U.S. index futures fell in pre-market trading this Friday, as

investors await the August jobs report for more clues about the

economy.

At 5:41 AM ET, Dow Jones futures fell 143 points, or 0.35%.

S&P 500 futures dropped 0.66%, and Nasdaq-100 futures fell

1.20%. The 10-year Treasury yield stood at 3.699%.

Today’s U.S. economic highlights include the jobs report,

expected at 8:30 AM, with forecasts of 161,000 jobs added in

August, compared to 114,000 in the previous month. Unemployment is

expected to dip slightly to 4.2% from 4.3%. Hourly wage growth is

anticipated to rise by 0.3%, with a 3.7% annual increase.

Additionally, New York Fed President Williams speaks at 8:45 AM,

followed by Governor Waller at 11 AM.

In the commodities market, oil prices stabilized as investors

awaited U.S. jobs data. The market also assessed the 6.9

million-barrel draw in crude stockpiles. OPEC+ postponed planned

production hikes for October and November due to falling prices and

weak demand concerns. The group will maintain a 2.2 million

barrel-per-day production cut until November and may adjust output

as necessary.

West Texas Intermediate crude for October rose 0.01% to $69.16

per barrel, while Brent for November increased by 0.08% to $72.76

per barrel.

Gold (PM:XAUUSD) exceeded $2,500 per ounce, quoted at $2,519.27,

driven by weak U.S. jobs data, signaling a potential rate cut by

the Federal Reserve. The metal, up 0.8% on Thursday, could benefit

further from a possible 50 basis point cut. A weaker dollar and

safe-haven demand amid Middle East and Ukraine crises also

supported gold prices, which have surged 20% this year, hitting a

record high in August.

Dalian iron ore futures hovered near a one-year low on Friday,

marking their largest weekly loss in nearly six months. Weak steel

demand in China, due to the property sector’s slowdown and

oversupply, has pressured ore prices. The steel market slump

negatively impacts iron ore. The most-traded January iron ore

contract on China’s Dalian Commodity Exchange (DCE), DCIOcv1, ended

daytime trading down 0.07% at $96.55 per metric ton.

Asia-Pacific markets closed mixed on Friday. Japan’s Nikkei 225

fell 0.72% after weak household spending data, and South Korea’s

Kospi dropped 1.21%. In contrast, Australia’s S&P/ASX 200 rose

0.39%. Hong Kong markets were closed due to Super Typhoon Yagi, and

China’s CSI 300 declined 0.81%.

According to a Reuters poll, Japan’s economy likely grew 3.2% in

the second quarter, slightly above the initial estimate of 3.1%,

driven by strong capital spending and private consumption. However,

external risks, such as slowdowns in the U.S. and China, could

affect future growth forecasts.

Japanese household spending increased just 0.1% in July, below

the forecasted 1.2%, reflecting caution amid rising prices. This

may complicate the Bank of Japan’s plans to raise interest rates.

Moreover, adjusted monthly spending fell 1.7%, adding uncertainty

to the economic recovery.

In China, the yield curve is becoming steeper, with investors

buying more short-term bonds and fewer long-term ones. The People’s

Bank of China is selling long-term bonds and buying short-term ones

to control rising long-term yields and maintain economic

stability.

European markets are down Friday morning after four consecutive

losing sessions this week.

In Germany, industrial production fell 2.4% in July,

highlighting ongoing struggles after an unexpected second-quarter

drop. The automotive sector was hit hardest, with Volkswagen

(TG:VOW3) considering factory closures. Growth forecasts have been

downgraded, with GDP expected to shrink 0.1% this year. The

manufacturing sector faces prolonged structural challenges.

Volvo (TG:8JO1) and Porsche (TG:PAH3) have seen a rise in short

sales, with 22% and 16% of their shares loaned out, respectively.

This reflects concerns over EU tariffs on Chinese electric cars and

possible Chinese retaliation. Volvo, particularly vulnerable, may

face challenges with its China-made electric SUVs.

Additionally, the European Aviation Safety Agency has ordered

inspections on Rolls-Royce (LSE:RR.) engines on Airbus A350-1000

(EU:AIR) aircraft after an incident involving Cathay Pacific

(TG:CTY).

Next week, the U.K. will release employment and economic growth

data.

Britain needs an additional $1.3 trillion in investments over

the next decade to boost economic growth. New Prime Minister Keir

Starmer is aiming for an annual growth rate of 2.5%, not seen since

before the 2008 crisis. Investment should focus on energy, housing,

and venture capital, potentially funded by the country’s pension

and insurance funds.

On Thursday, the Dow Jones fell 219.22 points, or 0.54%, closing

at 40,755.75, while the S&P 500 lost 0.30%, finishing at

5,503.41. The Nasdaq gained 0.25%, ending at 17,127.66 points. The

ADP reported 99,000 private-sector jobs added in August, below the

expected 145,000. Unemployment claims fell to 227,000. The airline

sector stood out, with the NYSE Arca Airline index rising 1.9%,

driven by JetBlue (NASDAQ:JBLU), which soared 7.2%.

Before the market opens, Big

Lots (NYSE:BIG), ABM

Industries (NYSE:ABM), Brady

Corporation (NYSE:BRC), Genesco (NYSE:GCO)

and BRP Inc. (NASDAQ:DOOO) will release

their quarterly reports.

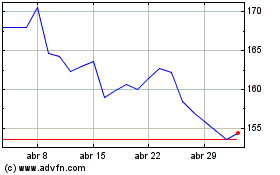

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Airbus (EU:AIR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025