U.S. Stocks Close On Mixed Note Again; Technology Stocks Rebound

25 Junho 2024 - 7:00PM

IH Market News

U.S. stocks closed mixed on Tuesday after a cautious session, as

investors looked ahead to the release of some crucial U.S. data,

including a report on consumer income and spending, for more

clarity about the outlook for Federal Reserve’s interest rates.

Among the major averages, the Dow (DOWI:DJI) settled with a loss

of 299.05 points or 0.76 percent, at 39,112.16. The Nasdaq

(NASDAQI:COMP) climbed up 220.84 points or 1.26 percent, to

17,717.65, while the S&P 500 (SPI:SP500) ended up by 21.43

points or 0.39 percent, at 5,469.30.

Nvidia (NASDAQ:NVDA) rallied nearly 7 percent, rebounding after

recent losses. Meta Platforms, Alphabet, Apple Inc., Eli Lilly,

Micron Technology, Uber Technologies, Arista Networks, Palo Alto

Networks, Dell, and Airbnb also posted strong gains.

Boeing, Nike, Goldman Sachs, IBM, Pfizer, McDonalds Corporation,

Wells Fargo, Bank of America, Home Depot and Johnson & Johnson

declined sharply.

Walmart ended lower by more than 2 percent, after the company’s

CFO flagged the second quarter as the “most challenging

quarter”.

On the economic front, the Chicago Fed’s measure of overall

economic activity and related inflationary pressure in the United

States rose in May for the first time in three months, survey

results showed.

The Chicago Fed National Activity Index, or CFNAI, rose to +0.18

in May from -0.26 in April, which was revised from -0.23.

U.S. house prices rose less than expected in April, after

stagnating in the previous month, latest data from the Federal

Housing Financing Agency showed.

The seasonally adjusted house price index increased 0.2 percent

from the previous month. Economists had forecast a 0.3 percent

gain. March’s 0.1 percent increase was revised down to 0.0

percent.

House prices rose 6.3 percent year-on-year in April, which was

more than double the 3.1 percent gain registered in the same month

last year.

Survey data from the Conference Board showed consumer confidence

in the U.S. eased slightly in June as households’ economic

expectations eroded. The Conference Board Consumer Confidence Index

fell to 100.4 from 101.3 in May. Economists had expected a reading

of 100.

The Expectations Index, which mirrors consumers’ short-term

outlook for income, business, and labor market conditions, slid to

73.0 from 74.9 in May.

In overseas trading, Asian stocks ended mostly higher on Tuesday

after China’s Premier Li Qiang said the country is capable of

achieving the full year growth target of around 5 percent.

European stocks closed on a weak note as investors closely

followed the political scene and digested some corporate news from

the region, besides looking ahead to U.S. consumer income &

spending data for clues about the outlook for Federal Reserve’s

monetary policy moves.

SOURCE: RTTNEWS

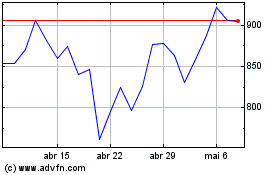

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024