US Index Futures Rise, Oil Dips Slightly

04 Abril 2024 - 8:31AM

IH Market News

This Thursday, U.S. index futures show cautious optimism,

reflecting market expectations in anticipation of payroll data.

This upward movement comes a day after statements by Jerome Powell,

chairman of the Federal Reserve (Fed), who reiterated the position

that a reduction in interest rates will only be considered when

there is a clear trend that inflation is returning to the bank’s

set goal of 2%.

At 06:47 AM, the futures of the Dow Jones (DOWI:DJI) rose by 104

points, or 0.26%. The futures of the S&P 500 advanced 0.29%,

and the futures of the Nasdaq-100 gained 0.40%. The yield on

10-year Treasury bonds was at 4.359%.

In the commodities market, West Texas Intermediate crude oil for

May fell by 0.14%, to $85.31 per barrel. Brent crude oil for June

dropped by 0.12%, near $89.24 per barrel.

On Thursday’s economic schedule, at 8:30 AM, the weekly

unemployment insurance claims will be announced, with LSEG

consensus expectations pointing to about 214,000 requests. At the

same time, the February trade balance will also be revealed, with

the same consensus forecasts indicating a deficit of $67.3

billion.

Asian markets closed higher, led by Japan’s Nikkei, which gained

0.81% thanks to financial and electronics stocks, and South Korea’s

Kospi, which rose by 1.29% driven by semiconductors and automotive

industries. While the Shanghai SE markets in China and the Hang

Seng Index in Hong Kong remained inactive due to local holidays,

Australia’s ASX 200 also saw an increase, albeit more modest, of

0.45%.

Markets in Europe show a positive trend, with investors looking

to boost activities after a turbulent start to the new financial

quarter. On the economic front, it is expected that the recently

released minutes from the last monetary policy session of the

European Central Bank (ECB) will clarify future directions

regarding the possible reduction of interest rates in the

eurozone.

On Wednesday, US stocks initially recovered but ended mixed,

with the Dow Jones falling slightly for the third consecutive day,

and the S&P 500 and Nasdaq advancing 0.11% and 0.23%,

respectively. The ISM report showed a slowdown in the services

sector, easing concerns about interest rates. The Fed chairman

indicated caution with the interest rate. Gold and energy stocks

were up, while Intel (NASDAQ:INTC) and

Ulta Beauty (NASDAQ:ULTA) recorded significant

losses on the day.

In terms of quarterly results, financial reports are scheduled

to be presented before the market opens from Lamb Weston

Holdings (NYSE:LW), Conagra Brands

(NYSE:CAG), Simply Good Foods (NASDAQ:SMPL),

AngioDynamics (NASDAQ:ANGO), Lindsay

Corporation (NYSE:LNN), RPM International

(NYSE:RPM), Radius Recycling (NASDAQ:RDUS),

Collplant Biotechnologies (NASDAQ:CLGN). After the

close, numbers from Kura Sushi USA (NASDAQ:KRUS)

will be awaited.

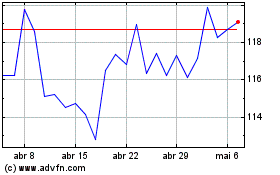

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

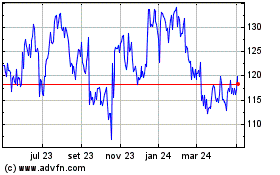

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024