U.S. Index Futures Decline Amid Israel-Iran Tensions

19 Abril 2024 - 8:32AM

IH Market News

In pre-market trading this Thursday, U.S. index futures are

down, reflecting increased tensions between Israel and Iran.

S&P 500 is headed for its worst week in nearly six months,

after five consecutive sessions of decline and a weekly accumulated

decline of 2.2%. This would be the third consecutive week of losses

for the index, largely due to reduced expectations of a short-term

interest rate cut.

At 6:36 AM, Dow Jones futures (DOWI:DJI) fell 129 points, or

0.34%. S&P 500 futures were down 0.42%, and Nasdaq-100 futures

lost 0.66%. The yield on 10-year Treasury notes was at 4.569%.

In the commodities market, West Texas Intermediate crude oil for

June fell 0.63% to $86.56 per barrel. Brent crude oil for June was

down 0.61%, near $86.58 per barrel. Iron ore traded on the Dalian

exchange fell 0.34% to $120.28 per metric ton.

European markets are seeing a sharp decline this week, marked by

increased tensions in the Middle East and a reassessment of

expectations for future monetary policies. Geopolitical tension and

statements during the Spring Meetings of the International Monetary

Fund have kept investors on alert. Notably, François Villeroy de

Galhau, a voting member of the European Central Bank, expressed in

an interview with CNBC that the bank should consider a rate cut as

early as June. According to him, this measure would be crucial to

prevent a delay in responding to inflation, reflecting the

necessary caution in a period of economic and political

uncertainties.

Asian markets ended Friday with significant declines, in

response to Israel’s limited attack on Iran. Among the main

indices, the Taiwan Index registered the sharpest drop, plummeting

3.81% to 19,527.12 points, the lowest level in over a month.

Japan’s Nikkei also suffered considerable losses, retreating 2.66%.

Other markets, including the Shanghai SE in China, which fell

0.29%, the Hang Seng in Hong Kong, with a reduction of 0.99%, the

Kospi in South Korea, which decreased 1.63%, and the ASX 200 in

Australia, which retreated 0.98%, also reflected the increasing

geopolitical tension and the impact on investor sentiment.

On Thursday, U.S. stock markets had a volatile day. Despite a

positive start, the S&P 500 and Nasdaq closed down for the

fifth consecutive day, while the Dow Jones managed a small gain.

The Dow rose 22.07 points, closing at 37,775.38, an increase of

0.06%. The S&P 500 fell 11.09 points, ending at 5,011.12, a

decline of 0.22%. The Nasdaq retreated 81.87 points, closing at

15,601.50, a decrease of 0.52%. The Federal Reserve of

Philadelphia’s manufacturing activity index jumped from 3.2 in

March to 15.5 in April. Unemployment claims remained stable at

212,000. Existing home sales fell 4.3%, to an annual rate of 4.19

million.

In terms of quarterly earnings, scheduled to report on Friday

are American Express (NYSE:AXP),

P&G (NYSE:PG), Schlumberger

(NYSE:SLB), Wipro (NYSE:WIT), Fifth Third

Bank (NASDAQ:FITB), Huntington Bancshares

(NASDAQ:HBAN), Regions (NYSE:RF), Lakeland

Bank (NASDAQ:LBAI), among others.

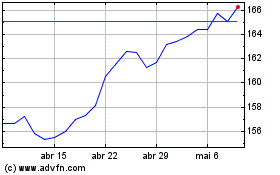

Procter and Gamble (NYSE:PG)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

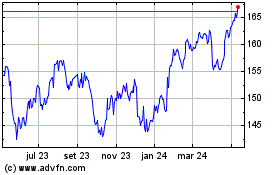

Procter and Gamble (NYSE:PG)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024