Fisker (NYSE:FSR) – The American electric

vehicle manufacturer filed for bankruptcy last night, aiming to

sell its assets and restructure debts following severe financial

challenges in the production and delivery of its “Ocean” SUVs.

Fisker, declaring bankruptcy under Chapter 11, reported assets

valued between $500 million and $1 billion and liabilities ranging

from $100 million to $500 million. This indicates that while the

company has substantial resources, it also faces significant debt.

In 2023, Fisker produced over 10,000 vehicles but delivered only

about 4,700, showing a discrepancy between production and actual

delivery, possibly reflecting operational or demand challenges.

Chegg (NYSE:CHGG) – Chegg plans to reduce its

global workforce by 23%, cutting 441 employees and closing offices.

The restructuring aims to focus on more integrated and efficient

educational solutions driven by artificial intelligence. Nathan

Schultz, the new CEO, is leading the transformation to compete in a

market dominated by educational technology. Shares jumped 19.5% in

pre-market trading.

Nvidia (NASDAQ:NVDA) – On Monday, the US

Supreme Court decided to hear an appeal by Nvidia to overturn a

lawsuit accusing the company of misleading investors about the

extent of sales related to the cryptocurrency sector. The case was

revived after a lower court allowed the class-action suit to

proceed.

Apple (NASDAQ:AAPL) – Apple announced it will

discontinue its “buy now, pay later” service in the US, replacing

it with a new installment loan program. Starting later this year,

users will be able to access loans through credit cards, debit

cards, and other lenders when using Apple Pay.

Microsoft (NASDAQ:MSFT),

Roblox (NYSE:RBLX) – Jerret West, head of

marketing at Xbox, is leaving Microsoft to become chief marketing

officer at Roblox. His departure comes amid a broad restructuring

in Xbox marketing, forming a central game marketing team and

transferring other teams.

Adobe (NASDAQ:ADBE) – The US government has

sued Adobe, accusing it of hiding high termination fees and making

it difficult to cancel subscriptions in its most popular plan. The

FTC claims that Adobe was not transparent about the terms of the

subscription and created obstacles for consumers trying to

cancel.

Broadcom (NASDAQ:AVGO) – On Monday, Broadcom’s

shares closed up 5.4%, pushing its market capitalization above Eli

Lilly’s, making it the 8th most valuable US company, with over $847

billion. The surge reflects the company’s strong recent performance

in the chip sector and its expansion into the AI market. In

pre-market trading on Tuesday, shares rose +2.80%.

Amazon (NASDAQ:AMZN) – Unionized Amazon workers

voted to join the International Brotherhood of Teamsters, one of

the largest unions in the US. This partnership aims to strengthen

workers’ positions in future negotiations for better working

conditions and dignified jobs at Amazon.

Snowflake (NYSE:SNOW) – Cybercriminals are

demanding ransoms from up to 10 companies compromised on the

Snowflake data platform, with amounts ranging from $300,000 to $5

million. The gang is using stolen data to pressure payments,

auctioning them off on illegal forums, in a campaign described as a

“new stage” by Mandiant analyst Austin Larsen.

Tesla (NASDAQ:TSLA) – Tesla has filed a lawsuit

against Matthews International in a California federal court,

accusing it of misappropriating and disclosing trade secrets

related to battery manufacturing. The electric vehicle company is

seeking more than $1 billion in damages and injunctions to

safeguard its innovations. Matthews denies the allegations and

commits to defending itself robustly. Meanwhile, Tesla is also

involved in a legal dispute related to validating a shareholder

vote that approved a record compensation package for Elon Musk,

arguing that it impacts a Delaware case on the legality of the

salary package. Elon Musk also announced a stock-based compensation

plan for high-performing employees at Tesla, aiming to reward

exceptional contributions amidst job cuts and competitive

challenges in the electric vehicle market.

Toyota Motor (NYSE:TM) – Despite contrary

recommendations from major proxy advisors, Akio Toyoda and nine

other Toyota board members were re-elected, reflecting their

popularity among retail investors and the company’s record results.

The drop in Toyoda’s approval rating to 85% and certification

testing violations could prompt governance reforms.

Stellantis NV (NYSE:STLA) – Stellantis NV has

reversed its remote work policy, requiring its engineers to work in

the office at least three days a week to facilitate collaboration

in vehicle design and development, especially during new model

launches.

