US jobs report could heavily impact Bitcoin and markets

Bitcoin’s recent rise was influenced by falling interest rates,

which also benefited traditional markets. Recently, the

cryptocurrency market has shown remarkable growth, with Bitcoin,

the largest cryptocurrency, exceeding large companies in market

capitalization such as Tesla (NASDAQ:TSLA) and Visa (NYSE:V).

Bitcoin has reached a market capitalization of US$809.6 billion,

approaching the market cap of Meta (NASDAQ:META), making it become

the tenth largest global asset. Its value has increased by 23% in

the last 30 days, currently trading at US$43,670. The upcoming US

employment report could significantly affect Bitcoin (COIN:BTCUSD)

and financial markets.Expectations for interest rate cuts by the

Federal Reserve depend on the economic slowdown. Friday’s report,

expected to show a gain of 185,000 jobs, is crucial. Negative

results could boost Bitcoin, while positive results could hinder

its recovery.

Significant growth in Cardano’s TVL and rise in the price of ADA

The Cardano (COIN:ADAUSD) DeFi ecosystem is close to reaching

its highest value of locked assets (TVL) in 21 months, approaching

US$300 million, driven by the appreciation of the ADA token.

Cardano’s TVL is $298 million, an increase of 508% since the

beginning of the year. Trading volume on Cardano’s DEXs also grew,

indicating greater activity and confidence in the ecosystem.

Furthermore, the price of ADA has risen by more than 19.3% in the

last 7 days, contributing to the increase in Cardano’s market

capitalization.

Sudden spike and volatility in the price of BitTorrent’s BTT token

BitTorrent’s native token (COIN:BTTUSD), used in decentralized

file-sharing applications, has seen a notable jump of more than 75%

on Wednesday, reaching highs above US$0.0000011, the highest value

since May 2022. This increase came after the announcement that the

Tron network, the basis of the BTT token, surpassed 200 million

users. However, BTT has suffered a 30% drop since its peak, trading

at around $0.00000076, remaining a high-risk investment. The

utility of BTT, which aims to improve the BitTorrent protocol,

remains a concern for investors.

BNB faces difficulties after regulatory challenges

The BNB token (COIN:BNBUSD) from Binance, a leading

cryptocurrency exchange, recorded lower-than-expected growth,

contrasting with other digital assets. This trend reflects

Binance’s recent challenges, including admissions of guilt and a

$4.3 billion fine in US lawsuits. While the cryptocurrency market

grew by around 12% in the last week, BNB saw a modest increase of

1.58%. Regulatory investigations and the drop in Binance’s market

share, from 55% to 32% in spot trading and from 60% to 48% in

derivatives, impacted confidence in the token. With the recent

change in leadership to Richard Teng, Binance seeks restructuring

to regain its market position, but BNB continues to face

uncertainty.

Strategic partnership between Merit Circle DAO and Immutable to

strengthen Beam gaming ecosystem

Merit Circle DAO has joined forces with Immutable to expand its

Beam gaming ecosystem. Utilizing Immutable’s zkEVM scaling

solution, powered by Polygon, Beam will launch, offering advanced

tools for web3 game developers and improving user experience. This

collaboration integrates innovative technologies from Immutable,

such as Immutable Orderbook and Passport, aiming to increase

revenue and liquidity in games. The BEAM token (COIN:BEAMMUSD) has

grown 212% in the last 7 days.

Worldcoin launches ‘Wave0’ initiative to foster resilient

technology and equity

Worldcoin (COIN:WLDUSD), known for its iris scanning project,

has announced a new initiative called ‘Wave0’. This initiative aims

to support innovators in developing adaptive technologies and

promoting fairer systems, with a budget of 5 million dollars. Sam

Altman, CEO of OpenAI, supports the program that will be managed by

the Worldcoin Foundation, a non-profit entity. The fund will be

distributed across three categories of grants, paid in WLD tokens,

on the Ethereum blockchain. The selected projects should contribute

to the advancement of Worldcoin technology, including improvements

to World ID, the platform’s identification system. The foundation

also considers payments in stablecoins such as USDC

(COIN:USDCUSD).

JPMorgan Chase CEO Jamie Dimon strongly criticizes cryptocurrencies

in Senate

Jamie Dimon, CEO of JPMorgan Chase (NYSE:JPM), reaffirmed his

strong aversion to cryptocurrencies, suggesting a ban on digital

assets such as o Bitcoin (COIN:BTCUSD). In a session of the Senate

Banking Committee, questioned by Senator Elizabeth Warren, Dimon

associated cryptocurrencies with illicit activities and proposed

their closure if possible. His comments, consistent with previous

criticisms, include describing Bitcoin as a “scam.” However, he

recognized the potential of blockchain technology. During the

hearing, he and other bank CEOs agreed to apply anti-money

laundering regulations to crypto companies, similar to those for

traditional financial institutions.

Cathie Wood’s ARK Invest continues to sell Coinbase shares

ARK Invest, led by Cathie Wood, sold shares of Coinbase

(NASDAQ:COIN) again on Wednesday, raising about $ $24.3 million for

the sale of 180,422 shares. Sales were made through the ETFs ARKK

(AMEX:ARKK), ARKW (AMEX:ARKW ) and ARKF (AMEX:ARKF), while

Coinbase’s price remained near its 19-month high. The company also

sold shares of the Grayscale Bitcoin Trust (USOTC:GBTC), totaling

nearly $3.5 million.

