Australia prepares to launch Bitcoin ETFs in line with global trend

Australia is aligning with other countries, such as the USA and

Hong Kong, by planning to allow its citizens to invest in Bitcoin

ETFs later this year. The Australian Securities Exchange (ASX:ASX)

is considering approving its first offerings of spot Bitcoin ETFs,

with companies like VanEck, BetaShares, and DigitalX already having

submitted their applications. Despite an initially lukewarm

response and the challenges of the cryptocurrency market in the

past, the industry is optimistic about the growing demand for these

innovative financial products.

Hong Kong to launch Bitcoin and Ether ETFs tomorrow, awaits impact

on global market

The cryptocurrency community is watching closely as Bitcoin and

Ether ETFs are set to launch in Hong Kong on April 30, marking a

significant event for the sector. Three major Chinese firms, China

Asset Management, Bosera Asset Management, and Harvest Global

Investments, plan to introduce these cryptocurrency ETFs on the

Hong Kong Stock Exchange. This launch follows the success of spot

Bitcoin ETFs in the USA and represents a step forward in offering

globally regulated investment products. The initiative is seen as a

milestone that could influence the development of similar products

around the world.

Significant drop in Bitcoin ETF inflows as interest wanes

According to the weekly report from CoinShares, investments in

Bitcoin ETFs in the United States have seen a drastic reduction of

over 50% last week, falling from $254 million to $126 million. This

decrease has contributed to the third consecutive week of net

outflows in the cryptocurrency investment products market, reaching

$435 million, the highest since March. Despite the outflows

decreasing, Grayscale (AMEX:GBTC) led with $440 million withdrawn

from the ETF, although this amount represents the smallest weekly

outflow in nine weeks.

Falls in Bitcoin and Ether reflect concerns about stagflation in

the USA

Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD) recorded drops

of -0.25% and -3.21%, respectively, in the last 24 hours.

Influenced by renewed concerns about stagflation in the USA,

Bitcoin reached $62,841, while Ether depreciated to $3,163. The

stagflation scenario, characterized by slow economic growth and

persistent inflation, further diminishes the chances of the Fed

reducing interest rates.

Lone miner achieves significant victory in Bitcoin mining

A lone Bitcoin miner (COIN:BTCUSD) defied the odds and unlocked

a valuable block, earning both the full subsidy and transaction

fees. This miner received 3.433 Bitcoin, valued at $218,544, for

mining block 841,286, using CKpool’s solo software. With a hash

rate of 120 PH/s against the network’s total 638 EH/s, his chances

of success were slim, but his determination prevailed. This rare

feat highlights the persistence and potentially lucrative nature of

solitary mining, especially following the recent halving of

rewards.

Tether invests $200 million in Blackrock Neurotech’s brain-computer

interface technology

Tether, issuer of the stablecoin (COIN:USDTUSD), announced an

investment of $200 million in Blackrock Neurotech, a manufacturer

of brain-computer interfaces. The investment was made by Tether’s

newly created venture capital arm, Tether Evo. The official

statement, released on the company’s website, did not specify

Blackrock’s new valuation, which is based in Salt Lake City. This

sector gained fame primarily through Elon Musk’s Neuralink, known

for advancements such as the implant that allowed a quadriplegic

man to control videos using only his mind.

Peaq elevates its position in the Polkadot ecosystem with new DePIN

adoptions

Recently, the Peaq blockchain network, focused on decentralized

physical infrastructure (DePIN) and real-world assets (RWAs),

gained prominence by being chosen for two major DePIN projects:

MapMetrics and Natix Network. MapMetrics, a Web3 platform that

rewards users with tokens and NFTs for sharing traffic and map

data, announced its migration from the Solana blockchain to Peaq in

search of better compatibility and integration within the DePIN

ecosystem. Meanwhile, Natix Network successfully integrated Peaq

IDs into its Drive& app to collect geospatial data, aiming to

leverage Peaq’s advanced data verification and management

capabilities.

io.net CEO responds to criticisms about GPU availability and

network attack

Ahmad Shadid, CEO of the decentralized computing platform

io.net, rebutted criticisms regarding GPU availability on his

network, revealing a Sybil attack. Shadid explained how the company

detected and combated the massive influx of fake GPUs. Despite

temporary setbacks, Shadid assures that the infrastructure is

operational. Executives, including Hushky and Gaurav Sharma,

quelled rumors, suggesting personal motivations behind the

criticisms. io.net remains steadfast in its development plans.

Wasabi Wallet bans US users following regulatory threats

zkSNACKs, the developer of Wasabi Wallet, took a drastic step by

strictly prohibiting US citizens and residents from accessing its

services, in response to recent regulatory pressures. The team

announced the blocking of IP addresses for US users on their main

domains. This move comes after the arrests of the founders of

Samourai Wallet and the co-founder of Tornado Cash, Roman Storm, on

charges of money laundering and sanctions violations.

Lazarus Group launders over $200 million in stolen cryptocurrencies

According to on-chain researcher ZachXBT, the Lazarus Group,

linked to North Korea, laundered over $200 million in stolen

cryptocurrencies between 2020 and 2023. Utilizing cryptocurrency

mixer services and peer-to-peer (P2P) markets, the group converted

the stolen digital assets into fiat currency. Lazarus, responsible

for major hacks including the Ronin Bridge in 2022, is considered

one of the most notorious cryptographic hacker groups.

Binance founder, CZ, confronts sentencing in the US with support

from prominent figures

The former CEO of Binance, Changpeng “CZ” Zhao, will face his

sentencing in a Seattle court this Tuesday, where the US Department

of Justice has recommended a three-year prison term due to the

severity of his conduct. Despite this, the prediction market

platform Polymarket suggests a possible early release, with bettors

predicting a 42% chance of CZ being released in less than six

months. Bets also indicate a 96% chance of him being released

before two years. Significant support from influential figures,

such as former US Ambassador to China, Max S. Baucus, and others,

may influence the reduction of the sentence.

BCB Group expands in Europe with new French regulatory licenses

BCB Group, a payment processor that links the cryptocurrency

sector to the banking system, announced plans for European

expansion after receiving regulatory approval in France. The

company received authorization from ACPR and AMF, the main

financial regulatory bodies in France, to operate as an Electronic

Money Institution (EMI) and Digital Asset Service Provider (DASP).

These licenses will allow BCB to offer expanded institutional

services in Europe and collaborate with various participants in the

financial and virtual assets market.

Russia imposes restrictions on cryptocurrency circulation starting

in September

Russia will implement strict measures from September 1,

restricting the use of cryptographic assets like Bitcoin

(COIN:BTCUSD), allowing only locally issued digital financial

assets. Anatoly Aksakov, leader of the initiative from the State

Duma’s Committee for the Financial Market, explains that the action

seeks to strengthen the ruble’s dominance amid geopolitical

tensions. While the restrictions will affect exchanges and trading

platforms, exceptions will be made for miners and experimental

projects from the Central Bank, recognizing the significant tax

revenue generated by cryptocurrency mining.

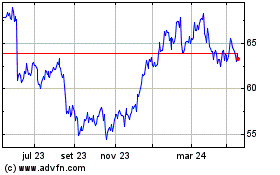

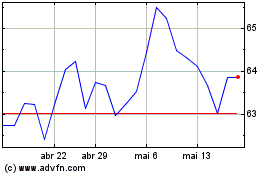

ASX (ASX:ASX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

ASX (ASX:ASX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025