GE Aerospace (NYSE:GE) – The Wall Street

Journal reported that Larry Culp, CEO of GE Aerospace, declined an

offer from Boeing to take the top position at the aircraft

manufacturer. Culp previously mentioned that he could better serve

Boeing as its primary supplier.

Boeing (NYSE:BA) – Boeing CEO Dave Calhoun will

address safety culture concerns at a US Senate hearing today,

acknowledging the need for improvements following recent incidents

with the 737 MAX 9. Calhoun is expected to state that the company

is acting to correct flaws and ensure aerospace safety.

Embraer (NYSE:ERJ) – Embraer arrives at the

Farnborough Airshow event, scheduled from July 22 to 26, with

shares at a historic high. After receiving significant orders, the

Brazilian aircraft manufacturer is ready to meet future demand for

new planes. The company stands out amid a global shortage,

benefiting from available production slots ahead of its larger

rivals.

Citigroup (NYSE:C) – Citigroup is highlighting

one of its less visible segments, services, in its revitalization

strategy. This sector, responsible for nearly half of last

quarter’s profits, will be presented to investors by Jane Fraser

and Mark Mason in New York. The initiative aims to demonstrate how

efficient global money movement operations can boost the bank’s

profitability. Meanwhile, the Federal Deposit Insurance Corp (FDIC)

board plans to vote to downgrade Citigroup’s data management

systems rating from “deficiency” to “shortcoming.” This action

stems from a gap identified in the bank’s “living will,” detailing

how it would be dissolved in case of bankruptcy. Although the FDIC

considers this action, it is not expected that the US Federal

Reserve will do the same. Citigroup stated that it is always

improving its stress testing and resolution planning processes,

maintaining strong financial health.

Goldman Sachs (NYSE:GS) – Goldman Sachs

economists warn that the US labor market may be at a “tipping

point,” where a decline in worker demand would directly affect

employment, not just available positions. This reflects economic

uncertainty that could lead to interest rate cuts by the Fed.

Bank of America (NYSE:BAC) – According to a

Bank of America survey, global investors are expected to continue

investing in stocks, with 32% preferring US stocks after

reallocating funds from the money market. The survey revealed

record optimism among managers, with money market fund cash levels

at a three-year low.

UBS Group AG (NYSE:UBS) – UBS has started a

share buyback program, acquiring about $50.21 million (44.8 million

Swiss francs) in shares last week, with plans to repurchase up to

$1 billion in shares this year.

Berkshire Hathaway (NYSE:BRK.A),

BYD (USOTC:BYDDY), Occidental

Petroleum (NYSE:OXY) – Warren Buffett’s Berkshire Hathaway

recently reduced its stake in BYD, the world’s largest electric

vehicle seller in 2022, by selling 1.3 million shares, reducing its

stake from 7.02% to 6.90%. Additionally, Berkshire increased its

stake in Occidental Petroleum to about 29%, acquiring 2.9 million

shares for approximately $173 million in June. Buffett took

advantage of falling energy sector stock prices, paying an average

of less than $60 per share in recent purchases.

Blackstone (NYSE:BX) – Blackstone has proposed

an offer of 275.8 billion yen (approximately $1.74 billion) to buy

Infocom, a Japanese digital comics distributor. The offer includes

a public share acquisition at 6,060 yen per share, totaling 141.4

billion yen. Teijin, the current controller, plans to sell its 58%

stake in the company after the acquisition.

Standard Chartered (LSE:STAN) – Standard

Chartered failed to dismiss allegations of more extensive

violations of US sanctions against Iran than previously admitted.

More than 200 investors are suing the bank in London for false

statements about compliance with sanctions from 2007 to 2019.

Shell (NYSE:SHEL) – Shell agreed to buy

Singapore’s Pavilion Energy from Temasek, strengthening its

dominant position in the liquefied natural gas (LNG) market. The

deal, with no financial details disclosed yet, will expand Shell’s

access to gas markets in Europe and Singapore.

Exxon Mobil (NYSE:XOM) – A US judge dismissed

Exxon Mobil’s lawsuit against the activist group Arjuna Capital

after the latter agreed not to present future proposals at the

company’s annual meetings about greenhouse gas emissions,

eliminating the basis of the lawsuit.

Bunge Global SA (NYSE:BG) – The $34 billion

merger between US-based Bunge and Glencore-backed Viterra to form

an agricultural trading giant is pending EU regulatory approval

until July 18. The European Commission will decide whether to

approve the deal, require corrective measures, or initiate a

prolonged investigation.

