Impact of Mt. Gox transfers on Bitcoin and cryptocurrency markets

The recent transfer of BTC by Mt. Gox, a significant amount

intended for creditor reimbursement, has coincided with a drop in

Bitcoin (COIN:BTCUSD) prices, reaching its lowest level since the

end of February. Following the transfer, Bitcoin’s price fell to

$53,499.90, rebounding to a 1% decrease at $56,473.76 at the time

of writing. BTC’s value has dropped 8.77% in a week, erasing all

gains since February.

The possibility of a massive sell-off by creditors, who are set

to receive around 140,000 BTC, raises fears of intense selling

pressure in the market. Analysts predict that with this pressure,

the price could decline to the $50,000 range in the coming weeks,

highlighting Bitcoin’s sensitivity to large on-chain transactions,

especially those involving liquidations by major entities like Mt.

Gox.

Investor sentiment in cryptocurrencies has also worsened, with

market sentiment hitting the lowest levels since the crypto winter

of 2022. According to the Crypto Fear & Greed Index, developed

by Alternative.me, the score reached 29, indicating “extreme fear,”

a sentiment not seen since January 2023 when Bitcoin was near

$17,000 after a prolonged period of decline.

The shares of cryptocurrency-related companies experienced

significant drops on Friday. Coinbase Global (NASDAQ:COIN) saw its

shares fall by 2.1%, MicroStrategy (NASDAQ:MSTR) faced a 1.3%

reduction, and Marathon Digital Holdings (NASDAQ:MARA) and Riot

Platforms (NASDAQ:RIOT) also registered declines of 5.2% and 0.9%,

respectively. Additionally, Robinhood Markets’ shares (NASDAQ:HOOD)

decreased by 1.9%. The instability in the cryptocurrency market

directly impacts the stock market performance of these

companies.

Meanwhile, Ethereum (COIN:ETHUSD) fell below the $3,000 mark,

priced at $2,983.15 with a -2.4% decline. Binance Coin

(COIN:BNBUSD) dropped by -2.9% to $497.66. Ripple (COIN:XRPUSD)

fell by -1.94%, while Dogecoin (COIN:DOGEUSD) decreased by -0.98%.

Contrarily, Solana (COIN:SOLUSD) and TonCoin (COIN:TONCOINUSD) rose

by 5.9% and 2.6%, respectively.

PancakeSwap launches community reward with zkSync token airdrop

PancakeSwap (COIN:CAKEUSD), a decentralized exchange (DEX), has

launched a community reward campaign running from July 5 to August

5. A total of 2,452,128 zkSync (ZK) tokens will be distributed to

users who have shown continuous support since the implementation of

zkSync on PancakeSwap in July 2023. The airdrop aims to reward both

current and new contributors, involving veCAKE holders, liquidity

providers, and other active participants. This initiative

celebrates the platform’s growth, which has surpassed $3 billion in

transaction volume.

Grayscale Ethereum Trust reaches parity with net asset value

The Grayscale Ethereum Trust (USOTC:ETHE), after three years of

trading at a discount, reached a premium of 0.31% over its net

asset value (NAV) on the eve of Independence Day. This change

occurs amid expectations of Ethereum spot ETFs being launched in

the US, driven by recent SEC approvals for various fund managers.

The closing of the fund’s discount is seen as investor anticipation

of a possible conversion to an ETF, similar to what happened with

the Grayscale Bitcoin Trust.

Bitcoin Cash hash rate surge draws attention and speculation

This week, the hash rate of Bitcoin Cash (COIN:BCHUSD) reached

an annual peak after an anonymous miner named “Phoenix” took over

about 90% of the network’s mining in just two days. Meanwhile, the

BCH token’s value fell to $324.23, a -2.1% drop in the last 24

hours, amid a general market decline and the end of Mt. Gox’s

repayment plans for BCH. During the short period between July 2 and

4, the Bitcoin Cash network started at 3.6 exahashes per second

(EH/s) and spiked to a peak of 9.4 EH/s, the highest rate recorded

this year. After this peak, the hash rate stabilized again,

returning to the weekly average of approximately 3.3 EH/s by the

date of publication. This sudden increase in hash rate brought both

excitement and concerns about the centralization of mining in the

Bitcoin Cash network.

New era of data centers: merging bitcoin mining and AI demand

Private equity firms are beginning to invest in bitcoin miners

due to the rising demand for data centers capable of supporting

artificial intelligence technologies. With the increasing energy

needs imposed by AI, these miners offer ready infrastructure that

can be quickly adapted or expanded to meet intensive computational

demands. Adam Sullivan, CEO of Core Scientific (NASDAQ:CORZ),

reveals that this renewed interest is driving a wave of mergers and

acquisitions in the sector, with the company recently closing a

major contract to support AI operations, attracting even more

attention and investment to the area.

