Super Micro Computer (NASDAQ:SMCI) – An analyst

has joined the optimistic group regarding the shares of Super Micro

Computer, with an increase of about 856% over the last 12 months.

Rated Overweight, JPMorgan analyst Samik Chatterjee justifies the

“premium valuation” due to the rapid growth of the artificial

intelligence server market. SMCI shares are up 2.6% in pre-market

trading.

Seagate Technology (NASDAQ:STX) – Shares of

Seagate Technology advanced 4.2% to reach $91.88 in pre-market

trading, following a positive review by Morgan Stanley analysts who

upgraded their rating from Equal Weight to Overweight. They also

raised the target price for the shares from $73 to $115.

Apple (NASDAQ:AAPL), Alphabet

(NASDAQ:GOOGL), Meta Platforms (NASDAQ:META) –

Apple, Google, and Meta are under investigations under the EU’s new

Digital Markets Act, aiming to challenge the power of tech giants.

Violations could lead to hefty fines of up to 10%, reflecting a

global crackdown on Big Tech’s anti-competitive practices. Google

stated on Monday that it would continue to defend its practices,

with Google’s competition director, Oliver Bethell, highlighting

significant operational changes in Europe.

Apple (NASDAQ:AAPL) – Apple faces multiple

consumer lawsuits accusing it of monopolizing the smartphone

market, in line with the antitrust case filed by the U.S.

government and 15 states. Allegations include suppression of

technology to increase competition. Apple denies the charges.

Microsoft (NASDAQ:MSFT) – According to The

Verge, Microsoft has appointed Pavan Davuluri as the new leader

responsible for the Windows and Surface sector, as per an internal

memo. Additionally, Mikhail Parakhin, responsible for Bing and

advertising, will leave these roles to pursue new opportunities.

Mustafa Suleyman, appointed to lead consumer artificial

intelligence, now oversees his work, while Parakhin will

temporarily report to the chief technology officer.

Amazon (NASDAQ:AMZN) – Amazon is contesting a

$34.6 million fine imposed by CNIL, the French data protection

body, for a system considered “excessively intrusive” in monitoring

employees. The company claims the systems are standard in the

industry and essential for security and efficiency.

Dell Technologies (NYSE:DELL) – Dell

Technologies reduced its workforce as part of an initiative to cut

costs, including limiting hiring and reorganizations. With about

120,000 employees in February 2024, down from 126,000 the previous

year, the layoffs reflect the decline in PC demand, contributing to

an 11% drop in fourth-quarter revenue. Dell also notes a continued

reduction in revenue from other businesses due to changes in the

commercial relationship with VMware

(NYSE:VMW).

Equinix (NASDAQ:EQIX) – Equinix announced on

Monday an independent investigation conducted by its audit

committee in response to allegations made by short-seller

Hindenburg Research in its recent report. The allegations concern

accounting practices and were denied by Equinix.

Salesforce (NYSE:CRM) – Salesforce faces the

challenge of integrating generative AI into its portfolio amid

fierce competition in a market estimated at $40 billion. The

company has integrated generative AI with Einstein Copilot and

customizable tools, seeking to transform sales and customer

service. Success in this reinvention promises to accelerate

business growth.

Ericsson (NASDAQ:ERIC) – Ericsson announced on

Monday the layoff of about 1,200 employees in Sweden as part of

cost-cutting measures due to reduced customer spending on 5G

equipment. With slowing sales, the company faces a challenging

market in 2024.

Flutter Entertainment (NYSE:FLUT) – Flutter, a

world leader in online betting, forecasts a 30% increase in its

core profit this year, driven by the exceptional growth of its

American brand Fanduel, with an estimated profit in the US between

$635 million and $785 million. The company also expects a core

profit of $1.63 billion to $1.83 billion in other markets.

DraftKings (NASDAQ:DKNG) – Shares of DraftKings

have shown an impressive increase of almost 170% over the last 12

months. Ben Chaiken of Mizuho initiated coverage of the shares with

a buy rating and a target price of $58, highlighting the company’s

underestimated profit potential. He emphasized the reduction of

external marketing costs in established states and operational

leverage as promotional expenses decrease. Chaiken also mentioned

opportunities for improvement in customer retention and maximizing

free cash flow. DraftKings shares are up 1.2% in Tuesday’s

pre-market.

GameStop (NYSE:GME) – GameStop shares saw their

best performance in over three months on Monday, ahead of the

anticipated quarterly earnings report, ending the day with a 15.4%

increase, the largest since December 13, 2023. The fourth-quarter

results will be announced after the market closes on Tuesday.

Analysts expect earnings of 30 cents per share and revenue of $2.05

billion.

Digital World Acquisition (NASDAQ:DWAC) –

Shares of Digital World Acquisition surged on Monday following the

official completion of its merger with Donald Trump’s social media

company. The SPAC is now named Trump Media & Technology Group

Corp (NASDAQ:DJT).

WeWork (NYSE:WE) – Adam Neumann and his

associates have proposed to buy the bankrupt WeWork for more than

$500 million, potentially bringing the controversial startup

founder one step closer to regaining control. This move marks

another chapter in the company’s tumultuous history.

United Parcel Service (NYSE:UPS) – The past

year was challenging for UPS, which revised its three-year targets

in 2021. Shares, which closed above $200 in June 2021, are now

around $156.57. The company will discuss its strategies at a

crucial event on Tuesday in Louisville, Kentucky.

