US index futures are falling in pre-market trading on Wednesday,

a crucial day for markets due to the presentation of US inflation

data. This data could impact the Federal Reserve’s decision on

monetary policy next week.

At 7:07 AM, Dow Jones futures (DOWI:DJI) fell 52 points, or

0.15%. S&P 500 futures were down 0.14% and Nasdaq-100

futures were down 0.19%. The yield on the 10-year Treasury

note was at 4.306%.

The anticipation of consumer inflation influences a negative

trend in future indices. If the index is stable, the Fed may

consider keeping interest rates between 5.25% and 5.50%, postponing

a possible increase until November, in order to analyze more

information before deciding. Experts predict that inflation in

the US will increase by 0.60% in August, a rate well above the

0.20% recorded in July. Core inflation, which is crucial for

central banks’ decisions on monetary policy, is expected to grow

0.20% over the same period.

The MBA mortgage index showed that demand for mortgage

refinancing fell due to rising interest rates. There was a

0.8% drop in mortgage applications last week, with 30-year interest

rates hitting 7.27%. Requests for refinancing fell 5%, while

requests to purchase properties increased 1%.

In the remainder of Wednesday’s U.S. economic schedule, the

Department of Energy will release the week’s oil inventories at

10:30 a.m. At 1 PM, the Treasury announces the third Treasury

auction of the week, this time with a thirty-year

maturity. Yesterday, the government placed US$35 billion in

the tender, with a cut rate of 4.289%. Finally, at 2 PM, it

will be the turn of the federal budget balance, which has a

consensus of a deficit of US$240 billion in August, whereas in July

the deficit was smaller, at US$221 billion.

In the euro zone, industrial production in July recorded a

retraction of 1.1%, exceeding the forecast for a drop of

0.70%. This result highlights the bloc’s economic

challenges. In the United Kingdom, the drop was 0.70%, also

above expectations. Although these numbers show a slowdown,

the European Central Bank (ECB) anticipates that inflation in the

euro zone will remain above 3% until 2024. This suggests a possible

interest rate hike at Thursday’s meeting, as reported by

Reuters. However, many expect the rate to remain at 4.25% per

year.

Ursula von der Leyen, leader of the European Commission, said

the possibility of China providing excessive financial support to

electric car manufacturers will be investigated. She

emphasized that Europe values fair competition.

In Asia, there is an expectation of new incentives from the

Chinese government, especially for the real estate

sector. Asian markets closed lower today, with an eye on US

inflation. In Japan, producer prices grew 0.30% in August,

exceeding the estimate of 0.10%, negatively impacting higher risk

investments.

Regarding the real estate sector, according to Bloomberg,

Country Garden reached an agreement with creditors to extend the

payment of a debt of US$1.4 billion, easing its financial

burden.

In the commodities market, iron ore with a concentration of 62%

rose 0.47%, to US$118.09. West Texas Intermediate crude oil

for October rose 0.71% at $89.47 per barrel. Brent crude oil

for November rose 0.66% at US$92.69 per barrel.

At Tuesday’s close, stocks fell, especially the technology

sector, with attention focused on the CPI announcement. The

Dow Jones fell 17.73 points or 0.05% to 34,645.99. S&P 500 fell

25.56 points or 0.57% to 4,461.90. Nasdaq Composite fell 144.28

points or 1.04% to 13,773.61, largely offsetting the strong gain

recorded on Monday. Oracle presented a result below

expectations, with a decrease in its sales. The increase in

oil prices also influenced the growth of interest rates on

Treasuries, increasing the value of the dollar.

On Wednesday’s corporate earnings front, investors are watching

reports from Cracker Barrel (NASDAQ:CBRL), Burford (NYSE:BUR),

Semtech (NASDAQ:SMTC), Iris Energy (NASDAQ:IREN), Research

Solutions (NASDAQ:RSSS), among others.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL)

– At the event in

Cupertino, Apple launched a new series of

iPhones with titanium casing, advanced chip and better gaming

features. The iPhone 15 will launch on September 22 with a

subtle price increase, with new features powered by machine

learning. Apple’s iPhone 15 has received mixed reactions in

China, its third-largest market. Apple will launch three Apple

Watch models with recycled materials and as “carbon neutral”, using

renewable energy and reducing air transport. The company aims

for carbon neutrality by 2030 and is switching to less polluting

transport such as boats and trains. In other news, Apple

defended the iPhone 12’s compliance with global radiation standards

after French regulatory agency ANFR ordered a halt to sales in

France. ANFR claimed that the device exceeded European radiation

exposure limits.

Nvidia (NASDAQ:NVDA) – Startup Enfabrica

raised $125 million in capital, with Nvidia as a strategic

investor. Founded by former executives from Broadcom

(NASDAQ:AVGO) and Google (NASDAQ:GOOGL), Enfabrica designs chips

that optimize the use of Nvidia GPUs in AI data centers, making

them more efficient.

