Hotter-Than-Expected Inflation Data Likely To Weigh On Wall Street

13 Fevereiro 2024 - 11:05AM

IH Market News

The major U.S. index futures are currently pointing to a sharply

lower open on Tuesday, with stocks likely to come under pressure

after ending the previous session narrowly mixed.

The futures showed a significant move to the downside following

the release of a highly anticipated Labor Department report showing

consumer prices in the U.S. increased by slightly more than

expected in the month of January.

The Labor Department said its consumer price index rose by 0.3

percent in January after inching up by 0.2 percent in December.

Economists had expected consumer prices to edge up by 0.2

percent.

Excluding food and energy prices, core consumer prices climbed

by 0.4 percent in January after rising by 0.3 percent in December.

Core prices were expected to increase by 0.3 percent.

While the report also showed the annual rate of consumer price

growth slowed to 3.1 percent in January from 3.4 percent in

December, economists had expected the pace of growth to slow to 2.9

percent.

The annual rate of core consumer price in January came in

unchanged from the previous month at 3.9 percent. The pace of core

price growth was expected to decelerate to 3.7 percent.

With Federal Reserve officials repeatedly saying they need more

“confidence” inflation is slowing before lowering interest rates,

the data is likely to further reduce optimism about a near-term

rate cut.

CME Group’s FedWatch Tool is currently indicating just a 5.5

percent chance of a quarter point rate cut in March, while the

chances of a quarter point rate cut in early May have fallen to

32.3 percent.

Stocks showed a lack of direction over the course of the trading

session, with the major averages bouncing back and forth across the

unchanged before eventually closing narrowly mixed.

The Nasdaq and the S&P 500 had been poised to set new record

closing highs but pulled back into negative territory in afternoon

trading.

While the Nasdaq fell 48.12 points or 0.3 percent to 15,942.55

and the S&P 500 edged down 4.77 points or 0.1 percent to

5,021.84, the Dow rose 125.69 points or 0.3 percent to a record

closing high of 38,797.38.

The choppy trading on Wall Street came as traders took a

breather following recent strength, which has lifted the S&P

500 above 5,000 for the first time ever.

The tech-heavy Nasdaq has also shown a significant advance in

recent sessions, closing in the on the record highs set in November

2021.

A lack of major U.S. economic data also kept some traders on the

sidelines ahead of the release of several key reports in the coming

days.

On Tuesday, the Labor Department is due to release its report on

consumer price inflation in the month of January, which could have

a significant impact on the outlook for interest rates.

Reports on retail sales, industrial production, producer price

inflation and consumer sentiment are also likely to attract

attention later in the week.

Among individual stocks, shares of Teva Pharmaceutical

(NYSE:TEVA) soared by 7.5 percent after Piper Sandler upgraded its

rating on the pharmaceutical company to Overweight from

Neutral.

Space company Rocket Lab (NASDAQ:RKLB) also spiked by 8.8

percent after Citi resumed coverage of the company’s stock with a

Buy rating.

On the other hand, shares of Big Lot (NYSE:BIG) plunged by 28.0

percent after Loop Capital downgraded its rating on the discount

retailer to Sell from Hold.

Despite the lackluster performance by the broader markets,

tobacco stocks moved sharply higher on the day, driving the NYSE

Arca Tobacco Index up by 3.5 percent.

Substantial strength was also visible among networking stocks,

as reflected by the 2.5 percent surge by the NYSE Arca Networking

Index.

Telecom stocks also showed a significant move to the upside,

resulting in a 1.8 percent jump by the NYSE Arca North American

Telecom Index.

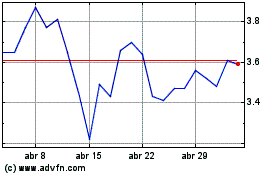

Big Lots (NYSE:BIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

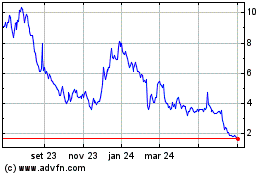

Big Lots (NYSE:BIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024