1. Powell’s speech in the spotlight

Jerome Powell is set to hold the spotlight Thursday, as the

Federal Reserve chairman speaks at the Economic Club of New York

later in the session, with markets nervous that he may strike a

hawkish tone after a series of U.S. data pointed to strength in the

economy.

Fed policy makers have recently signaled that the central bank

may be close to ending its rate-hiking cycle, as rising yields have

done some of their job in cooling the economy by reining in

credit.

However, recent data has indicated that the labor market remains

strong and inflation sticky, and this prompted New York Federal

Reserve president John Williams to take a more hawkish

stance, stating Wednesday that the Fed will likely keep rates

higher for longer for “some time” to rein in inflation toward its

2% target.

The benchmark 10-year Treasury yield surged on

Wednesday, trading past 4.9% for the first time since 2007.

Another pause on rate hikes for November is nearly fully priced

in, according to Investing’s Fed Rate Monitor Tool, but the

odds of a December rate hike have jumped to 40% this week from 26%

last week.

2. Futures sell off as risk sentiment takes a hit

U.S. stock futures traded lower Thursday, continuing the

previous session’s weakness as rising bond yields prompted

investors to exit more risky assets.

At 04:50 ET, the Dow futures contract dropped 100

points or 0.3%, S&P 500 futures fell by 13 points or

0.3%, and Nasdaq 100 futures dropped by 34 points or

0.2%.

The major indices closed lower Wednesday, weighed by

escalating tensions in the Middle East and worries over elevated

bond yields, with the benchmark 10-year Treasury yield climbing to

its highest level since mid-2007.

Investors have started to become fearful of the possibility of

another rate increase in December to round out the year, and all

eyes will be on Federal Reserve Chair Jerome Powell as he speaks

later in the session [see above].

Economic data on deck include weekly jobless

claims, existing home sales for September and

the Philadelphia Fed manufacturing index for October.

There are more earnings to digest during the session [see

below], while Netflix (NASDAQ:NFLX) and Tesla (NASDAQ:TSLA) will

also be in the spotlight after the two corporate powerhouses

reported results after the close Wednesday.

3. Netflix soars with new subscribers; Tesla

disappoints

Netflix’s subscription service was in demand in the third

quarter, as the streaming giant shattered expectations for new

customers, sending its stock surging over 12% in premarket

trading.

The company said paid subscribers rose 8.76 million in the third

quarter, boosted by its efforts to restrict sharing of accounts,

well above expectations for just over 6 million.

These gains represented its strongest quarterly uptick since the

second quarter of 2020, in the early days of the global

pandemic.

Substantial subscriber additions came in Europe, the Middle East

and Africa, where Netflix added nearly 4 million subscribers. More

than 70% of its members now reside outside the United States.

Netflix also increased subscription prices for some of its

streaming plans as it posted revenue of $8.54 billion, in line with

forecasts. Earnings came in at $3.73 per share, ahead of Wall

Street’s expectation of $3.49.

Tesla, on the other hand, disappointed with its quarterly

results as its recent wave of electric vehicle price cuts

weighed on margins. Its stock fell over 4%

premarket.

Gross margins excluding credits, which have been closely watched

following recent price EV cuts, slowed to 16.1% in the third

quarter from 18.7% in the previous quarter.

Tesla delivered 435,000 EVs in the quarter, down from 466,140 in

the second quarter, with the company citing upgrades at various

factories for the decline in production volumes.

Tesla was also cautious about expanding electric vehicle

production capacity, with CEO Elon Musk saying he was worried that

higher borrowing costs would prevent potential customers from

affording its vehicles despite substantial price cuts.

4. Third-quarter earnings season continues

The quarterly earnings season continues Thursday, with results

due from the likes of American Airlines (NASDAQ:AAL), telecoms

company AT&T (NYSE:T), tobacco giant Philip Morris (NYSE:PM),

railroad operator CSX (NASDAQ:CSX), asset manager Blackstone

(NYSE:BX) as well as a number of regional banks.

So far, admittedly very early in the season, 83% of companies

have so far topped earnings expectations, while about 70% have

surpassed sales estimates, according to FactSet data.

Earlier Thursday, Taiwan Semiconductor Manufacturing (NYSE:TSM),

the world’s largest contract chipmaker and a major Apple

(NASDAQ:AAPL) supplier, posted an almost 25% fall in third-quarter

net profit as global economic woes hit demand for chips used in

applications from cars to cellphones and servers.

