US Index Futures See Gains, Oil Prices Dip

17 Abril 2024 - 7:59AM

IH Market News

U.S. index futures displayed positive performance in pre-market

trading on Wednesday, with S&P 500 aiming to halt a downward

trend that persisted over the last three consecutive days.

As of 6:23 AM, Dow Jones futures (DOWI:DJI) were up 146 points,

or 0.39%. S&P 500 futures rose 0.36%, and Nasdaq-100 futures

increased by 0.22%. The yield on the 10-year Treasury notes was at

4.641%.

In the commodities market, West Texas Intermediate crude oil for

May delivery dropped by 0.91% to $84.58 per barrel. Brent crude oil

for June fell by 0.92% to approximately $89.19 per barrel. Iron ore

traded on the Dalian Exchange rose by 4.25% to $120.21 per metric

ton.

The economic agenda in the United States for Wednesday starts at

10:30 AM with the publication of the crude oil inventory position

up to the previous Friday by the Department of Energy (DoE). Later,

at 2:00 PM, the focus shifts to the Federal Reserve (Fed), which

will release the Beige Book.

European markets showed resilience, trading higher despite

recent statements by Federal Reserve Chairman Jerome Powell, which

usually have a significant influence on global markets. Even with

ongoing geopolitical tension involving potential confrontations

between Iran and Israel, investors maintained cautious

optimism.

The Stoxx 600 index, a key benchmark for the region, recorded an

increase, with most sectors showing gains. Mining stocks were

particularly highlighted, with a rise of 2.2%. Meanwhile, in the

United Kingdom, the March inflation rate dropped to 3.2%, a result

below economists’ expectations. This indicator of inflation slowing

down could signal future interest rate cuts by the Bank of England,

bringing significant implications for monetary policy and economic

expectations in the region.

Asian stock markets had a mixed close on Wednesday following a

significant drop in the previous session, reflecting the complexity

of the regional economic landscape influenced by tensions in the

Middle East. Notably, Singapore’s economy revealed concerning data

with a 20.7% decrease in non-oil exports, a substantially larger

number than the 7% forecast by analysts surveyed by Reuters. This

scenario was exacerbated by the ongoing appreciation of the dollar,

which has placed additional pressures on regional currencies,

especially the Japanese yen.

At market close, the Shanghai SE in China registered a gain of

2.14%, while the Nikkei in Japan fell by 1.32%. The Hang Seng in

Hong Kong virtually stagnated with a slight increase of 0.02%, and

other indices like the Kospi in South Korea and the ASX 200 in

Australia also experienced declines, recording -0.98% and -0.09%,

respectively.

On Tuesday, the U.S. stock market showed uncertainty,

fluctuating throughout the day after recent losses. The Dow Jones

slightly rose, gaining 63.86 points, or 0.17%, to close at

37,798.97. The S&P 500, however, fell by 10.41 points, or

0.21%, to 5,051.41, while the Nasdaq dropped 19.77 points, or

0.12%, to 15,865.25. The Dow Jones was boosted by a jump in shares

of UnitedHealth (NYSE:UNH). However, a drop in

shares of Johnson & Johnson (NYSE:JNJ) limited

further gains, as market participants assessed future risks, such

as the prospect of higher interest rates.

In terms of quarterly earnings, reports are scheduled to be

presented before the start of trading from ASML

(NASDAQ:ASML), Abbott (NYSE:ABT),

Prologis (NYSE:PLD), Travelers

(NYSE:TRV), US Bancorp (NYSE:USB), First

Horizon National Corp (NYSE:FHN), First Community

Corporation (NASDAQ:FCCO), BankUnited Inc

(NYSE:BKU), SHL Telemedicine (NASDAQ:SHLT), among

others.

After the close, earnings numbers from Alcoa

(NYSE:AA), Bank OZK (NASDAQ:OZK), Las

Vegas Sands (NYSE:LVS), Liberty Energy

(NYSE:LBRT), Kinder Morgan (NYSE:KMI),

Synovus Financial Corp (NYSE:SNV),

Discover Financial Services (NYSE:DFS), SL

Green Realty Corp (NYSE:SLG), CSX

Corporation (NASDAQ:CSX), and more will be awaited.

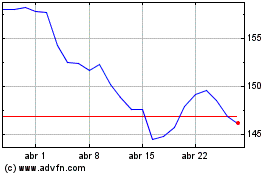

Johnson and Johnson (NYSE:JNJ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Johnson and Johnson (NYSE:JNJ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024