Dow Finishes Choppy Trading Day Above 40,000 For First Time

17 Maio 2024 - 5:35PM

IH Market News

Following the modest pullback seen over the course of the

previous session, stocks showed a lack of direction during trading

on Friday. The major average spent the day bouncing back and forth

across the unchanged line before eventually closing narrowly

mixed.

Despite the choppy trading, the Dow closed above 40,000 for the

first time, rising 134.21 points or 0.3 percent to 40,003.59.

The S&P 500 also crept up 6.17 points or 0.1 percent to

5,303.27, while the tech-heavy Nasdaq edged down 12.35 points or

0.1 percent at 16,685.97.

For the week, the Nasdaq surged by 2.1 percent, while the

S&P 500 jumped by 1.5 percent and the Dow shot up by 1.2

percent.

The choppy trading on Wall Street came as traders seemed

reluctant to make significant moves as they digest recent strength

in the markets, which saw the major averages reach new record

highs.

While recent economic data has generated optimism about an

interest rate cut in the coming months, comments from Federal

Reserve officials have put a damper on some of the cheer.

Following the slew of U.S. data released over the past two days,

the economic calendar was relatively quiet today, although the

Conference Board released a report showing a continued decrease by

its reading on leading U.S. economic indicators in the month of

April.

The Conference Board said its leading economic index fell by 0.6

percent in April after dipping by 0.3 percent in March. Economists

had expected the index to decrease by another 0.3 percent.

Among individual stocks, shares of Reddit (NYSE:RDDT) moved

sharply higher after the social media company announced a

partnership with OpenAI.

Online networking company Doximity (NYSE:DOCS) also surged after

reporting better than expected fiscal fourth quarter results.

On the other hand, shares of GameStop (NYSE:GME) plunged after

the video game retailer forecast a decrease in first quarter sales

and revealed plans to sell up to 45 million class A common

shares

Sector News

Most of the major sectors showed only modest moves on the day,

contributing to the lackluster performance by the broader

markets.

Gold stocks showed a substantial move to the upside, however,

with the NYSE Arca Gold Bugs Index surging by 3.7 percent to a

two-year closing high. The rally by gold stocks came amid a sharp

increase by the price of the precious metal.

Oil producer, brokerage and networking stocks also turned in

strong performances, while modest weakness emerged among

semiconductor stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Friday.

Japan’s Nikkei 225 Index fell by 0.3 percent, while Hong Kong’s

Hang Seng Index advanced by 0.9 percent and China’s Shanghai

Composite Index jumped by 1.0 percent.

Meanwhile, the major European markets all moved to the downside

on the day. While the French CAC 40 Index declined by 0.3 percent,

the U.K.’s FTSE 100 Index dipped by 0.2 percent and the German DAX

Index edged down by 0.1 percent.

In the bond market, treasuries came under pressure, extending

the modest pullback seen over the course of the previous session.

Subsequently, the yield on the benchmark ten-year note, which moves

opposite of its price, climbed 4.3 basis points to 4.420

percent.

Looking Ahead

The U.S. economic calendar for next week is relatively quiet,

although reports on durable goods orders and new and existing home

sales may attraction some attention along with remarks by several

Fed officials.

SOURCE: RTTNEWS

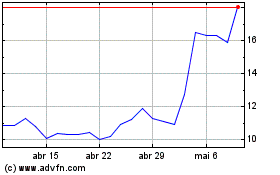

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

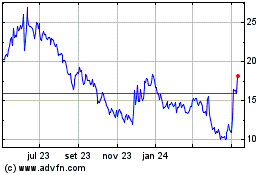

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024