U.S. index futures are down this Tuesday during the pre-market

period, reflecting investor caution. They eagerly await the release

of quarterly results from major U.S. companies, as well as the

publication of the minutes from the most recent meeting of the

Federal Open Market Committee (FOMC), scheduled for 2 PM.

At 6:05 AM, Dow Jones futures (DOWI:DJI) fell 64 points, or

0.18%. S&P 500 futures dropped 0.13% and Nasdaq-100 futures

fell 0.04%. The yield on 10-year Treasury bonds was at 4.408%.

In the commodities market, West Texas Intermediate crude oil for

January fell 0.42% to $77.50 per barrel. Brent crude oil for

January fell 0.45% to around $81.95 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, rose 1.34% to $132.85

a ton, the highest value since March 15.

There is also an expectation for the release of economic data

throughout the day, the October economic activity index at 08:30

AM. At 10 AM, it will be the turn of existing home sales, projected

at 3.9 million in October, while at 4:30 PM, the API will release

the weekly oil stock.

European markets showed mixed performances, amidst anticipation

for the FOMC minutes and news of the UK public sector net borrowing

reaching £14.9 billion in October, the second highest since 1993.

The British Finance Minister, Jeremy Hunt, may

announce tax cuts soon, seeking economic growth.

In Asia, stock markets displayed mixed trends on Tuesday. While

China’s Shanghai SE index and Japan’s

Nikkei experienced slight declines of 0.01% and

0.10%, respectively, South Korea’s Kospi rose by

0.77%, boosted by electronics stocks. Hong Kong’s Hang

Seng fell by 0.25%, affected by the technology sector, and

Australia’s ASX 200 saw an increase of 0.28%.

Market movements were influenced by a variety of factors, from

signs of support for the real estate sector to the strength of the

yen and demand for semiconductors.

U.S. stocks rebounded on Monday, with the

Nasdaq climbing 1.1% and reaching its best close

since July. The Dow Jones and the S&P

500 also saw significant gains. This advance reflected

investor optimism over stabilizing interest rates and signs of

slowing inflation, with expectations that the Fed will keep rates

stable until 2024. Bond yields fell after a bond auction, while

sectors like tobacco, software, airlines, and semiconductors

performed notably.

In Tuesday’s corporate earnings front, investors will be keen on

reports from Kohl’s (NYSE:KSS), Best

Buy (NYSE:BBY), Lowe’s (NYSE:LOW),

Medtronic (NYSE:MDT), Baidu

(NASDAQ:BIDU), Burlington (NYSE:BURL),

American Eagle (NYSE:AEO), Dick’s Sporting

Goods (NYSE:DKS), before the market opening. After the

close, the reports from Nvidia (NASDAQ:NVDA),

Hewlett-Packard (NYSE:HPQ), among others will be

observed.

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT) – Microsoft secured its

leadership in AI by hiring Sam Altman and other

top employees from OpenAI. This prevents a

possible departure to competitors and strengthens its position in

the AI race. Microsoft might also attract about 500 employees from

OpenAI, despite concerns over the startup’s stock

valuation. The team led by Altman at Microsoft will have access to

more computational resources, owing to Microsoft’s position as a

major cloud player.

Amazon (NASDAQ:AMZN) – The Spanish union

CCOO called for a one-hour strike per shift at

Amazon on November 27, “Cyber Monday,” seeking better wages and

working conditions. The strike will also occur the next day.

Moreover, three female employees of Amazon filed a lawsuit alleging

gender discrimination and pay inequality on Monday.

Alibaba (NYSE:BABA) – Alibaba Group canceled

its cloud services listing citing U.S. restrictions on

semiconductors, highlighting a global chip shortage. This creates a

divide between companies with access to necessary GPUs for AI and

those without. Alibaba, despite substantial resources, faces

competitive challenges in AI.

Nvidia (NASDAQ:NVDA) – Nvidia’s shares closed

at a record of $504.20 on Monday before the third-quarter fiscal

results, which will be released today, with expectations of a

significant increase in revenue. The earnings call may provide

valuable insights into the generative AI market.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC is considering building a third factory in Japan, producing

3-nanometer chips, potentially making the country a global hub for

chip manufacturing. TSMC is already building a factory in Japan for

less advanced chips and is investing in factories in the U.S. and

Germany.

Petrobras (NYSE:PBR) – The Brazilian government

is considering replacing Petrobras CEO Jean Paul

Prates, due to concerns about the company. President

Lula expressed dissatisfaction with Prates’

management and called for adjustments in the investment plan to

prioritize local jobs. Tensions regarding fuel prices have also

emerged. No immediate replacement has been announced.

