US Index Futures are marginally lower in Tuesday’s premarket,

awaiting important economic data, which may define the trajectory

of interest rates around the world.

By 6:51 AM, Dow Jones futures (DOWI:DJI) were down 7 points, or

0.02%. S&P 500 futures were down 0.01% and Nasdaq-100

futures were down 0.01%. The 10-year Treasury yield was at

4.21%.

On Tuesday’s US economic agenda, investors await, at 9:00 AM,

the release of July real estate prices, while at 10:00 AM the Labor

Department releases job offers for July, as measured by

Jolts. At the same time, the Conference Board consumer

confidence index will be released, which has a consensus of 116

points in August.

At 1 PM, the government holds yet another Treasury auction, this

time with a seven-year maturity. Yesterday, the US Treasury

put $46 billion in a five-year auction with a cut rate of

4,400%. At 4:30 PM, the API releases the weekly oil

inventory.

The week promises to be busy with the release of significant

economic indicators that could guide future monetary policy

decisions, such as the Payroll jobs report, the PCE price index and

a new assessment of the Gross Domestic Product (GDP).

In Germany, the GFK consumer confidence index fell to 25.50

points in September, beating pessimistic forecasts of 24.30 points,

indicating negative sentiment towards Europe’s largest

economy. Despite this, European stocks are up, following a

global positive momentum spurred by new stimulus measures in

China.

In Asian markets, the focus is on the rising unemployment rate

in Japan, which reached 2.70% in July. Chinese measures to

reduce taxes on stock market transactions are also influencing

optimism.

Country Garden, China’s largest private developer, is seeking to

extend the term of a $535.3 million bond by an additional 40

days. In addition, major Chinese state-owned banks are

considering lowering their local currency deposit rates by between

5 and 20 basis points, as reported by Bloomberg.

In commodities markets, West Texas Intermediate crude for

October was up 0.76% to trade at $80.71 a barrel. Brent crude

for October was up 0.75% near $85.05 a barrel. Iron ore

futures traded in Dalian, China, fell 1.04% to $110.99 a tonne, in

a realization move after a bull streak.

At the close of Monday, stocks had a positive day, influenced by

the flattening of the yield curve in the United States. The

Dow Jones rose 213.18 points or 0.62% to 3,560.08 points. The

S&P 500 rose 27.57 points or 0.63% to 4,433.28 points, while

the Nasdaq Composite rose 114.48 points or 0.84% to 13,705.13

points.

Jerome Powell, head of the US Central Bank, confirmed in his

statement the possibility of raising interest rates, depending on

factors such as the performance of the job market, wage variations

and inflation rates. At the same time, in Asia, the Chinese

government’s decision to cut rates applied to equity transactions

gave a boost to local markets.

Ahead of Tuesday’s corporate results, traders are watching

reports from Nio (NYSE:NIO), Best Buy (NYSE:BBY), Pinduoduo

(NASDAQ:PDD), Big Lots (NYSE:BIG), Bank of Nova Scotia (NYSE:BNS) ,

Catalent (NYSE:CTLT), among others. After closing, expect

reports from Hewlett Packard Enterprise (NYSE:HPE), HP Inc

(NYSE:HPQ), Box (NYSE:BOX), Ambarella (NASDAQ:AMBA), Joyy

(NASDAQ:YY), and more.

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – US Judge James

Donato plans to dismiss an antitrust class action lawsuit against

Google, claiming the company overcharged the Google Play

Store. The decision could limit the potential financial damage

to Google, a unit of Alphabet. In other news, Google plans to

license mapping data to renewable energy companies, a deal that

could fetch as much as $100 million in the first year, according to

CNBC. Potential partners

include SunRun (NASDAQ:RUN), Tesla

Energy (NASDAQ:TSLA), Zillow (NASDAQ:ZG), Redfin (NASDAQ:RDFN)

and Marriott (NASDAQ:MAR).

