth quarter of 2024 R&D

expenses were $1.7 million in non-cash stock-based compensation expenses. The year-over-year

increase in R&D expenses was primarily related to increased costs associated with manufacturing

and clinical development activities for Emi-Le and XMT-2056, primarily offset by reduced

costs related to clinical development activities for UpRi, a discontinued ADC candidate. |

| · | General

and administrative (G&A) expenses for the fourth quarter of 2024 were $8.9 million, compared

to $10.1 million during the same period in 2023. Included in the fourth quarter of 2024 G&A

expenses were $1.7 million in non-cash stock-based compensation expenses. The year-over-year

decline in G&A expenses was primarily related to reduced employee compensation expense

following the company’s 2023 restructuring and reduced consulting and professional

services fees. |

| · | Net

loss for the fourth quarter of 2024 was $14.1 million, or $0.11 per share, compared to a

net loss of $19.5 million, or $0.16 per share, for the same period in 2023. |

Full Year 2024 Financial Results

| · | Net cash used in operating activities for full year 2024 was $82.3 million. |

| · | Collaboration

revenue for full year 2024 was $40.5 million, compared to $36.9 million for 2023. The year-over-year

increase was primarily related to incremental milestone payments associated with the company’s

Johnson and Johnson collaboration and license agreement. |

| · | R&D

expenses for full year 2024 were $73.0 million, compared to $148.3 million for the full year

2023. Included in 2024 R&D expenses were $8.9 million in non-cash stock-based compensation

expenses. The decline in R&D expenses was primarily related to reduced costs associated

with manufacturing and clinical development activities for UpRi, reduced employee compensation

expenses following the company’s restructuring in 2023, and reduced consulting and

professional services fees, partially offset by increased costs for clinical development

activities for Emi-Le. |

| · | G&A

expenses for full year 2024 were $40.8 million, compared to $59.5 million for the full year

2023. Included in 2024 G&A expenses were $7.6 million in non-cash stock-based compensation

expenses. The year-over-year decline in G&A expenses was primarily related to reduced

consulting and professional services fees and reduced employee compensation expense following

the aforementioned restructuring. |

| · | Net

loss for full year 2024 was $69.2 million, or $0.56 per share, compared to a net loss of

$171.7 million, or $1.48 per share, for the full year 2023. |

Conference Call Reminder

Mersana will host a conference call today at 8:00 a.m. ET to discuss

business updates and its financial results for the fourth quarter and full year of 2024. To access the call, please dial 833-255-2826

(domestic) or 412-317-0689 (international). A live webcast of the presentation will be available on the Investors & Media section

of the Mersana website at www.mersana.com, and a replay of the webcast will be available in the same location following the conference

call for approximately 90 days.

About Mersana Therapeutics

Mersana

Therapeutics is a clinical-stage biopharmaceutical company focused on the development of novel antibody-drug conjugates (ADCs) and driven

by the knowledge that patients are waiting for new treatment options. The company has developed proprietary cytotoxic (Dolasynthen) and

immunostimulatory (Immunosynthen) ADC platforms that are generating a pipeline of wholly-owned and partnered product candidates with

the potential to treat a range of cancers. Its pipeline includes Emi-Le (emiltatug ledadotin; XMT-1660), a Dolasynthen ADC targeting

B7-H4, and XMT-2056, an Immunosynthen ADC targeting a novel epitope of human epidermal growth factor receptor 2 (HER2). Mersana routinely

posts information that may be useful to investors on the “Investors & Media” section of its website at www.mersana.com.

