Bitcoin price stability challenges record ETF outflows

Despite significant outflows totaling US$244.49 million from

bitcoin ETFs this week, the price of Bitcoin has remained stable

around US$64 thousand, showing a 1.01% increase over the last seven

days. However, the correlation between bitcoin prices and ETF

inflows has decreased, indicating a growing disconnect. Moreover, a

substantial volume of Bitcoin (COIN:BTCUSD) and Ethereum

(COIN:ETHUSD) options, valued at approximately $9.26 billion,

expired this Friday, with minimal impact on market volatility.

Declining interest in spot Bitcoin ETFs with significant outflows

Spot Bitcoin exchange-traded funds (ETFs) are experiencing

waning investor interest, evidenced by outflows of $218 million in

the past day alone. On April 25, both BlackRock’s Bitcoin ETF

(NASDAQ:IBIT) and Fidelity’s (AMEX:FBTC) saw negative flows, with

the latter recording its first major outflow of $23 million. Other

funds such as Grayscale (AMEX:GBTC) and 21Shares (AMEX:ARKB) also

faced notable outflows of $139.37 million and $31.34 million,

respectively. Despite this, ETFs have amassed net inflows exceeding

$12 billion since January, suggesting a temporary slowdown,

possibly due to speculation about the Federal Reserve’s monetary

policy.

BNY Mellon invests in Bitcoin ETFs managed by BlackRock and

Grayscale

The Bank of New York Mellon Corporation (NYSE:BK), one of the

largest banks in the US, has acquired stakes in Bitcoin Exchange

Traded Funds (ETFs) managed by BlackRock (NASDAQ:IBIT) and

Grayscale (AMEX:GBTC), documents revealed by the recent Securities

and Exchange Commission (SEC). Token purchases worth US$1.2 million

highlight a significant strategic move by the bank towards digital

assets, underlining the growing trend of traditional financial

institutions venturing into the cryptocurrency market.

ARK Invest divests completely from the ETF ProShares Bitcoin

Strategy

ARK Invest, led by Cathie Wood, has liquidated its position in

the ProShares Bitcoin Strategy ETF (AMEX:BITO), selling the last

237,983 shares for $6.7 million through its Next Generation

Internet ETF (AMEX:ARKW). The sale completes a short-term strategy

begun last year when ARK purchased more than 4 million shares in

anticipation of the approval of spot bitcoin ETFs in the US.

Meanwhile, the ARK 21Shares Bitcoin ETF (AMEX:ARKB) became the

fund’s top investment, representing 10.4% of its total value.

Metaplanet acquires Bitcoins in strategic investment

Metaplanet Inc., a Japanese investment and consulting company,

completed the purchase of 97.85 Bitcoins for one billion yen (about

US$6.25 million). Initially announced on April 8 and confirmed in

an X post on April 24, the acquisition marks Metaplanet as the

first publicly traded company on the Tokyo Stock Exchange to invest

in Bitcoin (COIN:BTCUSD). This strategic decision reflects a

commitment to digital assets and has coincided with an 81% increase

in its share price since January.

Pantera Capital acquires discounted Solana tokens in FTX auction

Pantera Capital, in a strategic move, acquired an undisclosed

amount of Solana (COIN:SOLUSD) tokens at a discount in an auction

recently organized by the administrators of the bankrupt FTX. The

company, along with industry giants like Galaxy Digital, purchased

tokens at a reduced price of $64 each, a significant decrease from

market values. This acquisition follows a fundraising by Pantera,

aiming to invest up to $250 million in locked Solana tokens.

Runes generates $135 million in transaction fees in the first week

on Bitcoin

The Runes tokenization standard was recently launched on the

Bitcoin network and has already raised more than 2,129 bitcoins

($135 million) in transaction fees in its first week. Using

Bitcoin’s UTXO model and the OP_RETURN opcode, Runes offers an

efficient tokenization solution that allows the creation of tokens,

such as memecoins, directly on the Bitcoin blockchain. Since its

launch during Bitcoin’s fourth halving, the protocol has

significantly contributed to increased transaction fees and

activity on the network.

Luke Dashjr warns about exploitation of Bitcoin flaws by

cryptoactive protocols

Luke Dashjr, one of the main developers of Bitcoin

(COIN:BTCUSD), criticized the Runes protocol for exploiting

fundamental design flaws in the blockchain. In a post on X on April

26, he highlighted the differences between Ordinals and Runes in

their interaction with the network. While Ordinals utilize

vulnerabilities in Bitcoin Core, Runes takes advantage of design

flaws in the network itself. Dashjr, who has previously expressed

concerns about these assets deviating from Bitcoin principles and

increasing spam on the blockchain, has also proposed methods to

filter Rune transactions to reduce their impact.