Microsoft (NASDAQ:MSFT) – In an interview

with CNBC, Brad Smith, President and Vice President of Microsoft,

emphasized the need for human oversight of artificial intelligence

(AI). He said that despite AI’s potential benefits, it also

poses risks and could be weaponized. On monday, Microsoft

shares rose 0.22%, in a positive day for the market, the second day

of consecutive gains. However, the company lagged behind

competitors like Apple (NASDAQ:AAPL) and

Alphabet (NASDAQ:GOOGL). Trading volume was

below the 50-day average.

Meta Platforms (NASDAQ:META) – New Zealand

plans to introduce a 3% tax on digital service revenues of large

multinationals, effective in 2025. The tax will affect companies

with global revenues above €750 million and local revenues above

3.5 million New Zealand dollars. Finance Minister Grant

Robertson has expressed concerns about inadequate taxation of

digital companies and said the country will not wait for an OECD

multilateral agreement.

AT&T (NYSE:T), Verizon (NYSE:VZ)

– Stocks are higher in premarket Tuesday after Citi upgraded both

companies’ ratings to Buy/High risk from Neutral.

Verizon (NYSE:VZ)

– Morgan Stanley (NYSE:MS)

predicts that Verizon will raise its dividend by about 2% in

September, continuing a 16-year trend despite concerns about lead

remediation costs. Analyst Simon Flannery notes that the

company generates sufficient cash flow to sustain payments.

Tesla (NASDAQ:TSLA) – Tesla is facing

judgments over alleged flaws in its Autopilot feature that have led

to fatal crashes. The cases represent a significant test for

both the technology and CEO Elon Musk’s reputation. These

trials will likely shed light on what Tesla and Musk knew about the

Autopilot system’s capabilities and possible

limitations. Given that autonomous technology is an important

part of Tesla’s future strategy, the results of these cases are

highly relevant. The company denies responsibility, saying the

autopilot is safe when monitored by humans.

Vinfast (NASDAQ:VFS) – Shares in Vinfast,

the Vietnamese maker of electric vehicles, jumped on Monday, taking

its market capitalization to $160 billion. With high

volatility, the company recently entered Wall Street and aims to

compete with Tesla (NASDAQ:TSLA) and Toyota (NYSE:TM). Its

focus is now on expanding sales in the US and Europe.

Toyota (NYSE:TM) – Toyota has halted

operations at its 14 factories in Japan due to a production system

issue. While the cause is still under investigation, it does

not appear to be a cyber attack. These factories represent a

third of the company’s global production.

Lordstown Motors (NASDAQ:RIDE) – Lordstown

Motors is seeking buyers for its business as it formulates a

Chapter 11 debt repayment plan. A US judge has denied

Foxconn’s (USOTC:FXCOF) attempt to thwart the

company’s bankruptcy efforts. The EV maker also faces lawsuits

and SEC investigations.

Nio (NYSE:NIO) – Analysts predict

the Chinese electric car maker will post a quarterly loss of 33

cents a share on sales of $1.3 billion, according to Bloomberg

data. The second quarter report comes against a backdrop of

concerns about competition, demand and the Chinese

economy. NIO shares in the US were up 1.6% ahead of Tuesday’s

premarket report.

American Airlines (NASDAQ:AAL) – The US

Department of Transportation fined American Airlines $4.1 million

for keeping passengers on the tarmac for hours in violation of

delay rules. It’s the biggest penalty of its kind, with $2.05

million credited to compensate those affected. American cited

“exceptional weather events” as the cause.

Micron (NASDAQ:MU), Intel (NASDAQ:INTC)

– US Commerce Secretary Gina Raimondo and Chinese Commerce Minister

Wang Wentao discussed restrictions on US companies, including Intel

and Micron Technology, and export controls at a recent

meeting. The two countries agreed to start exchanging

information on trade and export issues.