Nokia (NYSE:NOK) announced plans to cut up to 14,000 jobs in a

new cost reduction effort after the Finnish telecom gear

manufacturer’s third-quarter sales fell by a fifth, taken down by

sales of next-generation 5G equipment.

Today’s U.S. Earnings Spotlight: Thursday – October

19th

Philip Morris (PM), Union Pacific (UNP), Blackstone (BX),

AT&T (T), Intuitive Surgical (ISRG), Marsh McLennan (MMC), CSX

(CSX), Freeport-McMoran (FCX), Truist Financial Corp (TFC), Genuine

Parts (GPC), Fifth Third (FITB), Watsco (WSO), Snap-On (SNA), Pool

(POOL), KeyCorp (KEY), Knight-Swift Trans (KNX), American Airlines

(AAL), East West Bancorp (EWBC), Webster Financial (WBS), Iridium

(IRDM), Western Alliance (WAL), Home BancShares (HOMB), Alaska Air

(ALK), Bank Ozk (OZK), Badger Meter (BMI), ManpowerGroup (MAN),

Glacier (GBCI), WNS Holdings (WNS), Texas Capital (TCBI), WD-40

(WDFC), Associated Banc-Corp (ASB), Atlantic Union (AUB),

Independent Bank (INDB), BankUnited (BKU), Triumph Bancorp (TFIN),

Lindsay (LNN), 1st Source (SRCE), S&T Bancorp (STBA),

OceanFirst (OCFC), Dime Community (DCOM), Amerant Bancorp A (AMTB),

Insteel Industries (IIIN), Heritage Financial Co (HFWA), Five Point

(FPH), Metropolitan Bank (MCB).

5. Crude’s recent rally cools

Oil prices fell Thursday, handing back a lot of the previous

session’s sharp gains, as markets awaited more developments in the

Israel-Hamas war and the outlook for global supply.

By 04:50 ET, the U.S. crude futures traded 1.7% lower

at $85.75 a barrel, while the Brent contract dropped 1.7%

to $89.78 a barrel.

Crude prices climbed about 2% in the previous session on

concerns of disruptions to global supplies after Iran called for an

oil embargo on Israel over the conflict in Gaza and after the U.S.,

the world’s biggest oil consumer, reported a

larger-than-expected inventory draw.

However, the Organization of the Petroleum Exporting Countries

has shown few signs of taking any immediate action on Iran’s call,

easing worries over potential disruptions.

Prices have also been pressured after a deal was reached between

the Venezuelan government and the country’s political opposition to

ensure fair 2024 elections, potentially allowing the country’s oil

flows to reenter the global market after years of sanctions.

YESTERDAY

In Wednesday’s trading session, Wall Street’s major averages

ended lower. United Airlines Holdings Inc (UAL) plunged over -9%

after the carrier provided weaker-than-expected Q4 EPS guidance.

Also, Morgan Stanley (MS) slid more than -6% after reporting

weaker-than-expected Q3 wealth management net revenue. In addition,

Albemarle Corp (ALB) tumbled over -9% after Bank of America Global

Research downgraded the stock to Underperform from Neutral. On the

bullish side, Procter & Gamble Company (PG) rose more than +2%

after the company reported Q1 revenue, EPS, gross margin, and

organic sales that surpassed analysts’ estimates. Also, Nasdaq Inc

(NDAQ) climbed about +4% after delivering upbeat Q3

results.

Economic data on Wednesday showed that U.S. September Housing

Starts stood at 1.358M, compared to a consensus of 1.380M. Also,

U.S. Building Permits came in at 1.473M in September, stronger than

expectations of 1.455M.

Fed Governor Christopher Waller stated Wednesday that

policymakers can wait and collect more data before deciding whether

the economy necessitates further monetary restraint, indicating his

preference for keeping rates unchanged next month. “I believe we

can wait, watch, and see how the economy evolves before making

definitive moves on the path of the policy rate,” Waller said.

Also, New York Fed President John Williams said interest rates

would need to remain at restrictive levels “for some time” to lower

inflation to the U.S. central bank’s 2% target.

U.S. rate futures have priced in a 6.1% chance of a 25 basis

point rate increase at November’s monetary policy meeting and a

36.8% chance of a 25 basis point rate hike at the conclusion of the

Fed’s December meeting.

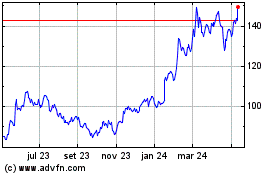

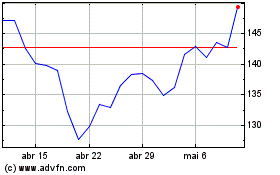

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024