Crypto ETP outflows hit $600 million after Fed’s aggressive stance

The Federal Reserve’s aggressive stance caused the worst week

for outflows from crypto ETPs since March, totaling $600 million.

The reduction in rate cut forecasts for 2024 affected institutional

investor confidence. Bitcoin ETFs experienced outflows of $621

million, while Ethereum, XRP, and Lido ETPs saw inflows of $15

million, $2 million, and $1 million, respectively. The largest

outflow was from the Grayscale (AMEX:GBTC) fund, with US$274

million, while the BlackRock (NASDAQ:IBIT) fund recorded the

largest inflow, with US$41.6 million. In the last 24 hours, the

price of Bitcoin rose 0.46%, trading at US$66,945.

ASX approves first spot Bitcoin ETF from VanEck

The Australian Securities Exchange (ASX:ASX) has approved the

launch of the country’s first spot bitcoin ETF, which will be

offered by VanEck on June 20. This ETF, described as the lowest

cost in Australia, marks a significant step forward for the

cryptocurrency market in the region.

David Hirsch steps down as head of SEC crypto unit

David Hirsch, head of the SEC’s crypto and cyber assets unit,

has announced his departure from the Commission after nearly nine

years. In his LinkedIn post, Hirsch expressed pride in the work he

has done overseeing cryptocurrency exchanges and DeFi projects. He

did not reveal his next career move.

ZKsync launches ZK token with 45% claimed in two hours

Blockchain giant ZKsync has launched its ZK token, with 45% of

the tokens claimed within two hours, the team reported Monday. The

token opened at $0.31 and fell to $0.24, with a market cap of $908

million. Exchanges including Binance, Bybit and KuCoin have listed

the token. Binance postponed the listing due to technical issues.

The non-profit ZKsync Association oversees the distribution of the

tokens.

US Bitcoin miners hit $22.8 billion market cap

In a volatile financial market, 14 US Bitcoin miners tracked by

JPMorgan (NYSE:JPM) achieved a market capitalization of $22.8

billion in the first half of June. This growth was driven by an

increase in hash rate share, also by the news of Core Scientific’s

(NASDAQ:CORZW) agreement with CoreWeave, and finally by the

integration of artificial intelligence (AI) technologies. AI

optimizes processes, reduces costs and increases energy efficiency,

strengthening the Bitcoin network and attracting investors.

Camino Network revolutionizes the travel industry with blockchain

Camino Network is transforming the travel industry by connecting

global businesses efficiently and securely through blockchain

technology. With more than 170 companies joining, Camino Network

promotes unified and secure communication, driving the expansion of

local services to a global market. One example is a surf school in

Bali that can now offer its services directly to major airlines and

travel agencies using Camino Messenger, eliminating traditional

barriers, eliminating the need for multiple APIs and complex

processes.

Blockchain Life 2024 to attract over 10,000 attendees from 120

countries

The Blockchain Life 2024 forum will return for its 13th edition

on October 22-23 in Dubai, and will bring together more than 10,000

people from 120 countries to explore opportunities in the

cryptocurrency market. The two-day event will feature experts,

leaders and innovators sharing insights and strategies. There will

be an exhibition area with cutting-edge products and technologies,

as well as an AfterParty for informal networking.

Tether launches aUSDT, a new cryptocurrency pegged to gold

Tether (COIN:USDTUSD), the world’s leading stablecoin provider,

has announced the launch of “Alloy by Tether” (aUSDT), a new token

backed by physical gold stored in Switzerland. aUSDT is a

cryptocurrency designed to track the value of one U.S. dollar,

over-collateralized by Tether Gold (XAUT). Developed with the help

of Moon Gold NA and Moon Gold El Salvador, aUSDT is part of

Tether’s new digital asset tokenization platform, set to launch

later this year.

Cumberland DRW obtains New York BitLicense

Leading digital asset trader Cumberland DRW has received a

BitLicense from the New York State Department of Financial

Services. The company highlighted the importance of the license in

strengthening business relationships with New York institutions.

The BitLicense, created in 2015, regulates cryptocurrency companies

but has faced criticism for stifling innovation. Cumberland, a

subsidiary of DRW, was selected by Fidelity Investments to trade

bitcoin for its spot bitcoin ETF.

Congressman Ro Khanna hosts significant Bitcoin roundtable in

Washington

Congressman Ro Khanna will host a roundtable on Bitcoin and

blockchain in Washington, DC in early July. The meeting, described

as crucial for policymakers and innovation leaders, is expected to

be attended by representatives from the Biden Administration,

Congress, the Senate and businessman Mark Cuban. The meeting aims

to discuss strategies to maintain innovation in Bitcoin and

blockchain in the US, in response to Donald Trump’s recent

endorsements of the industry.

Alex Lab’s XLink strengthens security after $10 million breach

Following a $10 million security breach, Alex Lab’s XLink has

partnered with Fireblocks and Ancilia to strengthen protection for

its users. The collaboration with Fireblocks will implement

multi-party computing wallets for secure asset management.

Additionally, Ancilia will provide real-time threat monitoring and

detection, accelerating the implementation of new security measures

scheduled for the end of June but brought forward due to the

incident.

Wasabi raises $3 million in seed round led by Electric Capital

Wasabi, a DeFi protocol for leveraged trading of memecoins and

NFTs, has raised $3 million in a seed round led by Electric

Capital. Other investors include Alliance, Memeland and Spencer

Ventures. Co-founder Eren Derman said Wasabi facilitates price

discovery for long-tail assets and has already attracted more than

18,000 traders, generating $500 million in volume. The company

plans to expand its team from six to ten people.

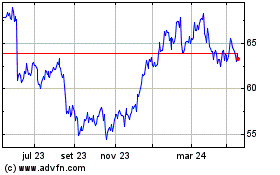

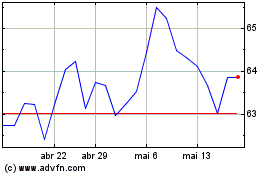

ASX (ASX:ASX)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ASX (ASX:ASX)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025