Intel (NASDAQ:INTC) – Intel

announced that its new data center chip, “Sierra Forest,” will

deliver 240% better performance per watt compared to previous

chips, marking a significant advance in energy efficiency. The

revelation was made at a conference at Stanford University.

Cisco

Systems (NASDAQ:CSCO), Nutanix (NASDAQ:NTNX)

– Cisco Systems and Nutanix announced a partnership to ease the

transition of businesses to multicloud systems. Cisco will

sell Nutanix’s cloud platform, which offers hyperconverged

infrastructure, through its computing and managed infrastructure

business.

Joann (NASDAQ:JOAN) – Shares in

Joann Inc. rose 7% in premarket Tuesday after an announcement of

increased quarterly sales, boosted by Halloween merchandise and

dorm decor. Although the company posted a loss in the second

quarter, sales beat expectations, with a strong performance in

July.

Best Buy (NYSE:BBY) – Best Buy results

will be revealing about consumer demand for electronics amid an

uncertain economic environment. While electronics sales have

suffered over the last year, some analysts believe demand may be

picking up, especially with the back-to-school season. Wall

Street expects a 7% drop in same-store sales, an improvement from

previous quarters.

Amazon (NASDAQ:AMZN) – Amazon CEO Andy

Jassy has warned employees who fail to abide by the

three-day-a-week return-to-the-office policy that they could lose

their jobs. According to Bloomberg, the measure has already

led to protests and low morale among employees, following recent

layoffs at the company. Additionally, Amazon has increased the

minimum spend for free shipping from $25 to $35 for non-Prime

customers in some markets. The move is part of a broader

strategy to cut costs, while the Prime program, with an annual cost

of $139, remains unchanged.

Heico (NYSE:HEI) – Heico announced fiscal

third-quarter earnings and revenue that beat analyst forecasts on

Monday. However, its operating margins decreased from 22.6% in

the previous year to 20.7%. The company’s shares fell 5.3% in

premarket trading on Tuesday.

CrowdStrike (NASDAQ:CRWD) – Shares in

CrowdStrike Holdings fell after a Morgan Stanley analyst downgraded

the company from Overweight to Equal Weight, lowering the price

target from $178 to $167. Citing a challenging demand environment

and potential slowdown in spending by large customers, the analyst

predicts a recovery only in 2025.

Vahanna Tech Edge

Acquisition (NASDAQ:VHNA) – Shares are down 11%

in premarket Tuesday, a day after rising 21% after shareholders

approved a business combination with insurance technology firm

Roadzen .

Bank of New York Mellon (NYSE:BK) – U.S.

Judge George Daniels in Manhattan dismissed much of Commerzbank’s

$1 billion lawsuit against Bank of New York Mellon related to

losses on toxic mortgages before the crisis. 2008. Daniels

dismissed claims on 87 of the 100 certificates purchased by

Commerzbank and also dismissed allegations of malpractice against

BNY Mellon.

Goldman Sachs (NYSE:GS) – Goldman Sachs

will sell part of its equity business to Creative Planning LLC as

part of a restructuring focused on the super-rich segment. The

deal, whose financial details were not disclosed, is expected to

close in the fourth quarter. The move comes after significant

losses elsewhere and an internal reorganization under CEO David

Solomon.

Hedge Funds – Data from Goldman Sachs

(NYSE:GS) says hedge funds have record exposure to the top seven

tech stocks, which now make up about 20% of the market cap held by

these funds. This includes companies such as Microsoft

(NASDAQ:MSFT), Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA), which

recently beat revenue expectations.

UBS (NYSE:UBS) – The Swiss Competition

Commission is investigating the merger of Credit Suisse and

UBS. The acquisition had already received swift approval from

the government and regulators. The results of the

investigation will be sent to FINMA by the end of September.

Robinhood Markets (NASDAQ:HOOD) – With a

portfolio containing around $3.1 billion worth of Bitcoin,

Robinhood Markets is now a significant player in cryptocurrency

trading in the US. The company is gaining market share even

against a backdrop of lower interest in cryptocurrencies due to its

competitive trading costs.

