Upbeat Earnings, Retail Sales Data May Generate Buying Interest

15 Abril 2024 - 10:10AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Monday, with stocks likely to regain ground following the

sell-off seen last Friday.

A positive reaction to earnings news from Goldman Sachs

(NYSE:GS) may generate early buying interest, as the investment

banking company is surging by 4.1 percent in pre-market

trading.

The jump by Goldman Sachs comes after the company reported first

quarter earnings that far exceeded analyst estimates on better than

expected revenues.

Positive sentiment may also be generated in reaction to a

Commerce Department report showing much stronger than expected U.S.

retail sales growth in the month of March.

The Commerce Department said retail sales climbed by 0.7 percent

in March after advancing by an upwardly revised 0.9 percent in

February.

Economists had expected retail sales to rise by 0.3 percent

compared to the 0.6 percent increase originally reported for the

previous month.

Excluding a pullback by sales by motor vehicle and parts

dealers, retail sales jumped by 1.1 percent in March after climbing

by 0.6 percent in February. Ex-auto sales were expected to rise by

0.4 percent.

Bargain hunting may also contribute to an early rebound on Wall

Street, as traders pick up stocks at relatively reduced levels.

The steep drop seen last Friday dragged the Dow down to its

lowest closing level in well over two months, while the S&P 500

fell to a nearly one-month closing low.

U.S. stocks closed sharply lower on Friday, as geopolitical

tensions, inflation worries and mixed earnings and guidance from

major banks rendered the mood a bit bearish.

The major averages all ended in the red. The Dow ended with a

loss of 475.84 points or 1.2 percent at 37,983.24. The S&P 500

tumbled 75.65 points or 1.5 percent to 5,123.41, while the Nasdaq

settled at 16,175.09, plunging 267.10 points or 1.6 percent.

The Dow shed nearly 2.5 percent for the week, while the S&P

500 and the Nasdaq dropped by about 1.6 percent and 0.5 percent,

respectively.

Shares of Citigroup (NYSE:C) fell by about 1.7 percent after the

company reported a 27 percent drop in net income in the first

quarter, due to lower non-interest revenue, as well as higher

expenses and cost of credit.

JPMorgan Chase & Co. (NYSE:JPM) tumbled nearly 6.5 percent,

weighed down by lower net interest income. The lender reported a 6

percent increase in first quarter profit. For the first quarter,

net income increased to $13.42 billion or $4.44 per share from

$12.62 billion or $4.10 per share in the prior-year quarter.

Wells Fargo Inc (NYSE:WFC) reported first-quarter net income of

$4.62 billion or $1.20 per share, down from last year’s $4.99

billion or $1.23 per share. The stock ended modestly lower.

Inflation concerns continued to weigh on the markets, as the

Labor Department released a report showing import prices in the

U.S. increased by slightly more than expected in the month of

March.

The report said import prices climbed by 0.4 percent in March

after rising by 0.3 percent in February. Economists had expected

import prices to increase by another 0.3 percent.

Import prices also rose by 0.4 percent compared to the same

month a year ago, marking the first year-over-year increase since

January 2023.

Meanwhile, the Labor Department said export prices rose by 0.3

percent in March after climbing by a revised 0.7 percent in

February. The increase in export prices matched economist

estimates.

Compared to the same month a year ago, export prices were down

by 1.4 percent in March following a 1.8 percent slump in

February.

A report showing a bigger than expected drop in consumer

sentiment in April also generated selling pressure. The University

of Michigan said its consumer sentiment fell to 77.9 in April from

79.4 in March. Economists had expected the index to edge down to

79.0.

The report also said year-ahead inflation expectations rose to

3.1 percent in April from 2.9 percent in March, climbing just above

the 2.3-3.0 percent range seen in the two years prior to the

pandemic.

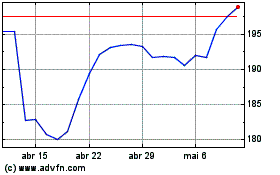

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

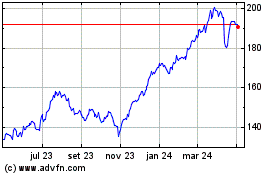

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024