Apple (NASDAQ:AAPL) – In April, Apple’s iPhone

sales in China surged by 52% compared to the previous year,

recovering from a challenging start to the year. This increase

comes despite strong competition from local manufacturers like

Huawei. Overall smartphone sales in the country also grew, totaling

22.7 million units. At the upcoming developer conference, Apple

will introduce the Greymatter Project, integrating AI into popular

apps and improving notifications. Initiatives such as a new

diversity chief and external collaborations are also highlights.

Apple, although lagging behind rivals in AI, plans to leverage its

large customer base as an advantage.

Alphabet (NASDAQ:GOOGL) – Groups from various

sectors, including aviation, hospitality, and retail, have urged EU

regulators to ensure that Google takes their perspectives into

account when adapting its operations to the new Digital Markets Act

(DMA). They are concerned that the changes may disproportionately

benefit large online intermediaries, negatively affecting their own

revenues. Meanwhile, the safety of Waymo’s autonomous vehicles,

another Alphabet subsidiary, is under increased scrutiny in the US

following the identification of new incidents. The primary

automotive safety regulator has expanded its investigation, adding

nine cases of collisions and traffic violations, involving a total

of 17 vehicles in accidents. Additionally, Alphabet continues to

expand its influence, with a new investment of around $350 million

in Flipkart, an Indian online retailer controlled by Walmart. This

investment is part of a broader financing round of approximately $1

billion, led by Walmart, which has already allocated $600 million

to Flipkart, one of Amazon’s main competitors in India.

Meta Platforms (NASDAQ:META) – Meta Platforms

has enhanced security measures on its CrowdTangle tool, now

dedicated to monitoring misinformation during the European

Parliament elections. These improvements aim to reassure the EU,

which is investigating the tool’s effectiveness. Candidates will be

guided on account protection on Meta platforms.

Flutter Entertainment (NYSE:FLUT) – Shares of

Flutter Entertainment, owner of DraftKings

(NASDAQ:DKNG) and FanDuel, fell by up to 4% in pre-market trading

following the approval by the Illinois Senate of a bill that

increases taxes on sports betting. The new legislation positions

Illinois as the second most costly state for the sports betting

sector, with higher gross adjusted revenue companies paying up to

40% tax. DraftKings shares fell by 5.5%.

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) is in negotiations with Italy to invest billions in expanding

its data centers, aiming to strengthen its cloud presence in

Europe. The amount and location of the investment are being

discussed, with possibilities including expansion in Milan or the

construction of a new facility.

Alibaba (NYSE:BABA) – AliExpress, owned by

Alibaba, has hired David Beckham as an ambassador to strengthen its

position against PDD Holdings’ Temu. This move aims to boost the

platform in the global market for affordable Chinese products.

Beckham’s campaign will coincide with sponsorship of UEFA Euro

2024, seeking greater engagement and sales.

PDD Holdings (NASDAQ:PDD) – PDD Holdings

shares, owner of Temu, are undervalued due to geopolitical tensions

and intense competition in the e-commerce sector in China,

according to Bloomberg. Despite significant growth of 43% since

March, the valuation is still modest, trading at 13 times expected

earnings, half the Nasdaq 100 average.

Nokia (NYSE:NOK) – Nokia is close to securing a

contract to provide 5G technology to MEO, a telecommunications

operator in Portugal, surpassing Huawei, the current supplier of

MEO’s 2G, 3G, and 4G RAN equipment. The agreement has not yet been

signed, but the announcement is expected soon.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC shares are being widely bought by foreign

investors, driven by the rise in the AI sector following Nvidia’s

strong results. Foreign ownership has reached 75%, the highest in

two years, but still below the 2017 record. This indicates

potential for further purchases, according to Goldman Sachs.

Nvidia (NASDAQ:NVDA) – Nvidia shares rose by

2.6% in pre-market trading after Elon Musk’s announcement about his

xAI startup. In the latest round of fundraising for xAI, a

significant portion of that amount is expected to be invested in

Nvidia hardware.

Tesla (NASDAQ:TSLA) – Glass Lewis advisory firm

has advised Tesla shareholders to reject a proposed $56 billion pay

package for CEO Elon Musk, citing its “excessive size” and

potential dilutive effect. The package, linked to Tesla’s market

value, is considered the largest for a CEO in American corporate

history. Elon Musk’s artificial intelligence startup, xAI, raised

$6 billion in a Series B round to compete with OpenAI. Less than a

year after its creation, xAI plans to use the funds to launch

products, develop infrastructure, and accelerate innovations, with

a post-investment valuation of $24 billion.

Toyota Motor (NYSE:TM) – Toyota has unveiled

new engines to meet stricter emissions standards, in partnership

with Subaru and Mazda. These engines, including a 2.0-liter turbo,

promise efficiency and reduced environmental impact. Additionally,

Glass Lewis advisory recommended that Toyota shareholders vote

against the re-election of president Akio Toyoda at the next annual

general meeting. They argue that the board lacks sufficient

independence. Toyoda, who was re-elected last year with 85% of the

votes, is the grandson of the company’s founder.

Stellantis (NYSE:STLA) – Stellantis announced

it will produce a hybrid version of the Fiat 500e at its Mirafiori

plant in Turin, Italy, in response to slowing electric vehicle

sales. CEO Carlos Tavares discussed this strategy during a meeting

with unions demanding a more affordable and high-volume model.

Lucid (NASDAQ:LCID) – Lucid announced the

dismissal of around 400 employees, representing 6% of its

workforce, as part of an effort to reduce costs amid a slowing

electric vehicle market. The layoffs are expected to be completed

by the end of the third quarter, generating restructuring costs

between $21 million and $25 million, with the majority being

accounted for in this quarter.