Forward-Looking Statements

This press release contains “forward-looking”

statements and information within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified

by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,”

“expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,”

“potential,” “seeks,” “will” and variations of these words or similar expressions, although not all

forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements

concerning Mersana’s plans regarding the clinical development of Emi-Le and XMT-2056, including with respect to the progress and

design of the clinical trials of these product candidates; the potential clinical benefits of Emi-Le; Mersana’s efforts to identify

an additional dose for investigation in the expansion portion of its Phase 1 clinical trial of Emi-Le; Mersana’s planned data presentations,

including with respect to its Phase 1 clinical trial of Emi-Le and to clinical pharmacodynamic STING activation data related to XMT-2056;

Mersana’s collaborations with third parties; the development and potential of Mersana’s product candidates, platforms, technology

and pipeline of ADC candidates; and Mersana’s expected cash runway. Mersana may not actually achieve the plans, intentions or expectations

disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results

or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result

of various factors, including, among other things, uncertainties inherent in research and development, in the advancement, progression

and completion of clinical trials and in the clinical development of Mersana’s product candidates, including Emi-Le and XMT-2056;

the risk that Mersana may face delays in patient enrollment in its Phase 1 clinical trials of Emi-Le and XMT-2056; the risk that outcomes

of preclinical studies may not be predictive of clinical trial results; the risk that initial or interim results from a clinical trial

may not be predictive of the final results of the trial or the results of future trials; the risk that clinical trial data may not support

regulatory applications or approvals; the risk that Mersana may not realize the intended benefits of its platforms, technology and collaborations;

the risk that Mersana's projections regarding its expected cash runway are inaccurate or that the conduct of its business requires more

cash than anticipated; and other important factors, any of which could cause Mersana’s actual results to differ from those contained

in the forward-looking statements, that are described in greater detail in the section entitled “Risk Factors” in Mersana’s

Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on November 13, 2024, as

well as in other filings Mersana may make with the SEC in the future. Any forward-looking statements contained in this press release speak

only as of the date hereof, and Mersana expressly disclaims any obligation to update any forward-looking statements contained herein,

whether because of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

Mersana Therapeutics, Inc.

Selected Condensed Consolidated Balance Sheet

Data

(in

thousands and unaudited)

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Cash, cash equivalents and marketable securities | |

$ | 134,620 | | |

$ | 209,084 | |

| Working capital(1) | |

| 74,446 | | |

| 150,420 | |

| Total assets | |

| 144,663 | | |

| 226,060 | |

| Total stockholders' (deficit) equity | |

| (9,509 | ) | |

| 36,904 | |

(1) The company defines working capital as current assets less current liabilities.

Mersana Therapeutics, Inc.

Condensed Consolidated Statement of Operations

(in

thousands, except share and per share data, and unaudited)

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Collaboration revenue | |

$ | 16,361 | | |

$ | 10,701 | | |

$ | 40,497 | | |

$ | 36,855 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 22,286 | | |

| 21,495 | | |

| 73,020 | | |

| 148,269 | |

| General and administrative | |

| 8,886 | | |

| 10,134 | | |

| 40,813 | | |

| 59,543 | |

| Restructuring expenses | |

| - | | |

| 499 | | |

| - | | |

| 8,713 | |

| Total operating expenses | |

| 31,172 | | |

| 32,128 | | |

| 113,833 | | |

| 216,525 | |

| Total other income, net | |

| 694 | | |

| 1,883 | | |

| 4,562 | | |

| 8,000 | |

| Loss before income taxes | |

| (14,117 | ) | |

| (19,544 | ) | |

| (68,774 | ) | |

| (171,670 | ) |

| Income tax expense | |

| - | | |

| - | | |

| (418 | ) | |

| - | |

| Net loss | |

$ | (14,117 | ) | |

$ | (19,544 | ) | |

$ | (69,192 | ) | |

$ | (171,670 | ) |

| Net loss per share — basic and diluted | |

$ | (0.11 | ) | |

$ | (0.16 | ) | |

$ | (0.56 | ) | |

$ | (1.48 | ) |

| Weighted-average number of common shares — basic and diluted | |

| 123,558,203 | | |

| 120,614,350 | | |

| 122,539,598 | | |

| 116,112,891 | |

###

Contact:

Jason Fredette

617-498-0020

jason.fredette@mersana.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

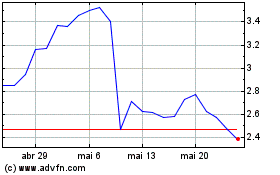

Mersana Therapeutics (NASDAQ:MRSN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Mersana Therapeutics (NASDAQ:MRSN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025