VF Corp (NYSE:VFC) – VF Corp, the owner of Vans

and North Face brands, sold two jets and listed a hangar for sale

as part of its cost-cutting and cash-generating strategies. These

actions are part of the company’s plan to address continuous

revenue declines and prepare for future debt maturities.

Morgan Stanley (NYSE:MS) – James

Gorman, former CEO of Morgan Stanley, will step down as

chairman of the board at the end of the year, highlighting the

smooth transition to CEO Ted Pick. Despite the

approval of proposed salary packages, the relatively low support

reflects a trend of declining support for executive compensation in

the financial industry.

Goldman Sachs (NYSE:GS) – Goldman Sachs has

obtained a license to establish its regional headquarters in

Riyadh, Saudi Arabia. The decision follows new rules favoring

companies with a regional presence in the country with tax

incentives and the risk of losing lucrative government contracts

for those not locally established.

HSBC (NYSE:HSBC) – According to Michael

Roberts, CEO of HSBC in the US and the Americas, employee

attendance at HSBC’s new office in Hudson Yards, New York, has

increased to 80%, doubling from the 40% recorded at the old

headquarters in Bryant Park before the pandemic.

Citigroup (NYSE:C), HSBC

(NYSE:HSBC), Barclays (NYSE:BCS) – Citigroup,

HSBC, and Barclays are requiring more employees to attend the

office five days a week due to regulatory changes. These changes

complicate remote work on Wall Street, forcing adaptations to

flexible work policies.

Raymond James (NYSE:RJF) – Butch Oorlog was

chosen by Raymond James Financial to succeed Paul Shoukry as CFO

amid a series of executive changes. The appointments aim to ensure

leadership continuity as the company prepares for a CEO transition

and promotes other key executives.

KKR & Co (NYSE:KKR) – KKR expects to

receive EU antitrust approval for the purchase of Telecom Italia’s

fixed network. This approval is likely after KKR agreed to maintain

commercial agreements with Telecom Italia’s rivals, easing

regulatory concerns about competition. This $23.9 billion deal is

notable for being the first of its kind in a major European

country.

Nvidia (NASDAQ:NVDA) –

Nvidia’s market value surged by about $218 billion

on Thursday, driven by an optimistic revenue forecast and growing

demand for AI chips. Nvidia also announced a 10-for-1 stock split

following a notable price increase, aiming to attract more retail

investors. This move could facilitate its inclusion in the Dow

Jones Industrial Average. In the Chinese market, Nvidia’s latest AI

chip had a slow start, selling at a lower price than Huawei’s rival

chip due to abundant supply and low demand. This discount

highlights the pricing and competition challenges Nvidia faces in

China, particularly with increasing US sanctions and strong local

competition.

Alphabet (NASDAQ:GOOGL) – Alphabet, the parent

company of Google, by acquiring HubSpot, a marketing software

maker, would strengthen its position in the cloud-based business

software market, becoming a more robust competitor against

Microsoft. The acquisition aims to integrate customer relationship

management services, potentially enhancing Google’s capabilities to

compete in the corporate market. In other news, Google is building

the Umoja submarine cable, which will directly link Africa to

Australia, improving connectivity in the region. The project

follows the Equiano, which already connects Africa to Europe, and

will expand internet access in under-connected parts. Additionally,

Google will invest billions in Tamil Nadu, India, to assemble Pixel

smartphones and drones, diversifying manufacturing outside China

and boosting local industrialization.

Meta Platforms (NASDAQ:META),

Alphabet (NASDAQ:GOOGL) – Alphabet and Meta

Platforms are negotiating with Hollywood studios to license content

for their AI technologies that create realistic videos from texts.

They seek robust financial partnerships, while the studios evaluate

the use of AI to reduce costs but are concerned about controlling

their content.

Micron Technology (NASDAQ:MU) – A US jury

determined that Micron Technology must pay $445 million to Netlist

for patent infringement in memory module technology. Jurors

concluded that Micron willfully infringed two Netlist patents,

allowing the judge to increase financial damages. Micron’s shares

are up 1.2% in pre-market trading.

Adobe (NASDAQ:ADBE) – Canva launched a set of

design tools for corporate users, directly competing with Adobe by

attracting large clients and accelerating revenue growth. Canva’s

new tools, aimed at HR, sales, and design teams, simplify editing

and ensure visual consistency in business documents.

Paramount Global (NASDAQ:PARA), Charter

Communications (NASDAQ:CHTR) – Paramount Global has closed

a multi-year deal with Charter Communications to distribute its

full portfolio of cable networks and ad-supported versions of its

streaming services, such as Paramount+ Essential and BET+

Essential, to Charter’s Spectrum TV customers at no additional

cost. Financial terms of the agreement were not disclosed.

