U.S. index futures show a negative trend in pre-market trading

this Wednesday, in contrast to the robust recovery observed in the

major indices in 2023.

At 05:02 AM, the Dow Jones futures (DOWI:DJI) fell 19 points, or

0.05%. The S&P 500 futures fell 0.15%, and the Nasdaq-100

futures declined 0.28%. The 10-year Treasury bond yield stood at

3.892%.

In the commodities market, oil prices are on the rise, with

traders keeping an eye on developments in the Red Sea. West Texas

Intermediate crude oil for February rose 1.24% to $74.86 per

barrel. Brent crude oil for February increased by 1.12%, nearing

$80.12 per barrel. Iron ore with a 62% concentration, traded on the

Dalian exchange, rose 1.46% to $132.78 per ton.

On Wednesday’s economic agenda, investors are awaiting the

third-quarter current account balance, which will be published at

08:30 AM by the Department of Commerce. Additionally, consumer

confidence data for December will be released at 10:00 AM by the

Conference Board, and existing home sales for November at 10:00 AM

by the NAR. Petroleum inventory positions as of the past Friday

will be published at 10:30 AM by the Department of Energy

(DoE).

Most European markets are recording losses after a positive

previous session. Surprisingly, UK inflation fell to 3.9% in

November, well below October’s 4.6%, indicating a greater slowdown

than expected. This scenario exerts additional pressure on the Bank

of England for potential interest rate cuts in 2024. Recently, the

Bank kept its key interest rate stable at 5.25%, emphasizing that

monetary policy may need to remain restrictive for an extended

period.

Asian markets mostly closed higher. In Japan, stocks extended

gains after the Bank of Japan maintained its ultra-flexible

monetary policy, with interest rates at -0.1% and yield curve

control. BOJ Governor Kazuo Ueda expressed a dovish tone. In China,

benchmark lending rates remained steady, with the one-year rate at

3.45% and the five-year rate at 4.2%. Shanghai SE fell 1.03%, while

Nikkei rose 1.37%, Hang Seng increased 0.66%, Kospi advanced 1.78%,

and ASX 200 grew 0.65%.

On Tuesday’s close, the Dow, S&P 500, and Nasdaq registered

nine consecutive sessions of gains. Optimism about interest rates

persisted after the Fed announced cuts, and San Francisco Fed

President Mary Daly indicated further reductions due to improving

inflation. Residential construction surprised with a 14.8% increase

in November. Gold rose, boosting the NYSE Arca Gold Bugs Index, and

brokerage stocks also climbed. Sectors like biotechnology, oil

services, and steel showed strong performance.

On the corporate earnings front for Wednesday, investors will be

watching for reports from General Mills

(NYSE:GIS), Live Ventures Incorporated

(NASDAQ:LIVE), Winnebago Industries (NYSE:WGO),

Toro (NYSE:TTC), and others before the market

opens. After the closing bell, reports are expected from

Micron Technology (NASDAQ:MU),

BlackBerry (NYSE:BB), MillerKnoll

(NASDAQ:MLKN), among others.

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – Google plans to

restrict responses generated by its chatbot Bard and related

searches to U.S. elections until 2024, implementing restrictions

early this year. The measure aims to deal with concerns about

misinformation and online political influence, including major

global elections such as those in India and South Africa.

Masimo Corp (NASDAQ:MASI),

Apple (NASDAQ:AAPL) – Masimo’s CEO Joe Kiani is

open to a deal with Apple following the import ban of the Apple

Watch in the U.S. due to patent violations. Kiani seeks “honest

dialogue” and apologies from Apple. The company alleges that Apple

stole its intellectual property by hiring its engineers. Apple

disagrees and is pursuing legal options. Kiani suggests that a ban

could be avoided if Apple manufactured the watch in the U.S.,

unlike Masimo, which produces its technology locally.

Accenture (NYSE:ACN) – In the first quarter,

Accenture reported a revenue of $16.22 billion, a 3% increase.

However, revenue from communications, media, and marketing sectors

dropped 10%, and sales in North America fell 1%, reaching $7.56

billion. Accenture forecasts revenue below Wall Street estimates

for the second quarter, citing cautious customer spending due to

economic uncertainty.