Marathon Digital doubles hash rate target to 50 EH/s after

strategic acquisition

Marathon Digital (NASDAQ:MARA), a leading Bitcoin miner, raised

its hash rate target for this fiscal year to 50 EH/s, driven by the

acquisition of a 200-megawatt mining center from Digital Applied.

Initially, the company aimed to reach 37 EH/s, but now foresees a

100% increase in its mining power. Fred Thiel, CEO of Marathon,

said the updated goal is achievable without the need for additional

capital, thanks to the recent acquisition and investment in

advanced technology. The increasing difficulty of mining has not

deterred the company’s ambitions, which continues to expand despite

market challenges.

Shiba Inu’s Shibarium Network announces hard fork for improvements

Shiba Inu’s (COIN:SHIBUSD) Shibarium network is scheduled for a

hard fork on May 2, with the aim of improving user experience and

reinforcing its infrastructure. This update will introduce new

features to speed up transactions and stabilize fees during peak

usage, as well as improve security.

Jiritsu Network Launches Innovative Asset Tokenization Platform

Jiritsu Network, a leader in verifiable computing, announced the

launch of Jiritsu Layer 1, a platform built on Avalanche subnet

technology and based on Zero-Knowledge Multi-Party Computation (ZK

MPC). This innovative system aims to revolutionize the way complex

real-world assets such as private equity and real estate are

represented and transacted on the network. With the initial

collaboration with Everready Group, Jiritsu begins checking more

than $20 million in inventory daily, highlighting Everready’s

commitment to accuracy in supply chain management. This launch not

only improves transaction transparency and security but also sets

new standards for asset management in the digital era.

Consensys sues SEC for attempted excessive regulation of Ethereum

Consensys, an influential supporter of the Ethereum network, is

suing the US SEC, alleging that the agency is trying to improperly

extend its regulatory authority over Ethereum, which is the second

largest blockchain by market capitalization. This move is part of a

growing trend of cryptocurrency entities in the US that are

challenging what they see as overly strict regulations. The lawsuit

argues that despite previous SEC statements indicating that

Ethereum (COIN:ETHUSD) is not a security, the agency is now

attempting to regulate the cryptocurrency under that

classification.

Senator Elizabeth Warren questions tools against illegal use of

cryptocurrencies

Senator Elizabeth Warren, along with Senator Bill Cassidy, sent

a letter to US Attorney General Merrick Garland and the head of the

Department of Homeland Security, Alejandro Mayorkas, asking about

the tools needed to combat the use of cryptocurrencies in crimes

child sexual exploitation. The senators point out that digital

assets have become the preferred method of payment in criminal

activities related to child abuse, highlighting the urgency of

improving laws and detection tools to effectively combat these

crimes. The letter asks agencies to specify the additional

resources they need to address this growing challenge.

New EU legislative package strengthens cryptoactive regulation

The European Parliament recently approved strict measures to

combat money laundering involving crypto assets. The new

legislative package obliges crypto asset service providers (CASPs)

to increase transparency in transactions with self-hosted wallets

and imposes restrictions on the use of anonymous cryptocurrencies.

In addition, a central agency will be created to develop regulatory

standards. Measures include enhanced due diligence for transactions

below 1,000 EUR and stricter KYC procedures for higher amounts. The

legislation aims to mitigate risks of financial crimes and aligns

with the recommendations of the International Financial Action Task

Force (FATF), despite there being criticisms about the lack of

sufficient data to justify the new rules.

Eminem revives crypto celebrity trend with new ad

After a period of downturn due to the collapse of FTX,

celebrities are slowly returning to promoting cryptocurrencies. A

recent example is Eminem, who lent his voice to an ad for

Crypto.com, which he announced on X and scheduled to debut during

an NBA playoff game at Crypto.com Arena. The ad, which will also be

shown at Formula 1 and UFC events, uses the slogan “Fortune favors

the brave,” previously associated with actor Matt Damon.

OpenDelta raises $2.15 million for Bitcoin-based stablecoin

OpenDelta, a stablecoin innovator, has raised $2.15 million in

its seed round of funding, led by 6th Man Ventures, CEO Konstantin

Wünscher announced. The startup aims to employ Bitcoin to support a

stablecoin pegged to fiat currencies. Called USDO, it promises to

maintain its value in dollars, using Bitcoin as collateral. This

project places OpenDelta at the forefront of decentralized finance

on the Bitcoin platform, particularly the new Runes trend, with

plans to launch the token in May in a closed beta.

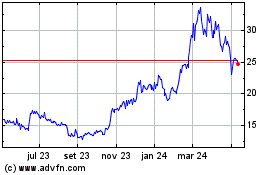

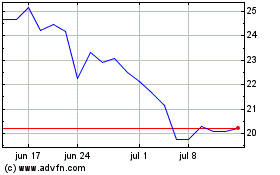

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025