Taiwan Semiconductor

Manufacturing (NYSE:TSM) – TSMC, facing problems at

its Arizona factory, is increasingly optimistic about Japan as a

production base. With an $8.6 billion factory underway in

Kyushu, it is considering expanding capacity and adding another

unit. Japanese expansion could strengthen Japan’s position in

chip manufacturing. Japan’s work culture and government

support are seen as advantages.

Meta Platforms (NASDAQ:META) – Writers

including Michael Chabon have sued Meta Platforms, alleging that

the company improperly used their work to train the AI software,

Llama. They also filed a similar lawsuit against

OpenAI. Both companies face increasing copyright-related

challenges in AI training.

Microsoft (NASDAQ:MSFT) – EU antitrust

regulators are probing Microsoft’s rivals and customers about

impacts of Activision Blizzard’s proposed $69 billion

acquisition. After being blocked by the UK CMA, Microsoft

proposed selling streaming rights to Ubisoft.

Oracle (NYSE:ORCL) – Oracle shares fell on

Tuesday due to intense competition in the cloud sector and a

pullback in digital spending. Even after a 50% increase this

year with optimism about generative AI, recent results have

indicated a slowdown. CEO Safra Catz expressed concerns about

the growth of the healthcare sector Cerner, acquired by

Oracle. Analysts remain cautiously optimistic, acknowledging

fierce competition and integration challenges.

Broadcom (NASDAQ:AVGO), VMware (NYSE:VMW)

– Broadcom plans to merge with VMware on October 30, in a $75

billion deal. VMware shareholders can choose between Broadcom

shares or cash. Due to Broadcom’s appreciation, the stock

option is seen as advantageous. There are regulatory

uncertainties, mainly Chinese, regarding the approval of the

merger.

Amazon (NASDAQ:AMZN) – Amazon will invest

more than $440 million in wages for contract delivery drivers,

targeting an average wage of $20.50 per hour in the US. Its

DSP program, launched in 2018, helps deliver millions of packages

daily in 19 countries.

Virtu Financial (NASDAQ:VIRT) – The SEC

sued Virtu Financial, alleging the company left customer data

vulnerable and misled about data protections. Virtu defended

its protocols and denied misconduct, hinting at political

motivation behind the allegations.

UPS (NYSE:UPS) – The new five-year deal

between United Parcel Service and the Teamsters will cost less than

the union’s proposed $30 billion. The contract, which covers

340,000 UPS workers in the U.S., calls for increases in salary and

benefit costs by 3.3% annually.

Boeing (NYSE:BA) – In August, Boeing

delivered 35 planes, its lowest number since April, due to defects

in the 737 MAX. In total, it delivered 344 planes in 2023,

while rival Airbus delivered 433. The company registered new orders

for 43 planes after considering two cancellations. SMBC

Aviation Capital has closed a $3.7 billion deal for 25 Boeing 737

MAX aircraft, bringing its orders to 81 jets. Scheduled for

2028 and 2029, the acquisitions support its growth plans and

customer demand.

Tesla (NASDAQ:TSLA) – Tesla led the most

shorted US stocks in August, according to Hazeltree. Its

shares rose following a Morgan Stanley note on supercomputer

Dojo. Charter Communications and Apple followed on the

list. Investors have been betting against Tesla, but Elon Musk

responded to a short position from Bill Gates, citing bankruptcy

risks. Hedge funds have rapidly increased their short

positions in recent weeks. Blackbird Capital’s Dan Izzo

admitted losses trying to bet against Tesla.

BYD (USOTC:BYDDY), Nio (NYSE:NIO), Xpeng (NYSE:XPEV)

– The European Commission is investigating the imposition of

tariffs on Chinese electric vehicles due to state

subsidies. Ursula von der Leyen highlighted the flood of cheap

electric cars on the market. Sales of Chinese EVs in Europe

have increased, affecting shares of Chinese manufacturers.

VinFast (NASDAQ:VFS) – Vietnamese electric

vehicle maker VinFast aims to expand into seven Asian markets,

focusing on Indonesia. Vinfast plans to invest US$1.2 billion

long-term in the Indonesian market, with US$200 million earmarked

for a factory scheduled for 2026, producing 30,000-50,000 units

annually.

General

Motors (NYSE:GM), Ford

Motor (NYSE:F) – Shares of General Motors and Ford

could come under pressure due to the potential strike by auto

workers in the US. Data from BondCliQ shows sales exceeding

purchases in the last 10 days for both. If negotiations

between automakers and the United Auto Workers union fail, some

146,000 workers could go on strike, seeking significant pay

increases and benefits.

Advance Auto Parts (NYSE:AAP) – Shares of

Advance Auto Parts declined after S&P Global Ratings downgraded

its credit rating to “non-investment grade.” S&P cited

Advance’s strategic challenges and weak performance, although it

predicted gradual improvement. In response, Advance

highlighted its financial strategies and search for operational

improvements. S&P expressed additional concerns about the

company’s strategy.

RTX Corp (NYSE:RTX) – North American

engine manufacturer RTX has revealed a manufacturing flaw in Airbus

A320neo jet engines, potentially affecting hundreds of

planes. This fault, a defect in the metal, can cause cracks in

engine components. RTX plans to recall 600 to 700 engines for

inspections over the next three years. The global aerospace

industry is concerned about rising costs and reductions in flight

capacity. Airlines, such as Lufthansa and Air New Zealand,

foresee significant impacts on their operations.