Boeing (NYSE:BA) – Boeing CEO Dave Calhoun will

step down by the end of the year, along with board chairman Larry

Kellner and Stan Deal from the commercial airplanes business, amid

a management shift due to a safety crisis exacerbated by recent

incidents. Boeing’s board has begun the search for a new CEO, and

the successor will face challenges in rebuilding trust with

regulators, customers, and the public as the company seeks external

solutions. Additionally, the labor union IAM District 751,

representing 32,000 Boeing workers in Washington, seeks a seat on

the company’s board, aiming for greater influence. Boeing is

reviewing union proposals during ongoing contract negotiations.

Tesla (NASDAQ:TSLA) – Tesla will offer US

customers a one-month free trial of its Full Self-Driving (FSD)

technology, as revealed by CEO Elon Musk on Monday, in response to

sales and profit margin pressures. Musk hopes to boost FSD

adoption, though the rate has been declining in North America. In

other related news, Canada’s leading port is registering a

significant increase in car imports from China, surpassing arrivals

from the US and Mexico, with Tesla shipping electric vehicles from

its Shanghai Gigafactory. Chinese shipments have quadrupled over

the last year, driven by Tesla.

Lucid (NASDAQ:LCID) – Lucid will secure $1

billion in financing from an affiliate of the Saudi Public

Investment Fund (PIF). The investment reflects Lucid’s competitive

advantage, with the Saudi government seeking to diversify its

economy. The company plans to use the funds for corporate purposes

and capital expenditures.

Fisker (NYSE:FSR) – Fisker’s lack of funds led

to the collapse of negotiations with a major automaker, while the

New York Stock Exchange plans to delist its shares due to

“abnormally low” prices. Failing to meet financial obligations, the

company faces uncertainties about its future, with speculations

about possible bankruptcy.

Stellantis NV (NYSE:STLA) – Stellantis is

cutting about 400 white-collar jobs in the US as the Jeep and Ram

automaker transitions to electric vehicles. The move, affecting 2%

of the global engineering, technology, and software team, takes

effect on March 31.

Citigroup (NYSE:C) – Citigroup is in the final

stages of a broad overhaul to simplify its structure and improve

performance, reducing 5,000 employees since September. CEO Jane

Fraser announced the largest personnel reorganization, part of a

goal to globally reduce 20,000 jobs over the next two years.

MicroStrategy (NASDAQ:MSTR), Coinbase

Global (NASDAQ:COIN) – Shares of MicroStrategy and

Coinbase, linked to cryptocurrency, saw pre-market increases of

4.4% and 2.5%, respectively, as Bitcoin

(COIN:BTCUSD) rallied, nearing the $71,000 mark.

Carlyle Group (NASDAQ:CG) – Carlyle Group is

exploring options for Hexaware Technologies, including a possible

initial public offering that could raise $1 billion. Other

alternatives include selling stakes to companies or investors.

Hexaware provides IT and business process services.

Blackstone (NYSE:BX) – Blackstone-owned Crown

Resorts retained its license to operate the Melbourne casino,

addressing irregularities including tax evasion and money

laundering. Victoria’s gaming regulator considers the issues

resolved but maintains strict oversight. Crown paid fines of $163

million.

Novo Nordisk (NYSE:NVO) – Novo Nordisk

announced on Monday the acquisition of Cardior Pharmaceuticals for

up to $1.1 billion, aiming to bolster its cardiovascular portfolio

and expand its focus beyond diabetes and weight-loss therapies. The

deal includes Cardior’s leading compound, CDR132L, currently in

mid-stage Phase II clinical trials for treating heart failure, with

plans to also investigate its efficacy in cardiac hypertrophy. The

transaction, expected to close in the second quarter, will not

impact Novo Nordisk’s operational profit targets for 2024.

AbbVie (NYSE:ABBV) – AbbVie plans to acquire

Landos Biopharma for up to $212 million, expanding its arsenal of

drugs for immune system diseases. Landos is in mid-stage trials of

NX-13 for ulcerative colitis. The deal is anticipated to close in

the second quarter.

AstraZeneca (NASDAQ:AZN),

Pfizer (NYSE:PFE) – CEOs of AstraZeneca and Pfizer

expressed support for the expansion of the biopharmaceutical

industry in China, highlighting the country’s crucial role in

innovation and the development of new drugs. This comes as the US

considers legislation to reduce the pharmaceutical industry’s

dependence on Chinese manufacturing.

McDonald’s (NYSE:MCD) – McDonald’s ended its

partnership in Sri Lanka, closing 12 outlets due to “standard

issues”. While specifics were not detailed, local reports suggest

concerns about hygiene. The country is recovering from a financial

crisis.

Albertsons (NYSE:ACI), Kroger

(NYSE:KR) – A Colorado court scheduled a preliminary hearing to

assess the proposed acquisition of Albertsons by Kroger in

mid-August, ahead of a US antitrust challenge. The companies agreed

to postpone the FTC’s proceedings to a later date.

Unilever (NYSE:UL) – Amsterdam may surpass

London as the potential headquarters for Unilever’s ice cream unit,

valued at $18.4 billion, according to the company’s CEO. The

Netherlands is favored following Unilever’s restructuring

announcement last week.

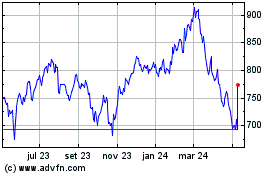

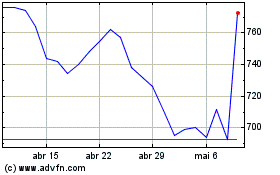

Equinix (NASDAQ:EQIX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Equinix (NASDAQ:EQIX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024