Tesla (NASDAQ:TSLA) – Tesla has removed the

target of 20 million vehicles annually by 2030 from its report,

signaling a shift in focus to robotaxis and indicating a pullback

in developing affordable electric vehicles. Tesla also reduced

Model Y production by double digits at its Shanghai plant,

responding to decreasing demand in China, its second-largest

market. This decision comes amid intense price competition among

electric vehicle manufacturers and an economic slowdown in the

country. Additionally, CEO Elon Musk has changed

his stance and expressed opposition to US tariffs on Chinese

electric vehicles. At an event in Paris, Musk emphasized that he

did not request the recent tariffs implemented by Biden and

stressed that market-distorting practices are harmful. Furthermore,

Bloomberg reported on Thursday that SpaceX, also led by Elon Musk,

is discussing the sale of existing shares that could value the

company at approximately $200 billion, up from a previous valuation

of $180 billion. On Friday, Elon Musk denied plans to sell SpaceX

shares.

General Motors (NYSE:GM) – At the Detroit

Economic Club, Mary Barra, CEO of General Motors,

emphasized the importance of developing autonomous vehicles by GM,

highlighting that the technology promises to be safer than human

driving, reducing the risk of accidents caused by human error.

Boeing (NYSE:BA) – Brian West,

CFO of Boeing, stated at the Wolfe Research conference that the

company will face negative free cash flow in 2024 and does not

foresee an increase in aircraft deliveries in the second quarter.

Boeing is dealing with production crises affecting its best-selling

models, as well as addressing safety concerns, as explained by the

head of the Federal Aviation Administration (FAA). Boeing has been

instructed to develop a plan within 90 days to correct systemic

quality issues following incidents and a ban on expanding 737 MAX

production. Boeing announced it has extended new hires’ training in

manufacturing and quality skills from 10 to 14 weeks, including

practice on a 737 fuselage section at its Renton training center,

as part of an improvement after a 737 MAX 9 incident.

BHP Group (NYSE:BHP), Anglo

American (USOTC:NGLOY) – BHP seeks to expand its copper

portfolio by acquiring Anglo American, facing the challenge of

overcoming the rejection of three acquisition proposals. After

ongoing negotiations and the need for adjustments in the offer,

Anglo American allows more time for a binding offer, highlighting

the complexity and resistance encountered, including demands for a

more attractive business structure for investors.

Hess Corp (NYSE:HES), Chevron

(NYSE:CVX) – John Hess, CEO of Hess Corp, has

until Tuesday to quell a shareholder rebellion dissatisfied with

the management of a $53 billion merger proposal with Chevron.

Support has dwindled in recent weeks, complicating the necessary

approval, despite Hess personally seeking investor support. The

decision is critical amid regulatory uncertainty and arbitration

disputes impacting the deal.

Earnings

Workday (NASDAQ:WDAY) – Workday reported

adjusted earnings per share of $1.74, above FactSet’s estimates of

$1.58 per share. Revenue rose to $1.9 billion, below expectations

of $1.97 billion. For the second quarter, Workday forecasted

subscription revenue of $1.895 billion, while StreetAccount

consensus forecasts $1.9 billion. Shares fell 12.3% in pre-market

trading.

Intuit (NASDAQ:INTU) – Intuit reported

third-quarter adjusted earnings per share of $9.88. Revenue

increased 12% to $6.74 billion. Analysts expected adjusted earnings

per share of $9.38 on revenue of $6.65 billion, according to

FactSet. For the fiscal fourth quarter, Intuit estimates adjusted

earnings of $1.80 to $1.85 per share, while analysts consulted by

FactSet expect $1.92 per share. Shares fell 6.2% in pre-market

trading.

Ross Stores (NASDAQ:ROST) – Ross Stores shares

rose 7.9% in pre-market trading after reporting first-quarter

earnings of $1.46 per share and revenue of $4.86 billion. Analysts

predicted earnings of $1.35 per share and revenue of $4.83 billion,

according to LSEG.

Deckers Outdoor (NYSE:DECK) – Deckers shares

rose 8.1% in pre-market trading after reporting fourth-quarter net

income of $127.5 million or $4.95 per share, on revenue of $960

million. Analysts consulted by LSEG predicted earnings of $2.89 per

share and revenue of $888 million. For the year, the company

expects earnings per share of $29.50 to $30, compared to $30.74 per

share expected by analysts consulted by FactSet.

Stepstone Group (NASDAQ:STEP) – The StepStone

Group announced fourth-quarter 2024 results, with earnings per

share of 33 cents, beating the 28 cents estimate. Reported revenue

was $177.36 million, 9.16% above analysts’ forecast of $162.47

million. Shares rose 3.0% in pre-market trading.

Lionsgate (NYSE:LGF.B) – In the fourth quarter,

Lionsgate reported revenues of $1.11 billion, representing a 3%

increase compared to the same period last year. The company managed

to reduce its net loss by 59% year over year, from $96.8 million to

$39.5 million in the fiscal fourth quarter of 2024, corresponding

to a loss of 22 cents per share. Shares rose 3.9% in pre-market

trading.

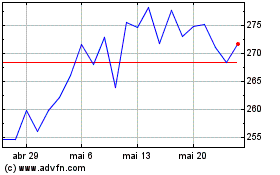

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024