GoDaddy (NYSE:GDDY) – Investor Starboard

Value claimed that GoDaddy is undervalued and suggested selling if

performance does not improve. GoDaddy, a leader in domain

registration, faces financial challenges

post-pandemic. Starboard, which owns 7.8% of the shares,

criticizes the company’s goals and spending.

Goldman Sachs (NYSE:GS) – Goldman Sachs

CEO David Solomon predicts the U.S. economy will avoid a major

recession, but warns of persistent inflation. Believing in a

more optimistic economic environment, he sees IPOs

flourishing. Solomon, however, criticizes US proposals that

would increase capital requirements for banks, arguing that this

would affect growth and companies’ access to capital. He also

commented on the recent departures of senior bankers from Goldman

following internal restructurings.

Wells Fargo (NYSE:WFC) – Wells Fargo plans

to increase efficiency, possibly further reducing its workforce,

which has already seen a 40,000 employee cut since 2020.

Morgan Stanley (NYSE:MS) – U.S. economic

growth in the third quarter, driven by entertainment, is seen as a

single peak. Morgan Stanley’s Vishwanath Tirupattur believes

the economy will slow and inflation will fall, limiting the Fed’s

rate hikes. He recommends long-term debt, anticipating lower yields

later in the year.

Citigroup (NYSE:C) – In the first half of

the year, rich families prioritized bonds and private equity,

reducing stocks, according to Citigroup research. Of the 268

family offices consulted, many increased fixed income

allocations. The dominant concerns were inflation, interest

rates and US-China tensions.

UBS Group (NYSE:UBS) – Goldman Sachs

analysts, led by Christopher Hallam, raised their target price on

UBS Group AG shares following its recent strong

performance. The new target is 35 Swiss francs from 25.80

Swiss francs. UBS, which is part of Credit Suisse after a

historic agreement, recovered after turbulence and stands out in

Europe. Hallam predicts $6 billion in share buybacks from UBS

in 2025.

HSBC (NYSE:HSBC) – Michael Krantz, a

former HSBC associate, sued the bank alleging discrimination due to

his Jewish faith and request for parental leave. Krantz claims

that after requesting time off for Jewish holidays and parental

leave, he was given reduced, less significant duties and was

subsequently fired. HSBC representatives did not comment on

the case.

Northern Trust (NASDAQ:NTRS) – Northern

Trust Corp predicted a larger decline in net interest income (NII)

in Q3. Jason Tyler revealed that the NII could fall by up to

10%, double the previous forecast. Amid high interest rates,

the company faces rising costs. Its deposits are down 10%, but

Tyler indicates recent stabilization. The company also

predicts limited economic growth and slower stock returns.

BP (NYSE:BP) – BP plans to invest $10.7

billion in Germany by 2030 in low-carbon fuels, renewable energy

and electric vehicle charging infrastructure, aiming to rival local

energy companies. The strategy includes expanding the electric

charger network, decarbonizing refineries and investing in wind

energy and low-carbon hydrogen imports. Additionally, Bernard

Looney, CEO of BP, resigned due to non-disclosure of past

relationships with colleagues. Murray Auchincloss will be

interim CEO. Looney took over in 2020, targeting net zero

emissions by 2050 and investment in renewable energy.

Enphase Energy (NASDAQ:ENPH) – Enphase

Energy shares were downgraded by Truist due to concerns about a

slow recovery in the U.S. residential solar market. Analyst

Jordan Levy downgraded Enphase to “Hold” and lowered the price

target to $135. The stock is down 54% in 2023. However, recent tax

incentives could boost solar demand in the future.

Nike (NYSE:NKE) – At Nike’s annual

meeting, investors rejected two shareholder proposals on equal pay

and sourcing policies. While requiring a majority for

approval, Nike is not required to adopt them. The company

faces pressure over transparency and labor issues.

Birkenstock – German brand Birkenstock has

filed for an initial public offering (IPO) in the US, marking a

trend of European companies seeking American

listings. Although financial details have not been fully

disclosed, the company’s net revenue grew 19% and profit fell

45.3%. Birkenstock’s popularity increased after its appearance

in the movie “Barbie”. The company plans to list its shares on

the NYSE as “BIRK”.

Philip Morris International (NYSE:PM) –

Philip Morris increased its quarterly dividend by 2.4% to $1.30 per

share, to be paid on October 12th to shareholders of record by

September 27th. Its shares are down 6.7% year to date, while

the S&P 500 is up 16.2%.

Rocket Pharmaceuticals (NASDAQ:RCKT) –

Rocket Pharmaceuticals rose 18% after announcing that it has

achieved agreement with the Food and Drug Administration on its

global Phase 2 trial to treat Danon’s disease, a lethal genetic

heart condition.

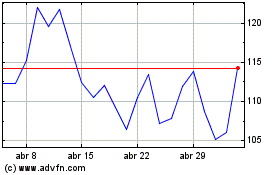

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025