Few bitcoin mining machines remain profitable after price drop

With the recent drop in bitcoin prices to a low of $53,499.90,

only five specific ASIC (Application-Specific Integrated Circuit)

models for bitcoin mining remain profitable. These models include

the Antminer S21 Hydro, Antminer S21, Avalon A1466I, Antminer S19

XP Hydro, and Antminer S19 XP, with breakeven prices ranging from

$39,581 to $53,187. Another model, the Whatsminer M56S++, is on the

verge of profitability, while the popular Antminer S19k Pro has

become unviable due to the low market price of bitcoin.

Global decline of bitcoin ATMs

In the last 40 days, the global network of Bitcoin ATMs has seen

a reduction of 334 units, breaking a ten-month growth trend. This

sharp decline, with 227 machines removed in just five days in July,

follows the drop in Bitcoin prices. While Australia and Spain are

expanding their networks, the US and Europe lead the decline,

driven in part by regulations against financial crimes.

Simultaneously, Bitcoin Depot, the largest US operator of these

cryptocurrency ATMs, reported that its revenues, which totaled $689

million in 2023 and $647 million in 2022, do not correlate with

Bitcoin price fluctuations. Despite a 155% increase in Bitcoin’s

price in 2023, Bitcoin Depot’s revenue grew only 6% in the same

period. The company attributes the lack of correlation to the

diversified nature of its services, which go beyond cryptocurrency

speculation, including international remittances and online

transactions.

German MP criticizes government Bitcoin sell-off and proposes

long-term strategy

German MP Joana Cotar expressed dissatisfaction with the

government’s decision to quickly sell off its bitcoin holdings. She

argues that instead of selling, the government should retain

Bitcoin (COIN:BTCUSD) as a strategic reserve, similar to

discussions in the US. Cotar contends that bitcoin can diversify

and reduce risks in state assets, as well as serve as a hedge

against inflation. She suggests that Germany develop a

comprehensive strategy that includes holding bitcoins, issuing

bitcoin-backed bonds, and creating a favorable regulatory

environment.

Stricter crypto regulation in the EU

The European Banking Authority (EBA) has updated its Travel Rule

guidelines to cover the cryptocurrency sector, requiring that, from

December 2024, cryptocurrency exchanges in the European Union

follow new rules that enhance the transparency of crypto-asset

transfers. The guidelines are part of a broader EU effort to combat

money laundering and terrorism financing, aiming to increase

traceability and facilitate investigations. The regulations require

the collection of detailed information about transfers and the

involved parties.

UK court imposes financial restrictions on Craig Wright in legal

dispute

The UK Supreme Court authorized a Worldwide Freezing Order (WFO)

in favor of Peter McCormack against Craig Wright, resulting from a

prolonged legal dispute over defamation. The decision, made by

Judge Mellor, aims to prevent Wright from hiding his assets to

evade paying high legal fees that McCormack incurred while

defending against defamation accusations. The order sets a limit of

£1.548 million, covering both the costs already awarded to

McCormack and additional expenses due to Wright’s fraudulent

conduct during the case.

Multicoin Capital invests in pro-crypto candidates for the US

Senate

Multicoin Capital, an influential US cryptocurrency investment

manager, has committed to donating up to $1 million to support

Senate candidates with favorable stances toward the crypto

industry. The firm plans to fund four Republican candidates through

the conservative Sentinel Action Fund, conditioning the donation

amount on the results of a crypto fundraising campaign.

Surprise NFT purchase by wallet from bankrupt Three Arrows Capital

A wallet associated with the bankrupt crypto hedge fund Three

Arrows Capital (3AC) acquired an NFT, resulting from an offer made

nearly three years ago and unnoticed by liquidators. The wallet

placed a bid of 20 ETH (equivalent to $58,800) in August 2021 for

the “Neon Village” NFT from the “Ninja Village” collection by

artist SeerLight, which was recently accepted by the seller

“@anonymoux.” The transaction occurred despite the fund being in

bankruptcy, indicating a possible oversight by the liquidation

administrators.

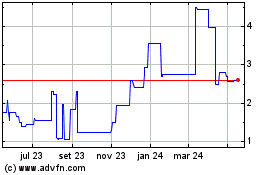

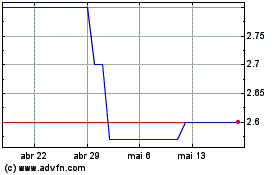

PancakeSwap Token (COIN:CAKEUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

PancakeSwap Token (COIN:CAKEUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024