U.S. index futures dipped slightly in premarket trading on

Thursday, following gains in the previous session, as investors

await September’s CPI data, which could influence Federal Reserve

policy. Consumer price data is expected to show moderate inflation,

hinting at smaller rate cuts.

At 5:57 AM, Dow Jones futures (DOWI:DJI) were down 42 points, or

0.10%. S&P 500 futures lost 0.13%, and Nasdaq-100 futures

dropped 0.15%. The 10-year Treasury yield stood at 4.082%.

In commodities, oil prices rose, driven by increased fuel demand

due to Hurricane Milton hitting Florida. Gasoline demand surged in

the state, with many stations running out of stock. Additionally,

rising tensions between Israel and Iran increased the risk of oil

supply disruptions, further supporting prices. Data released on

Wednesday showed U.S. crude oil inventories rose by 5.8 million

barrels, the largest increase since April.

West Texas Intermediate crude for November rose 1.53%, to $74.36

a barrel, while Brent for December climbed 1.37%, to $77.63 a

barrel.

Copper (CCOM:COPPER) dropped 0.3%, while aluminum

(CCOM:ALUMINUM) gained 0.2%. Copper prices reacted momentarily to

expectations of an imminent briefing from China’s government on

spending policies after recently hitting their lowest close in over

two weeks. Finance Minister Lan Fo’an is expected to discuss the

government’s commitment to infrastructure investments, which could

boost demand for commodities.

Gold prices (PM:XAUUSD) traded around $2,616.82, up 0.3%, as

traders awaited U.S. inflation data that could influence Federal

Reserve policy. Gold is down 1.6% for the week after closing lower

for six consecutive days as Treasury yields rose. Despite the

decline, gold has gained over 25% this year, driven by rate cuts

and geopolitical tensions.

In today’s U.S. economic agenda, at 8:30 AM, initial jobless

claims are expected to come in at 230,000, alongside September’s

consumer price index (CPI), expected to rise 0.1%, with core CPI

forecast at 0.2%. The annual CPI is projected at 2.3%, with core

annual CPI expected to remain at 3.2%.

At 9:15 AM, Federal Reserve Governor Lisa Cook will speak,

followed by Richmond Fed President Tom Barkin at 10:30 AM, and New

York Fed President John Williams at 11:00 AM.

Asia-Pacific markets closed higher on Thursday, boosted by gains

on Wall Street and a 2.8% rise in Japan’s producer prices in

September, beating the forecast of 2.3% and August’s 2.5%.

Australia’s S&P/ASX 200 gained 0.43%, reaching 8,223 points,

and South Korea’s Kospi advanced 0.34%, closing at 2,603.25, while

the Kosdaq fell 0.22%. In Japan, the Nikkei 225 rose 0.26%,

reaching 39,380.89, and the Topix climbed 0.2%. China’s CSI 300

gained 1.06%, while Hong Kong’s Hang Seng surged 3% in the final

hour of trading.

Chinese stocks resumed their upward trend, driven by

expectations for the scheduled briefing on October 12, which may

detail the anticipated fiscal stimulus. China’s central bank

activated a $70.7 billion (500 billion yuan) credit line to

stimulate markets.

Economic improvement in Japan and U.S. recession concerns are

raising expectations of a possible interest rate hike from the Bank

of Japan (BOJ) between December and January. However, opposition

from new Prime Minister Shigeru Ishiba could complicate the

timeline, despite pressure for adjustments due to controlled

inflation and rising wages.

Foreign investors bought $6.16 billion (¥919.3 billion) in

Japanese stocks in the week ending October 5, driven by a weaker

yen following comments from Prime Minister Shigeru Ishiba. It was

the largest net purchase since April.

Fast Retailing, owner of Uniqlo, posted its

third consecutive year of record profits, with a 31% increase in

operating profit, reaching $3.35 billion through August.

Investors also assessed Seven & i‘s

quarterly earnings after an acquisition offer from Couche-Tard. The

company lowered its operating and net profit forecasts, resulting

in a 0.43% drop in shares on Thursday.

European markets are trading lower, with investors cautious amid

global risks and uncertainties surrounding U.S. inflation. The

healthcare sector is performing well, led by GSK

Plc (LSE:GSK) after announcing a $2.2 billion settlement

to resolve Zantac-related lawsuits.

BPER Banca (BIT:BPE) shares also jumped after

unveiling new profit and dividend targets. Deutsche

Telekom (TG:DTE) shares rose with the announcement of a

share buyback program of up to €2 billion by 2025. On the other

hand, Repsol (TG:REP) shares dropped due to a

disappointing trading update.

Mercedes-Benz (TG:MBG) reported a 1% drop in

sales for the third quarter, with 503,600 cars sold. Battery

electric vehicle sales fell 31%, and in China, sales dropped 13%

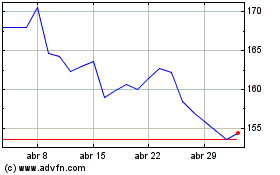

due to weaker demand and price cuts. Airbus

(EU:AIR) delivered 50 aircraft in September, down from 55 a year

earlier, totaling 497 for the year. The company mentioned that its

target of 770 deliveries is still achievable, but it depends on a

fourth-quarter boost.

Initial public offerings (IPOs) in Europe are rebounding after a

lull. Poland’s Zabka is set to raise $1.64 billion

in October, while Spain’s Cox Energy aims for $328

million. German publisher Springer Nature raised

up to €602 million, and Europastry canceled its

IPO due to market instability.

U.S. stocks closed higher on Wednesday, with the Dow rising

431.63 points, or 1.03%, and the S&P 500 gaining 0.71%, both

reaching record highs. The Nasdaq rose 0.6%. Investors reacted to

Federal Reserve minutes. Additionally, a narrower trade deficit of

$70.4 billion boosted market optimism.

According to Bloomberg, it’s unlikely that Jerome Powell will

implement another large rate cut while the labor market remains

strong. The recent half-point reduction was seen as a

recalibration, though some members preferred more gradual cuts,

considering the economy’s resilience.

A tight U.S. presidential race between Kamala Harris and Donald

Trump is raising investor concerns about a potential contested

outcome. The uncertainty could dampen the market rally, especially

if the contest drags on. Although the U.S. economy is strong,

expected volatility is worrying investors, who are bracing for

post-election turbulence.

In terms of quarterly earnings reports, numbers are expected

from Tilray (NASDAQ:TLRY), Delta

Air Lines (NYSE:DAL), Domino’s

Pizza (NYSE:DPZ), Thera

Technologies (NASDAQ:THTX)

and Neogen (NASDAQ:NEOG) before the

market opens. After the close, the focus will be on AEHR

Test Systems (NASDAQ:AEHR).

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025