Futures Pointing To Continued Weakness On Wall Street

05 Março 2024 - 11:03AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Tuesday, with stocks likely to see further downside

following the modest pullback seen on Monday.

Traders may continue to cash in on recent strength in the

markets, which lifted the S&P 500 and the Nasdaq to record

closing highs last Friday.

Uncertainty about the outlook for interest rates may also weigh

on the markets ahead of congressional testimony by Federal Reserve

Chair Jerome Powell

Powell is due to testify before the House Financial Services

Committee on Wednesday and the Senate Banking Committee on

Thursday.

The Fed chief is likely to reiterate recent comments stressing

the central bank needs greater confidence inflation is slowing

before cutting interest rates.

The next monetary policy meeting is scheduled for March 19-20,

with the Fed widely expected to leave interest rates unchanged.

After a weak start and a long spell in negative territory, U.S.

stocks briefly managed to turn positive in the final hour of

trading on Monday but failed to find support and ended marginally

lower.

The mood was cautious throughout the day’s session due to a lack

of major U.S. economic data. Traders largely stayed on the

sidelines ahead of a several key events this week.

The major averages all ended in negative territory. The Dow

ended down 97.55 points or 0.3 percent at 38,989.83. The S&P

500 settled with a loss of 6.13 points or 0.1 percent at 5,130.95,

while the Nasdaq ended lower by 67.43 points or 0.4 percent at

16,207.51.

Tesla (NASDAQ:TSLA) dropped more than 7 percent. Walgreens Boots

Alliance (NASDAQ:WBA), Target (NYSE:TGT), Alphabet (NASDAQ:GOOG),

Pfizer (NYSE:PFE), Apple Inc. (NASDAQ:AAPL), Nike (NYSE:NKE) and

Merck (NYSE:MRK) lost 2 to 4 percent.

Intel (NASDAQ:INTC), Nvidia (NASDAQ:NVDA), IBM (NYSE:IBM), Bank

of America (NYSE:BAC), Ford Motor (NYSE:F), Qualcomm (NASDAQ:QCOM),

eBay (NASDAQ:EBAY), Walt Disney (NYSE:DIS), General Electric

(NYSE:GE), Wells Fargo (NYSE:WFC), Costco (NASDAQ:COST) and

Citigroup (NYSE:C) posted strong gains.

Later in the week, the Labor Department’s monthly employment

report is due to be released on Friday. The report is expected to

show employment jumped by 200,000 jobs in February after surging by

353,000 jobs in January.

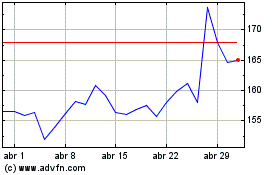

Alphabet (NASDAQ:GOOG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Alphabet (NASDAQ:GOOG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024