Meta Platforms (NASDAQ:META) – Meta Platforms

disclosed details on Wednesday about its upcoming generation of

internal AI accelerator chip, named Artemis, aiming to lessen its

dependence on Nvidia’s AI chips and energy costs. The MTIA chip

delivers thrice the performance of its preceding generation.

Furthermore, Instagram intends to trial features to blur messages

containing nudity, aiming to safeguard teenagers and prevent scams.

Under scrutiny for mental health issues, the company will employ

machine learning to analyze images directly on the devices of users

under 18, with plans to introduce encryption and anti-scam

technology. In other news, companies reliant on advertising on

Facebook and Instagram are encountering significant challenges. The

costs have escalated, outcomes are uncertain, and sales have

plummeted, without a formal explanation from Meta Platforms. This

is prompting marketers to seek alternatives.

Costco (NASDAQ:COST) – Costco’s sales increased

by 9.4% up to April 7, fueled by e-commerce. The total sales hit

$23.5 billion, with a 28.3% surge in online sales. The quarterly

dividends rose to $1.16 per share, reflecting an increase of nearly

14%. Analysts estimate that the company could sell up to $200

million in gold and silver per month, but Costco made no mention of

these sales in its latest monthly report.

Apple (NASDAQ:AAPL) – The U.S. Department of

Justice’s lawsuit against Apple, accusing it of monopolizing the

smartphone market, has been transferred to District Judge Julien

Neals, after another judge recused himself due to potential

conflicts of interest. Apple denied the charges, describing the

lawsuit as a threat to its competitive principles. In other news,

employees at Apple’s store in Short Hills, New Jersey, sought union

representation, following a national trend of unionization. Apple

stated it offers competitive compensation and benefits, while

previous instances of unionization were observed.

Foxconn (USOTC:FXCOF) – Foxconn, a supplier to

Apple, plans to implement a rotating CEO system to promote future

talent and strengthen corporate governance, according to Reuters.

This unusual global measure could foster teamwork and prevent

leadership concentration, driving the next generation of

talents.

Amazon (NASDAQ:AMZN) – Amazon Web Services, the

global leader in cloud services, was ordered by a federal jury in

Illinois to pay $525 million to Kove for patent infringement in

data storage technology. AWS plans to appeal, while Kove emphasizes

the importance of protecting the intellectual property of startups

against tech giants. In other news, Amazon.com will no longer pay

developers to create apps for Alexa, removing a crucial aspect of

its strategy to build a thriving app store for its voice-activated

digital assistant. The company expressed gratitude to developers

and highlighted the continuation of monetization through in-app

purchases.

Adobe (NASDAQ:ADBE) – Adobe is expanding its AI

capabilities to video, acquiring videos from its creative network

for up to $120 each. The payment for submission averages about

$2.62 per minute of video submitted, though it can reach about

$7.25 per minute, according to Bloomberg. This follows OpenAI

demonstrating similar technology. The company aims to train its AI

to generate video content, seeking to compete with new

advancements.

Paramount Global (NASDAQ:PARA) – Four board

members of Paramount Global, including former executives from

Spotify (NYSE:SPOT) and Sony

Entertainment (NYSE:SONY), are set to resign soon as the

company discusses a merger with Skydance Media, according to the

Wall Street Journal.

Netflix (NASDAQ:NFLX) – Vietnam ordered Netflix

to stop advertising and distributing its games in the country by

April 25, due to the lack of a gaming service license. The

streaming platform was instructed to adhere to local online gaming

regulations.

Roblox (NYSE:RBLX) – Roblox, a gaming platform,

is looking to increase its revenues through video ads. For this, it

hired PubMatic, a company specializing in advertising technology.

These video ads will be incorporated into games, allowing the

creators of these games to share the revenue generated from the

ads. Well-known brands such as Adidas, Nike, and Lamborghini are

seizing this opportunity to engage with players within Roblox’s

virtual world.

Uber Technologies (NYSE:UBER) – Uber

Technologies announced on Wednesday an increase in safety features

for passengers worldwide, including the option for encrypted audio

recordings and PIN verification during rides, aimed at nighttime

safety, especially for women. These features are already available

in the USA, Canada, and Latin America.

Nike (NYSE:NKE) – Nike is set to launch new

kits for Olympic teams, reinforcing its position as an athletic

performance brand. Following weak sales, the Paris Games offer a

chance to showcase high-performance products, including running

shoes like the Alphafly 3, amid increasing competition.

Macy’s (NYSE:M) – Macy’s completed a board

election process, accepting two nominees from Arkhouse Management.

They continue to discuss a revised acquisition offer with Arkhouse

and Brigade Capital Management.

Starbucks (NASDAQ:SBUX) – Starbucks is

investing in quieter spaces in its stores to improve communication

and customer experience, with acoustic treatments like ceiling

baffles. This change is part of its global expansion, including

adding more stores and focusing on drive-thrus and operational

efficiency.

Rent the Runway (NASDAQ:RENT) – Rent the Runway

reported a net loss of $24.8 million, or $7.02 per share, for the

fourth quarter, compared to $26.2 million, or $8.07 per share, in

the same quarter last year. Revenue increased by 0.5% year over

year, to $75.8 million. The total number of subscribers rose by 1%

to 173,247, while the most engaged active subscribers decreased by

1% to 125,954. Rent the Runway expects to achieve cash flow

breakeven this year, despite forecasting sales growth below

expectations. In Thursday’s pre-market, shares were up 37%.