UK FCA warns against cryptocurrency exchange Poloniex

The UK’s Financial Conduct Authority (FCA) has issued a warning

against Poloniex, a cryptocurrency exchange linked to Justin Sun,

for offering unauthorized financial services in the country. The

FCA has warned UK residents to avoid doing business with Poloniex,

highlighting that the company is not authorized to operate in the

region and that customers do not have access to complaints services

or financial compensation. Meanwhile, Poloniex faces challenges

including asset withdrawal issues following a recent hack.

Additionally, some cryptocurrencies are being traded on Poloniex at

discounts compared to other platforms.

Singapore crypto firm Cake Group begins liquidation process

Singapore-based Cake Group, the parent company of Bake, is

ceasing operations and seeking receivership. The decision, made by

founder U-Zyn Chua in the High Court of Singapore, follows a period

of financial difficulties, including layoffs of 30% of employees.

The liquidation order comes amid a decline in the company’s

revenue, which fell from $631 million in 2021 to $266 million in

2022, following a challenging period for the cryptocurrency

market.

Rise of Upbit, Bybit and CCData

Cryptocurrency exchanges Upbit, Bybit and CCData have recorded

the biggest gains in spot market share this year, according to OKX

analysis. Upbit, Bybit and CCData increased their market shares by

6.39%, 4.89% and 3.86%, reaching 9.20%, 5.80% and 7.41%,

respectively. On the other hand, Binance, BeQuant, and Crypto.com

experienced significant declines. In the derivatives markets, OKX

and Bybit saw substantial growth, while Binance faced the biggest

drop since October 2020, despite leading in monthly trading volume

in November, followed by OKX and Bybit with significant increases

in their volumes.

Robinhood launches crypto app in EU with Bitcoin rewards program

Robinhood (NASDAQ:HOOD) is expanding its crypto app to the

European Union, including a Bitcoin rewards program. Customers will

be able to earn a percentage of their BTC trading volume each

month. The program offers up to 1 BTC for new users and referrals,

with most rewards ranging between 10 to 20 euros. Rewards start at

0.10% for smaller trading volumes, increasing to 0.325% above €1

million with a 30-day account lock. The initiative follows the

recent launch of Robinhood in the UK and the discontinuation of

support for Cardano (COIN:BTCUSD), Polygon (COIN:MATICUSD) and

Solana (COIN:SOLUSD).

One Trading launches innovative crypto trading platform

One Trading, spun off from Bitpanda, is about to launch its

F.A.S.T platform, promising to be the fastest digital asset trading

venue ever seen. With a matching and risk engine operating in less

than a microsecond, it surpasses the speed of the London Stock

Exchange’s Turquoise and is a thousand times faster than the CME.

The platform will offer free trading in cryptocurrencies and seeks

to attract institutional traders, planning to launch derivatives

and structured products in the future.

Court case requires Craig Wright’s Tulip Trading to prove Bitcoin

ownership

Tulip Trading, owned by Craig Wright, who claims to be Satoshi

Nakamoto, creator of Bitcoin (COIN:BTCUSD), must prove the

possession of approximately 110,000 bitcoins in a lawsuit against

bitcoin developers initiated in 2021. The developers dispute

Tulip’s lawsuit, which accuses them of failing to help recover

billions in bitcoins allegedly lost in a hack. A preliminary trial

by the High Court of England and Wales will decide whether Tulip

actually owns these bitcoins. The case, filed in March 2022 and

reinstated after an appeal, will also investigate the occurrence of

the alleged hack and the loss of private keys. The Bitcoin Legal

Defense Fund, backed by Jack Dorsey among others, is involved in

the case.

Republican debate highlights cryptocurrencies and proposes changes

to the SEC

In the United States, the recent Republican presidential debate

discussed topics such as Bitcoin (COIN:BTCUSD), Ethereum

(COIN:ETHUSD), and SEC regulation. Pro-crypto candidate Vivek

Ramaswamy criticized the current U.S. regulatory approach, citing

cases like FTX and Binance. He proposed a significant reduction in

the SEC staff and suggested a more flexible treatment for most

cryptocurrencies, considering them as commodities, outside the

SEC’s reach. Ramaswamy also pointed out the SEC’s inefficiency in

clearly defining the regulatory nature of Ethereum.

Deloitte adopts Kilt blockchain for logistics services in the naval

industry

Deloitte, one of the leading accounting firms, is using

Polkadot’s Kilt blockchain to offer advanced logistics and supply

chain services in the naval industry. This initiative, in

collaboration with Nexxiot, includes the launch of the KYX logistic

service, a fusion of KYC (Know Your Client) and cargo tracking. The

system, built on the Kilt network, aims to improve security and

efficiency in customer identification and goods tracking, with

Hapag-Lloyd and Vodafone (NASDAQ:VOD) among the first to adopt

it.

Babylon raises $18 million to develop Bitcoin staking protocol

The Babylon project, focused on an innovative protocol for

Bitcoin staking, has raised $18 million in its Series A, led by

Polychain Capital and Hack VC. This funding, following the same

structure as the initial $8 million round, attracted investors like

Framework Ventures and Polygon Ventures. Babylon’s goal is to

integrate bitcoins into proof of staking (PoS) blockchains to

increase the security of these networks. Babylon’s implementation

is scheduled for the next Bitcoin halving in 2024, with plans to

expand the team and ecosystem.

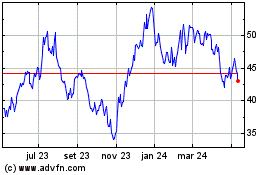

ARK Innovation ETF (AMEX:ARKK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

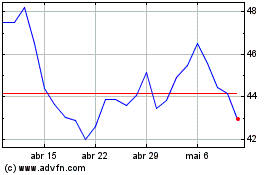

ARK Innovation ETF (AMEX:ARKK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024