Sociedad Quimica y Minera de Chile SA

(NYSE:SQM) – The world’s second-largest lithium producer has signed

a long-term agreement to supply lithium hydroxide to Hyundai and

Kia, crucial for electric vehicle batteries. This deal follows

similar partnerships with Ford and LG Energy, bolstering SQM’s

expansion plans.

Southern Company (NYSE:SO) – Southern Company

CEO Chris Womack predicts more industry commitments to build

large-scale light water reactors in the US before 2030, driven by

the recent start of operations at the Vogtle 4 reactor, the first

in over 30 years in the country.

Merck & Co. (NYSE:MRK) – Merck has received

FDA approval for its pneumococcal vaccine Capvaxive, competing with

Pfizer’s Prevnar 20. Capvaxive covers 84% of strains causing

pneumococcal diseases in older adults and may expand its access

depending on CDC recommendations this month. The competition

promises to be fierce in the adult pneumococcal vaccine market.

Pfizer (NYSE:PFE) – Kansas has sued Pfizer,

accusing it of misleading the public about the efficacy and safety

of its Covid-19 vaccine, alleging violations of the state’s

Consumer Protection Act. The state seeks unspecified damages for

purported false statements about the vaccine’s effectiveness and

risks.

UnitedHealth Group (NYSE:UNH) – The Centers for

Medicare & Medicaid Services announced they will end an advance

payment program that helped Medicare providers during service

disruptions from Change Healthcare, a UnitedHealth unit. The

program will conclude on July 12, and new requests will not be

accepted after that date.

Lennar (NYSE:LEN) – For the quarter ended May

31, Lennar Corp reported earnings of $3.45 per share, exceeding

analysts’ average estimate of $3.24 per share. The average price

per home was $426,000, down from $449,000 the previous year. The

company delivered 19,690 homes, compared to 17,885 last year. For

the next quarter, Lennar expects to deliver between 20,500 and

21,000 homes, while analysts estimate 20,917 homes. Shares fell

-3.44% in pre-market trading.

La-Z-Boy (NYSE:LZB) – La-Z-Boy exceeded

fourth-quarter expectations with net income of $40.3 million (91

cents per share), up from $34.6 million (79 cents per share) the

previous year. Sales reached $554 million. Analysts tracked by

FactSet estimated adjusted earnings per share of 70 cents on $516.4

million in sales. Projections for the first quarter include sales

between $475 million and $495 million. The company anticipates a

slowdown due to the summer season and a one-week factory shutdown

in July. Additionally, La-Z-Boy plans to open 12 to 15 new

furniture galleries in the next fiscal year.

Best Buy (NYSE:BBY) – UBS analyst Michael

Lasser said Best Buy shares are well-positioned for a rise. He

upgraded his rating to “Buy” due to an 18% upside potential,

highlighting the strong correlation with appliance sales, the

electronics replacement cycle, and product innovation.

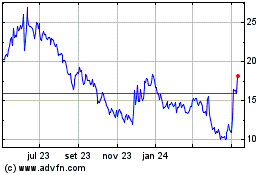

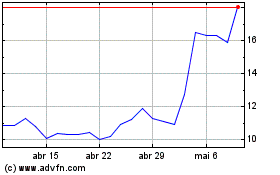

GameStop (NYSE:GME) – CEO Ryan Cohen announced

plans to operate a smaller network of stores without detailing the

use of the company’s $4 billion cash. The lack of clarity on

strategic plans disappointed investors, contributing to a 12% drop

in share value on Monday. Shares fell -1.55% in pre-market trading

on Tuesday.

Philip Morris International (NYSE:PM) – Philip

Morris International announced the suspension of online sales of

Zyn nicotine pouches by Swedish Match North America while

responding to a DC subpoena related to a flavored tobacco sales ban

in the region. The company seeks to ensure compliance with local

regulations.

Webtoon Entertainment – Webtoon Entertainment,

an online comics platform, plans to raise up to $315 million in its

US initial public offering, with a valuation of up to $2.67

billion. The company will offer 15 million shares at a price

between $18 and $21 each. The company will be listed on the Nasdaq

Global Select Market under the symbol “WBTN.” After the IPO and a

private placement, Naver, the South Korean tech giant and majority

owner of Webtoon Entertainment, will hold a 63.4% stake in the

company.

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025