Uber Technologies (NYSE:UBER) – Uber

Technologies increased its convertible bond offering to $1.5

billion, reflecting strong investor demand. The offering was priced

with a coupon of 0.875% and a conversion premium of 32.5%,

indicating strong market optimism for the company.

Tesla (NASDAQ:TSLA) – Tesla Inc. announced a

price increase for the Model Y long-range in China, raising it to

$42,212.70 as of Tuesday.

Fisker (NYSE:FSR) – Florus

Beuting, Fisker’s chief accounting officer, resigned just

two weeks after his appointment. He took up the role on November 6

to succeed John Finnucan, who left the company

amid issues related to internal controls over financial

reporting.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive announced that its CEO RJ Scaringe will

directly oversee product development, preparing to unveil a new

line of vehicles. The head of product development, Nick

Kalayjian, will assume an executive role before

transitioning to a consulting role in 2024.

Nio (NYSE:NIO) – Nio and Changan

Automobile have entered into an agreement to collaborate

on electric vehicle battery swapping, representing another

partnership between EV startups and traditional manufacturers,

aiming for expansion and joint technological development.

Toyota Motor (NYSE:TM) – Toyota agreed to pay

$60 million to settle charges by the U.S. regulator, the

Consumer Financial Protection Bureau (CFPB), that

it prevented car buyers from canceling unwanted product bundles.

This includes a civil fine of $12 million and $48 million to

compensate affected buyers since 2016. Toyota also agreed to make

it easier to cancel these products and to closely monitor dealer

activities.

Stellantis (NYSE:STLA) – Stellantis and

CATL signed a preliminary agreement to supply

battery cells and modules for electric vehicles in Europe,

including the possibility of a joint venture. Stellantis is also

building gigafactories in Europe to meet EV battery demands.

Additionally, Stellantis will start negotiations in December with

the Italian government to increase annual vehicle production to one

million in Italy. The talks will address investments in innovation,

supplier support, and will depend on government measures, such as

emission regulations and incentives for electric vehicles.

General Motors (NYSE:GM) – GM does not plan to

advertise in the 2024 Super Bowl, marking the first time since 2019

that it will not participate in the NFL game, as the company cuts

marketing costs as part of a broader strategy to reduce fixed

expenses.

Stellantis, General Motors

(NYSE:GM), Ford Motor (NYSE:F),

Tesla (NASDAQ:TSLA) – The United Auto

Workers (UAW) announced that 64% of Detroit automakers’

workers ratified new contracts that include a 25% increase in base

wages and improvements in benefits until April 2028. The union also

plans to organize foreign automobile factories and Tesla.

Caesars Entertainment (NASDAQ:CZR) – The

Culinary Workers and Bartenders Unions announced

that 10,000 Caesars Entertainment workers in Las Vegas ratified a

five-year contract. The landmark agreement includes reduced

cleaning quotas, daily room cleaning, and expanded recall rights.

Similar agreements with Wynn Resorts (NASDAQ:WYNN)

and MGM Resorts International (NYSE:MGM) are up

for vote. After seven months of negotiations, the planned November

10 strike in Las Vegas was averted.

Southwest Airlines (NYSE:LUV) – Andrew

Watterson, Southwest Airlines’ chief operating officer,

faces challenges to avoid travel disruptions during the holiday

season following an operational breakdown last year. The company

has invested in technology and training to cope with adverse

weather conditions and increased traffic.

Citigroup (NYSE:C) – Citigroup continues its

simplification strategy, eliminating over 300 senior management

roles, part of a restructuring led by CEO Jane

Fraser to speed up decision-making and align the structure

with the strategy. The company plans further cuts globally over the

next year. Additionally, Nacho Gutiérrez-Orrantia,

a senior banker, will lead Citigroup’s banking and cluster sector

in Europe as part of its restructuring. Citigroup also appointed

Carmen Haddad, a Middle East veteran, as

vice-chair to deepen operations in the region, focusing on senior

dialogue and expansion in Saudi Arabia. Moreover, Citigroup is

facing a sexual harassment lawsuit by a managing director who

alleges death threats from a former stock market head. The bank

denies and vows to defend itself.

Morgan Stanley (NYSE:MS) – Morgan Stanley

recommends that investors focus on higher-quality corporate bonds,

as the wave of maturities poses a risk for “junk” rated companies.

Morgan Stanley anticipates a resumption in loan issuances next year

for mergers and acquisitions.