Gol Linhas Aéreas Inteligentes SA (NYSE:GOL),

Azul SA (NYSE:AZUL) – Azul and Gol have initiated

a flight network connection, suggesting a possible future

consolidation. Discussions about a merger between the two companies

are still ongoing. Gol expects to emerge from bankruptcy

proceedings with a $1.5 billion injection of new capital and the

refinancing of $2 billion in debt. The Brazilian airline, which

filed for bankruptcy in the US due to debts and Boeing delays,

detailed this in a regulatory document.

DuPont de Nemours (NYSE:DD) – DuPont shares

rose by 1.2% in pre-market trading after Citi analysts upgraded

their recommendation from neutral to buy and increased the price

target from $85 to $95. This upgrade was driven by the company’s

plans to split into three parts, as reported by Fly. Last week,

Wells Fargo also upgraded DuPont’s stock rating from hold to

buy.

BP plc (NYSE:BP), Shell

(NYSE:SHEL), EOG Resources (NYSE:EOG) – In the

2023 shallow-water auction in Trinidad and Tobago, BP, Shell, and

EOG Resources submitted six proposals to explore four oil and gas

blocks. The Modified UC block, near existing fields, was the most

contested. Results will be announced in four months.

BlackRock (NYSE:BLK) – Major shareholders of

Anglo American (NASDAQ:AAL), including BlackRock, have encouraged

continued negotiations with BHP Group (NYSE:BHP) on a merger

proposal valued at $49.18 billion. BHP, the world’s largest listed

miner, has until May 29 to formalize an offer, under UK takeover

rules.

Blackstone (NYSE:BX) – Blackstone acquired a $1

billion portfolio of mortgages from Deutsche Pfandbriefbank AG,

reflecting the German bank’s challenge with volatile commercial

real estate markets. Comprising 11 loans in the US and UK, the

purchase was made in cash by Blackstone’s real estate debt

strategies unit.

UBS Group AG (NYSE:UBS) – UBS has decided not

to consider external candidates to replace CEO Sergio Ermotti and

will focus on three internal options. The Financial Times reported

that the Swiss bank may reveal the names of potential successors at

the next annual meeting. Iqbal Khan, among others, is on the list

of candidates.

Goldman Sachs (NYSE:GS) – Goldman Sachs

economists, led by Jan Hatzius, adjusted the forecast for the first

interest rate cut by the Federal Reserve to September, instead of

July. This aligns with current employment and inflation conditions,

which do not indicate an immediate need for cuts. The probability

of a cut in September is 52.2%, as shown by interest rate futures.

The team maintains the expectation of two cuts in 2024.

Citigroup (NYSE:C) – Citigroup has asked 600 of

its eligible employees in the US to return to the office full-time.

This decision stems from regulations that make remote work

difficult for activities like trading. However, most will continue

with a hybrid scheme, working at least three days in the

office.

Capital One (NYSE:COF),

Walmart (NYSE:WMT) – Capital One will no longer be

the exclusive issuer of Walmart credit cards, after terminating the

agreement due to the retailer’s claims of delays in transaction

updates and replacement of lost cards. The partnership, started in

2018 after the end of the relationship with Synchrony Financial,

was terminated after a favorable court decision for Walmart.

Waystar Holding Corp. – The healthcare payment

software company is preparing for an initial public offering in the

US for Tuesday. With backers like EQT AB and the Canada Pension

Plan Investment Board, the offering could raise about $950 million

in new shares, potentially valuing the company at up to $6 billion.

Waystar plans to trade its shares on Nasdaq under the symbol

WAY.

FedEx (NYSE:FDX) – FedEx announced on Friday

that it has resumed its priority international delivery services to

Ukraine while continuing to suspend services in Belarus and Russia.

The decision follows the initial interruption of operations in the

region after the Russian invasion of Ukraine in February 2022.

Live Nation (NYSE:LYV) – Live Nation and

Ticketmaster face a class-action antitrust lawsuit, the first after

US government lawsuits. The lawsuit, filed in Manhattan, seeks $5

billion for monopolistic practices in the live events market.

Plaintiffs allege that the company threatens venues and eliminates

competitors.

GameStop (NYSE:GME) – GameStop shares rose by

20% in pre-market trading after announcing on Friday the completion

of a 45 million share offering, raising about $933.4 million. The

company stated it will use these funds for general corporate

purposes, such as acquisitions and investments. The offering was

initially disclosed on May 17.

Starbucks (NASDAQ:SBUX) – In China, Starbucks

faces increasing competition from low-cost rivals like Luckin

Coffee, which aggressively lower prices. This pressures Starbucks

to participate in a price war, despite its preference for

maintaining a premium image and avoiding significant discounts.

McDonald’s (NYSE:MCD) – McDonald’s franchisees

are concerned about the chain’s new summer promotion, offering a

combo for $5. Despite some locations already selling such items

separately for over $5, the offer includes a McDouble or McChicken,

small fries, small soda, and four McNuggets. Franchisees argue that

this promotion squeezes their already tight profit margins. The

campaign, starting on June 25, is part of the company’s efforts to

increase out-of-home consumption.

Eli Lilly (NYSE:LLY) – Eli Lilly announced an

additional $5.3 billion investment in its new facility in Lebanon,

Indiana, bringing the total to $9 billion. This investment aims to

increase production of ingredients for its weight loss and diabetes

drugs, Zepbound and Mounjaro, due to high demand.

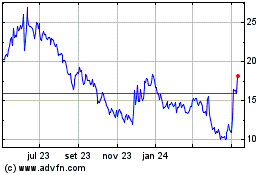

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

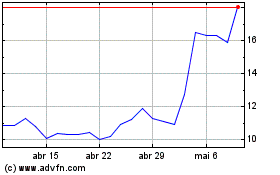

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025