Catalent (NYSE:CTLT) – Catalent is close

to an agreement with Elliott Investment Management that could

include the addition of four new directors and a review of

strategies, including the sale of the company. The deal would

affect Catalent’s relationship with Novo

Nordisk (NYSE:NVO) and the drug

Wegovy. Elliott’s move could also weigh on Catalent’s already

volatile financial situation.

Mallinckrodt (AMEX:MNK) – Irish drugmaker

Mallinckrodt has filed for bankruptcy for the second time in the

US, aiming to cut $1 billion in debt related to the opioid

crisis. The restructuring plan would hand the company over to

creditors and eliminate existing equity stakes. The NYSE

suspended its shares.

Boston Scientific (NYSE:BSX) – Boston

Scientific, a medical device company, on Sunday reported promising

results for its treatment of atrial fibrillation, an irregular

heart rhythm condition.

Akero Therapeutics (NASDAQ:AKRO) – UBS has

begun tracking Akero Therapeutics with a ‘Buy’ rating, arguing that

its non-alcoholic steatohepatitis treatment has market potential

that is being undervalued.

Walmart (NYSE:WMT), Walgreens (NASDAQ:WBA), CVS (NYSE:CVS)

– Walmart, Walgreens and CVS are expanding their healthcare

services, including testing and treatment for various diseases,

previously restricted to doctors’ offices. This movement seeks

to capitalize on legislative changes that allow pharmacists to

treat simpler conditions, reducing the need for costly doctor

visits. Prices vary and are not yet covered by Medicare or

insurance.

Standard Chartered (USOTC:SCBFF) –

Standard Chartered is selling its aviation leasing business to

AviLease of Saudi Arabia for $3.6 billion to focus on areas where

it has a competitive advantage. The deal includes an initial

payment of US$700 million and additional financing of US$2.9

billion.

Disney (NYSE:DIS) – To combat the loss of

subscribers in India, Disney is offering free cricket streams on

smartphones. The strategy aims to increase advertising revenue

and recover users after a loss of US$ 41.5 million in the year

ended in March 2022.

3M (NYSE:MMM) – 3M has reached a final $6

billion settlement to settle allegations over the sale of defective

earplugs to the US military. The value of the deal is

significantly lower than analysts’ initial forecasts, which

estimated a cost of between $10 billion and $15 billion, bringing

relief to investors. As a result, 3M shares saw a lift, rising

0.4% in premarket trade after a 5.2% jump on Monday.

Hawaiian Electric Industries (NYSE:HE) –

After denying allegations that its power lines caused a deadly fire

in Maui, Hawaiian Electric Industries shares are up 5.15% in

premarket Tuesday after rising 45% on Monday, marking its biggest

percentage increase on record. The company faces lawsuits and

has suspended its dividend to shore up its cash position.

UGI Corp (NYSE:UGI) – Wells Fargo analyst

Sarah Akers upgraded the company’s rating to “Overweight” from

“Equal Weight”. While the company lowered its price target for

UGI due to structural challenges, it said the decline in the stock

now presents a “sufficiently attractive” valuation.

RPT Realty (NYSE:RPT) – RPT Realty

announced that Kimco Realty plans to acquire it in an all-equity

transaction valued at approximately $2 billion. Conor Flynn,

CEO of Kimco, highlighted that around 70% of RPT’s portfolio aligns

with its target markets. Completion of the agreement is

expected in early 2024.

Mister Car Wash (NYSE:MCW) – Piper Sandler

raised the company rating from “Neutral” to

“Overweight”. According to the firm, the company’s growth

potential is being underestimated by investors.

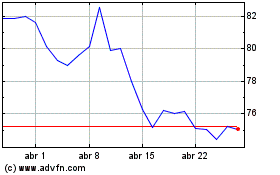

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024