Choppy Trading Likely To Persist On Wall Street

09 Maio 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Thursday, with stocks likely to extend the lackluster

performance seen over the two previous sessions.

The futures had been pointing to a modestly lower open but

regained ground following the release of a report from the Labor

Department showing a much bigger than expected increase by

first-time claims for U.S. unemployment benefits in the week ended

May 4th.

The report said initial jobless claims climbed to 231,000, an

increase of 22,000 from the previous week’s revised level of

209,000.

Economists had expected jobless claims to inch up to 210,000

from the 208,000 originally reported for the previous week.

With the much bigger than expected increase, jobless claims

reached their highest level since hitting 234,000 in week ended

August 26th.

The data may add to recently renewed optimism that the Federal

Reserve will lower interest rates in the coming months.

Trading activity may remain somewhat subdued, however, as

traders express some uncertainty about the near-term outlook for

the markets.

Stocks showed a lack of direction over the course of the trading

day on Wednesday, extending the lackluster performance seen during

Tuesday’s session. Despite the choppy trading, the Dow closed

higher for the sixth straight day, reaching its best closing level

in over a month.

The major averages eventually finished the day mixed. While the

Dow climbed 172.13 points or 0.4 percent to 39,056.39, the S&P

500 edged down 0.03 points or less than a tenth of a percent to

5,187.67 and the Nasdaq dipped 29.80 points or 0.2 percent to

16,302.76.

The choppy trading on Wall Street came amid lingering

uncertainty about the outlook for interest rates following

Tuesday’s remarks by Minneapolis Federal Reserve President Neel

Kashkari.

Kashkari suggested interest rates may need to remain at current

levels for an “extended period” and said he couldn’t rule out

another rate increase.

The Federal Reserve is still widely expected to lower rates

sometime in the third quarter, however, with CME Group’s FedWatch

Tool currently indicating an 83.5 percent chance rates will be

lower by September.

Traders may also have been reluctant to make more significant

moves amid another relatively quiet day on the U.S. economic

front.

A report on weekly jobless claims may attract attention on

Thursday, while the University of Michigan is due to release its

preliminary reading on consumer sentiment in May on Friday.

Among individual stocks, shares of Uber Technologies (NYSE:UBER)

moved sharply lower after the ride-hailing giant reported an

unexpected first quarter loss on weaker than expected booking

revenue.

Cloud communications company Twilio (NYSE:TWLO) also came under

pressure after reporting first quarter results that exceeded

estimates but providing disappointing second quarter revenue

guidance.

Meanwhile, ride-hailing company Lyft (NASDAQ:LYFT) showed a

strong move the upside after reporting first quarter results that

exceeded analyst estimates on both the top and bottom lines.

Reflecting the lackluster performance by the broader markets,

most of the major sectors showed only modest moves on the day.

Networking stocks showed a strong move to the upside, however,

with the NYSE Arca Networking Index climbing by 1.1 percent.

Arista Networks (NYSE:ANET) helped lead the sector higher,

surging by 6.5 percent after reporting better than expected first

quarter results.

Tobacco and telecom stocks also saw notable strength on the day,

while biotechnology and commercial real estate stocks moved to the

downside.

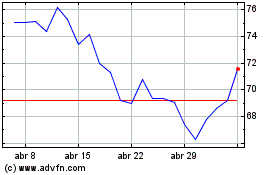

Uber Technologies (NYSE:UBER)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Uber Technologies (NYSE:UBER)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024