Wells Fargo (NYSE:WFC) – Employees at two Wells

Fargo branches filed for union elections, marking a rare effort in

the U.S. financial sector. They seek unionization through the

Wells Fargo Workers United (WFWU) of the

Communications Workers of America. Wells Fargo has

reinforced its commitment to improving wages and benefits for its

employees.

Bank of America (NYSE:BAC) – Bank of America

plans to move its Japanese headquarters to an eco-friendly tower

under construction in Tokyo, aiming for a more modern space aligned

with its 2050 sustainability goals.

UBS (NYSE:UBS) – The team of financial advisors

led by Maureen Keating, Michael DeCorleto, Matthew Marques, and

Matthew Mardirosian, who manage about $700 million in

high-net-worth client assets, has joined UBS Wealth Management USA

at the Hartford office, One State Street.

Blackstone (NYSE:BX) – Blackstone plans to

close the Blackstone Diversified Multi-Strategy fund due to a

nearly 90% drop in assets over four years. The closure is expected

by the end of the year, according to Blackstone. Blackstone is

discussing capital reallocation options with investors.

Bain Capital (NYSE:BCSF) – Bain Capital has

closed its fifth pan-Asian private equity fund at $7.1 billion,

exceeding its initial target of $5 billion despite geopolitical

uncertainties. The fund’s focus is on Asia, with an emphasis on

Japan, and in sectors like healthcare, information technology,

entertainment, and consumer. Bain Capital manages about $180

billion in assets globally.

McDonald’s (NYSE:MCD) – McDonald’s will expand

its stake in China, acquiring Carlyle’s share, confident in its

growth. The deal, valued at about $6 billion, reflects the

company’s ongoing momentum in the rapidly growing Chinese

market.

Live Nation (NYSE:LYV) – Live Nation and its

subsidiary Ticketmaster have received a subpoena related to ticket

pricing, fees, and secondary sales from a U.S. Senate panel. The

subpoena was due to Live Nation’s lack of cooperation in a previous

investigation. The company claims to have provided extensive

information and seeks confidentiality assurances before providing

more.

Paramount Global (NASDAQ:PARA) – Paramount

Global’s shares rose 1.5% in Tuesday’s pre-market amid speculation

about a potential sale of the media company, following the

disclosure of new employment deals with executives, which include

change-of-control clauses. Paramount faces challenges in the

streaming landscape and high debt.

Earnings

Baidu (NASDAQ:BIDU) – Baidu has exceeded

financial expectations by diversifying into new fields like

Artificial Intelligence, shielding itself from economic challenges.

With a 6% increase in sales to $4.8 billion and a net profit of

approximately $940.72 million for the quarter, the company stands

out in a period of economic uncertainties. This progress, driven by

its chatbot Ernie and expansion into essential products, challenges

concerns about deflation in the Chinese economy and limited growth

in the tech sector.

Zoom Video Communication (NASDAQ:ZM) – Zoom

Video Communications’ shares are up 0.4% in Tuesday’s pre-market

following impressive quarterly results, driven by growth in

corporate clients and a reduction in individual user losses. Zoom

reported an adjusted earnings of $1.29 per share, significantly

exceeding expectations of $1.08 per share. Its revenue of $1.137

billion surpassed expectations, with the company projecting solid

results for the next quarter and revising its annual forecasts

upwards.

Keysight Technologies (NYSE:KEYS) – Keysight

Technologies announced quarterly earnings above expectations,

despite a challenging economic environment. The company recorded

earnings of $1.99 per share, with revenue of $1.31 billion,

predicting solid results for the next quarter. FactSet’s consensus

called for adjusted earnings of $1.87 per share on sales of $1.3

billion.

Symbotic (NASDAQ:SYM) – Symbotic’s shares rose

23% in Tuesday’s pre-market after reporting a 25% increase in

fourth-quarter revenue and exceeding adjusted profit expectations.

The company projected first-quarter revenue between $350 million

and $370 million, surpassing analyst forecasts and exceeding the

previous year’s $206.3 million.

Agilent Technologies (NYSE:A) – Agilent

Technologies’ shares rose 6.2% in Tuesday’s pre-market after

announcing a net profit of $475 million last quarter, with adjusted

earnings of $1.38 per share, beating estimates. However, revenue

fell to $1.69 billion, with a notable 17% decline in the

biosciences and applied markets group.

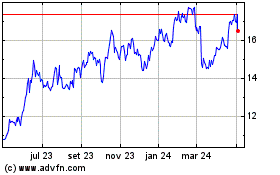

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024