General Motors (NYSE:GM), Toyota

Motor (NYSE:TM), Volkswagen (TG:VOW3) –

Major automakers, including GM, Toyota, and Volkswagen, oppose the

proposed recall of 52 million airbag inflators by the U.S. NHTSA,

arguing that risks are small and questioning the agency’s

rationale. The NHTSA seeks the recall after an eight-year

investigation related to one death and seven injuries in the U.S.

Automakers and airbag manufacturers claim the NHTSA has not

demonstrated the need for a massive and unprecedented recall. ARC

Automotive and Delphi Automotive are the manufacturers in question.

If the recall happens, it will be the second largest in U.S.

history.

Toyota Motor (NYSE:TM) – Daihatsu, a unit of

Toyota, will halt vehicle shipments due to safety issues in 64

models, including some from Toyota. The scandal also affected Mazda

and Subaru. Toyota announced a “fundamental reform” of Daihatsu to

restore its reputation, and shares remained stable in Wednesday’s

pre-market.

Tesla (NASDAQ:TSLA) – Tesla is not awarding

annual stock-based merit awards to its employees, according to

Bloomberg News. This follows the announcement by the United Auto

Workers union of an effort to organize the non-unionized automotive

sector in the U.S., including Tesla. However, employees received

modest salary adjustments, and some received stock renewals to

maintain competitive pay.

Boeing (NYSE:BA) – The FAA has no set timeline

to certify Boeing’s 737 MAX 7, prioritizing safety and complete

data. Boeing is seeking a waiver from regulations related to the

engine nacelle and anti-ice system of the MAX 7 to expedite

certification. Additionally, it was announced on Tuesday that

Lufthansa (TG:LHA) ordered 80 planes from Boeing and Airbus

(EU:AIR) worth $9 billion, including 40 Boeing 737 MAX 8s and 40

Airbus A220-300s, with future purchase options. It’s Lufthansa’s

first narrow-body Boeing plane purchase in 30 years and the first

of the 737 MAX model.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines and the pilots’ union reached a preliminary five-year

contract agreement worth $12 billion. The union will review the

deal before sending it to member voting. Negotiations lasted over

three years. Pilot shortages are increasing bargaining power in the

sector.

FedEx (NYSE:FDX) – FedEx announced an adjusted

profit of $1.01 billion for the quarter ending November 30,

equating to $3.99 per diluted share, 19 cents below analyst

expectations. The company also reduced its annual revenue forecast,

predicting a single-digit decline from the previous year. The

company still expects to earn between $17 and $18.50 per share in

fiscal year 2024, the same guidance provided in September. Shares

fell more than 9% after the announcement.

Alibaba (NYSE:BABA) – Alibaba’s co-founder and

executive chairman Eddie Wu will take over as CEO of Taobao and

Tmall Group, Alibaba’s main e-commerce unit. This is part of a

broader reshuffle after Alibaba was surpassed by other e-commerce

companies in China, and its stock lost value this year. In other

news, Japanese company BWB Inc. sued Alibaba in three countries for

alleged patent infringement in cross-border electronic

transactions. BWB seeks injunctions and damages in Japan, South

Korea, and the U.S., claiming Alibaba infringed its patents related

to customs clearance and logistics. Alibaba denied the

allegations.

Affirm (NASDAQ:AFRM), Walmart

(NYSE:WMT) – Affirm announced it will make its “buy now, pay later”

(BNPL) services available at self-service kiosks in over 4,500

Walmart stores in the U.S. Affirm’s shares have risen 411% this

year.

Lowe’s (NYSE:LOW) – Stifel downgraded Lowe’s,

the building materials retailer, from “Buy” to “Hold” but increased

the target price from $235 to $240.

Worthington Enterprises (NYSE:WOR) – In the

second fiscal quarter, Worthington Enterprises reported a net

profit of $24.3 million, or 49 cents per share, an increase from

the same period last year. However, revenue dropped 7.5% to $1.09

billion, influenced by its consumer products and sustainable energy

solutions units. The company completed the spin-off of its steel

processing business, Worthington Steel, in December.

FuelCell Energy (NASDAQ:FCEL) – FuelCell

reported fourth quarter financial results with revenue of $22.5

million and a loss of 7 cents per share, below Wall Street

expectations. The company attributed the revenue decline mainly to

lower product revenues and is seeking future growth and

profitability.

