Dow Reaches New Record Closing High But Nasdaq, S&P 500 Give Back Ground

12 Fevereiro 2024 - 7:03PM

IH Market News

Stocks showed a lack of direction over the course of the trading

session, with the major averages bouncing back and forth across the

unchanged before eventually closing narrowly mixed.

The Nasdaq and the S&P 500 had been poised to set new record

closing highs but pulled back into negative territory in afternoon

trading.

While the Nasdaq fell 48.12 points or 0.3 percent to 15,942.55

and the S&P 500 edged down 4.77 points or 0.1 percent to

5,021.84, the Dow rose 125.69 points or 0.3 percent to a record

closing high of 38,797.38.

The choppy trading on Wall Street came as traders took a

breather following recent strength, which has lifted the S&P

500 above 5,000 for the first time ever.

The tech-heavy Nasdaq has also shown a significant advance in

recent sessions, closing in the on the record highs set in November

2021.

A lack of major U.S. economic data also kept some traders on the

sidelines ahead of the release of several key reports in the coming

days.

On Tuesday, the Labor Department is due to release its report on

consumer price inflation in the month of January, which could have

a significant impact on the outlook for interest rates.

Reports on retail sales, industrial production, producer price

inflation and consumer sentiment are also likely to attract

attention later in the week.

Among individual stocks, shares of Teva Pharmaceutical

(NYSE:TEVA) soared by 7.5 percent after Piper Sandler upgraded its

rating on the pharmaceutical company to Overweight from

Neutral.

Space company Rocket Lab (NASDAQ:RKLB) also spiked by 8.8

percent after Citi resumed coverage of the company’s stock with a

Buy rating.

On the other hand, shares of Big Lot (NYSE:BIG) plunged by 28.0

percent after Loop Capital downgraded its rating on the discount

retailer to Sell from Hold.

Sector News

Despite the lackluster performance by the broader markets,

tobacco stocks moved sharply higher on the day, driving the NYSE

Arca Tobacco Index up by 3.5 percent.

Substantial strength was also visible among networking stocks,

as reflected by the 2.5 percent surge by the NYSE Arca Networking

Index.

Telecom stocks also showed a significant move to the upside,

resulting in a 1.8 percent jump by the NYSE Arca North American

Telecom Index.

Housing, natural gas and banking stocks also saw notable

strength, while software stocks came under pressure over the course

of the session.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower on Monday, with several major markets

closed for holidays. Australia’s S&P/ASX 200 Index fell by 0.4

percent, while India’s Sensex slid by 0.7 percent.

Meanwhile, the major European markets moved to the upside on the

day. While the German DAX Index and the French CAC 40 Index climbed

by 0.7 percent and 0.6 percent, respectively, the U.K.’s FTSE 100

Index closed just above the unchanged line.

In the bond market, treasuries have fluctuated over the course

of the session and are currently seeing modest strength. As a

result, the yield on the benchmark ten-year note, which moves

opposite of its price, is down by 1.9 basis points at 4.168

percent.

Looking Ahead

Trading on Tuesday is likely to be driven by reaction to the

Labor Department’s closely watched report on consumer price

inflation in the month of January.

Source: RTTNews.com

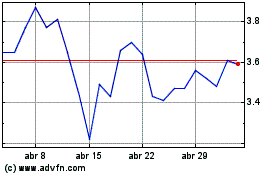

Big Lots (NYSE:BIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Big Lots (NYSE:BIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024