General Electric (NYSE:GE) – John Slattery, the

commercial director of GE Aerospace, will leave his position in

June, remaining as an advisor. Slattery previously led Embraer and

joined GE in 2020. Succeeded by Larry Culp in 2022, he focused on

strategy after GE split into three companies, concluding his long

tenure at GE.

US Steel (NYSE:X) – The U.S. Department of

Justice launched an antitrust investigation into the $14.1 billion

acquisition of US Steel by Nippon Steel. The deal faces legislative

scrutiny and national security concerns, with President Biden

advocating for keeping US Steel as an American company.

UBS Group AG (NYSE:UBS) – The Swiss government

plans to impose stricter capital requirements on UBS and other

systemically important banks, in response to the Credit Suisse

collapse. The aim is to prevent similar crises. Although the

proposed measures seek to enhance stability, the precise impact and

implementation remain uncertain. The bank hopes to influence the

political process for less stringent terms.

Barclays (NYSE:BCS) – Barclays revised its

projection for the U.S. Federal Reserve, now anticipating a single

25 basis-point cut in 2024, after positive CPI data. The company

expects rates between 5.00% and 5.25% at the end of 2024 and

between 4.00% and 4.25% by the end of 2025.

Goldman Sachs (NYSE:GS) – Goldman Sachs

upgraded its annual economic growth forecasts for China for the

first quarter and the entire year of 2024, driven by the country’s

industrial robustness. The annual GDP forecast for China was raised

to 5.0%, while the first-quarter forecast was also adjusted to

5.0%.

KKR and Company (NYSE:KKR) – On Wednesday, KKR

outlined a strategy to expand access to alternative investments for

wealthy investors. The K series offers direct access to areas like

private equity and real estate. The company seeks partnerships with

financial advisors and asset platforms to facilitate this

expansion.

AstraZeneca (NASDAQ:AZN) – AstraZeneca plans to

increase its annual dividend by 7% by 2024, maintaining its

progressive dividend policy. Meanwhile, shareholders will vote on a

potential increase in CEO Pascal Soriot’s pay package. Analysts

consider this move an attempt to balance diverging interests.

Regeneron Pharmaceuticals (NASDAQ:REGN) – The

U.S. Department of Justice accused Regeneron Pharmaceuticals of

manipulating Medicare drug prices by concealing payments intended

to subsidize purchases of Eylea. The expensive FDA-approved drug

has generated over $25 billion in Medicare expenses.

Regeneron denies the charges.

Vertex Pharmaceuticals (NASDAQ:VRTX) – Vertex

Pharmaceuticals agreed to acquire Alpine Immune

Sciences (NASDAQ:ALPN) for approximately $4.9 billion in

cash, targeting autoimmune kidney disease treatment. The deal,

valuing each Alpine share at $65, represents a 67% premium. The

transaction is expected to close in the second quarter of 2024.

Alpine shares were up 36.12% in Thursday’s pre-market. Vera

Therapeutics (NASDAQ:VERA), whose main drug in development

shares similarities with Alpine Immune’s, saw a 13.4% increase.

Ford Motor (NYSE:F) – The U.S. National

Transportation Safety Board (NTSB) announced an investigation into

a fatal accident involving a Ford Mustang Mach-E and two cars on

the I-95 highway in Philadelphia on March 3. The NTSB previously

investigated a similar incident in San Antonio, Texas, involving

the Mustang Mach-E.

Toyota Motor (NYSE:TM) – Toyota is injecting

$300 million into its venture capital arm to support

climate-focused startups and frontier technologies like carbon

capture, AI, and space commercialization. This expansion raises

Toyota Ventures’ assets under management to over $800 million. Jim

Adler, managing partner at Toyota Ventures, emphasizes the

importance of taking risks to keep pace with changing global

dynamics and highlights past successes, such as the investment in

Joby Aviation Inc. The new funds will be evenly split between

Toyota Ventures’ second climate fund and its second deep tech fund,

focusing on large-scale scientific startups. Additionally, mid-size

SUVs maintain a strong presence in the U.S., with ample space and

seating for up to eight people. Toyota is preparing to revitalize

its 4Runner, while competitors like Hyundai and Jeep advance.

Challenges include intense competition and shifting consumer

preferences.

Southwest Airlines (NYSE:LUV) – A Southwest

Airlines Boeing 737-800 lost an engine cover during takeoff in

Denver due to maintenance issues. The NTSB did not open a formal

investigation as Southwest is addressing the issue. The FAA is

investigating, while Boeing directed inquiries to the airline.

Carnival (NYSE:CCL) – Carnival is selling its

Miami headquarters, planning to profit from real estate it has

owned for decades. The company intends to downsize to about 300,000

square feet of office space in the Miami area and remain in its

current Doral headquarters for two years while exploring options

for new facilities. The sale reflects a broader trend of

reevaluating post-pandemic office space needs.

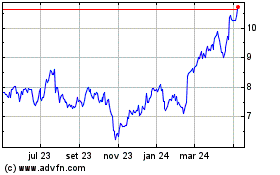

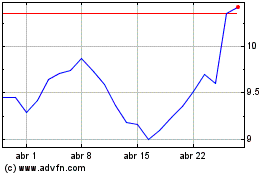

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024