General Electric (NYSE:GE) – GE’s shares hit a

new 52-week high on Tuesday. The rise in shares is attributed to

improved profitability and corporate restructuring. Analysts are

also optimistic about 2024, reflected in the target prices of the

shares. GE’s division of its energy and aviation businesses is

planned for the first half of 2024.

Union Pacific (NYSE:UNP) – The prolonged

closure of two critical railway bridges between the U.S. and

Mexico, due to increased crossings by illegal migrants, is causing

“huge losses” and threatens the supply of yellow corn and soybean

meal in Mexico, essential for livestock and industry. The Mexican

agricultural lobby, CNA, warned about the critical situation,

noting that Mexican soybean meal supply ranges from 3 to 8 days,

while yellow corn ranges from 8 to 20 days. Union Pacific, the main

freight rail operator, estimates the daily economic impact of the

closures exceeds $200 million.

Steelcase (NYSE:SCS) – Steelcase announced

third quarter fiscal earnings above analyst estimates, but revenue

fell 6% to $777.9 million, below forecasts. The company predicted

fourth quarter revenues between $765 million and $790 million,

lower than the previous year. Shares fell 9.4% in Wednesday’s

pre-market.

Telefonica (NYSE:TEF) – The Spanish government

plans to acquire up to a 10% stake in Telefonica. The move aims to

provide Telefonica with greater shareholder stability and

corresponds to the recent purchase of a 9.9% stake in Saudi

Arabia’s STC.

Diageo (NYSE:DEO) – Diageo faces challenges

after the company warned last month of falling sales in Latin

America and the Caribbean. Demand for premium brands is lagging

behind cheaper options, making inventory clearance difficult.

Bigger challenges include a declining market in the U.S. and global

post-Covid slowdown. Shares have fallen 22% year-to-date, causing

investor skepticism.

Starbucks (NASDAQ:SBUX) – Starbucks’ CEO Laxman

Narasimhan stated that protests against the company related to the

Israel-Hamas conflict were influenced by misinformation on social

media. Starbucks also faced vandalism and publicly disagreed with a

union expressing support for Hamas on social media.

Airbnb (NASDAQ:ABNB) – Airbnb was fined by the

Australian Federal Court for misleading consumers about

accommodation prices. The company displayed prices only in U.S.

dollars without making it clear they were in foreign currency,

affecting over 2,000 Australian customers. Airbnb regretted the

incident and apologized to the affected customers.

Spotify (NYSE:SPOT) – American authors are

concerned about Spotify’s payment model for audiobooks, arguing it

could reduce their earnings. A group, the Coalition of Concerned

Creators, is calling for more transparency in payments. Spotify

defends its model, while publishers claim authors will receive

royalty credits for each unit listened to.

Kenvue (NYSE:KVUE) – Kenvue won a significant

legal case related to Tylenol, as a federal judge did not allow

plaintiffs to present evidence linking the drug to neurological

disorders in children.

BlackRock (NYSE:BLK) – BlackRock updated its

spot bitcoin ETF application to allow cash redemptions, seeking

regulatory approval. The move follows a trend of cryptocurrency

ETFs to revive the market after collapses in 2022.

HSBC Holdings (NYSE:HSBC) – HSBC has expanded

its equity research team in the Americas, hiring 12 analysts and

growing the team to 24 people. This allowed the bank to expand its

US equity coverage to more than 250 stocks across 83 sectors,

meeting growing demand from wealthy clients, especially in Asia.

HSBC’s wealth division manages around US$1.6 trillion in

assets.

UBS (NYSE:UBS) – UBS has appointed Nozomi

Moriya as equity strategist in Japan due to growing demand from

institutional investors as the Japanese stock market outperforms

many other markets. The Nikkei index is up 29% this year, and UBS

is expanding its presence in the country after acquiring Credit

Suisse. In addition, the bank appointed other professionals to

positions related to research in specific sectors.

Jefferies Financial Group (NYSE:JEF) –

Jefferies Financial Group has achieved success in the municipal

finance sector, becoming the fourth largest player. Kym Arnone and

her team’s leadership contributed to growth, securing major deals

and avoiding political controversy. She is the only woman to lead a

major public finance department and has a solid reputation.

Jefferies has expanded its presence in the sector, taking advantage

of the exit of other banks and hiring notable talent.

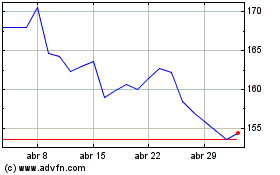

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024