Bitcoin ETFs in the US registered an inflow of $158.3 million on

Thursday

On September 19, Bitcoin ETFs saw a significant inflow of

$158.21 million, marking a strong recovery from the previous day’s

outflow of $52.7 million. The main contributors to this inflow were

the Ark 21Shares Bitcoin ETF (AMEX:ARKB), attracting $81.07

million, and the Fidelity Wise Origin Bitcoin Fund (AMEX:FBTC),

with $49.88 million. The BlackRock ETF (NASDAQ:IBIT) recorded its

third consecutive day of zero flows, while Grayscale (AMEX:GBTC)

experienced a slowdown in outflows.

Ether spot ETFs saw $5.24 million in net inflows yesterday,

exclusively from the BlackRock fund (NASDAQ:ETHA). Meanwhile, the

other eight funds showed no flows on Thursday.

Bitcoin nears key resistance of $65,000

On Friday afternoon, Bitcoin (COIN:BTCUSD) is down 0.4% in the

last 24 hours, trading at $62,700. The cryptocurrency’s price fell

alongside US stocks, with the S&P 500 and Nasdaq posting losses

of 0.25% and 0.43%, respectively. Popular traders believe Bitcoin

looks attractive, with low volume, as it approaches the $65,000

resistance. Analysts note that a weekly close above $64,000 could

signal a bullish breakout in the market structure, pushing for new

highs.

MicroStrategy buys 7,420 bitcoins with debt proceeds

MicroStrategy (NASDAQ:MSTR) purchased 7,420 bitcoins for $458.2

million between September 13 and 19, at an average price of $61,750

per BTC. The company expanded its convertible note issuance to

$1.01 billion, intended to fund additional BTC acquisitions.

MicroStrategy now holds 252,220 bitcoins, acquired at an average

cost of $39,266.

The complexity of cryptocurrencies hinders mass adoption

The technology behind cryptocurrencies and blockchain is

complex, deterring many ordinary users and hindering mass adoption.

Research indicates that a significant portion of people avoids

cryptocurrencies because they don’t understand how they work.

Experts suggest that the industry should simplify technical terms

and create more user-friendly interfaces, focusing on public

education. Additionally, the difficulty in securely storing digital

assets is another obstacle. Confusing regulatory environments also

increase user hesitation. Simplifying processes and offering

interactive learning experiences could make cryptocurrencies more

accessible, encouraging broader adoption.

Solana’s Seeker phone announcement boosts SOL

Solana developers announced that the network’s second phone, the

Seeker, will be released in 2025, boosting trading activity and

pushing SOL’s price (COIN:SOLUSD) to an intraday high of $152.41.

SOL is now up 2.4%, trading at $146.33, while Bitcoin shows a

slight decline. According to Beincrypto, if the strong bullish

momentum continues, SOL could break the $160 resistance and reach

$190; otherwise, it may retreat to $131.47.

Aptos rises with new strategic partnerships

Aptos (COIN:APTUSD) is up 5.14% at the time of writing, trading

at $7.16, standing out in the market. The increase was driven after

MEXC Ventures, Foresight Ventures, and Mirana Ventures created a

fund to support projects on the Aptos blockchain. This initiative

aims to accelerate the development of decentralized applications

and protocols using Aptos’ unique technology. The fund will also

support innovative solutions for critical challenges in the

blockchain community.

Aethir and Filecoin join forces to combat global GPU shortage

Aethir, a decentralized cloud computing network with GPUs, has

partnered with the Filecoin Foundation (COIN:FILUSD) to address the

global GPU shortage. Together, they offer integrated GPU rental

services with Filecoin’s decentralized storage, aiming to meet the

growing computational demands of the AI and Web3 sectors. The

collaboration seeks to balance computational power and data storage

in a decentralized manner, avoiding single points of failure and

improving GPU efficiency.

PancakeSwap launches v4 to enhance user experience and expand to

more networks

The decentralized exchange PancakeSwap (COIN:CAKEUSD) reported

$836 billion in accumulated trading volume and a total value locked

(TVL) of around $1.72 billion over four years, though it has

declined since its 2021 peak of $7.16 billion. To improve user

experience and scalability, PancakeSwap announced version v4,

aiming to address current AMM deficiencies, such as inflexible

pricing models and high gas fees. The update will offer dynamic

fees, advanced tools, and plans to expand its DEX to more

blockchains.

Judge dismisses Consensys lawsuit against SEC after Ethereum

investigation ends

Consensys sued the SEC for overreach due to the Ethereum

investigation. However, after the regulator ended the

investigation, a Texas judge ruled that the lawsuit was unnecessary

since there was no imminent threat to the company. The SEC ended

the “Ethereum 2.0” investigation, meeting Consensys’ demand, but

the company claimed the action raised concerns about SEC oversight

in the blockchain sector.

India’s Supreme Court YouTube channel hacked, shows Ripple videos

On Friday, the official YouTube channel of India’s Supreme Court

was hacked for the first time. The channel, which typically

livestreams court sessions, displayed videos promoting XRP tokens

(COIN:XRPUSD) and had its name changed to “Ripple.live24”. A fake

video titled “Brad Garlinghouse: Ripple responds to SEC’s $2

billion fine! XRP PRICE PREDICTION” aired. The channel and video

were taken down shortly after. The Supreme Court stated that the

channel would return soon.

Germany shuts down 47 crypto exchanges for facilitating criminal

activities

The German government closed 47 cryptocurrency exchanges,

accusing them of knowingly enabling an underground market that

benefits cybercriminals. Authorities allege that these platforms

facilitated the concealment of illicit funds’ origins, including

ransomware operations and black-market trades. While they seized

servers and user data, the government acknowledged the difficulty

in prosecuting all involved, especially those residing abroad.

Judiciary approves Terraform Labs bankruptcy after SEC settlement

Terraform Labs obtained judicial approval to end operations in

its bankruptcy proceedings after settling a case with the US

Securities and Exchange Commission (SEC), Reuters reported on

September 19. Judge Brendan Shannon deemed the bankruptcy plan in

Delaware a “welcome alternative” to avoid further litigation over

investor losses. The company agreed to pay $4.47 billion to the SEC

for frauds estimated at $40 billion. Co-founder Do Kwon is set to

contribute $110 million and transfer assets to compensate affected

investors.

Nexon integrates blockchain to transform online gaming with

MapleStory Universe

South Korean gaming giant Nexon announced the integration of

blockchain technology into MapleStory Universe, allowing the market

to control in-game assets. Keith Kim, head of strategy, emphasized

that this approach removes centralized control and creates a more

sustainable economy, giving players greater control over assets.

Additionally, the company launched its cryptocurrency NXPC for

in-game transactions.

Telegram’s Catizen token launched amid player dissatisfaction

Telegram’s play-to-earn game Catizen launched its CATI token for

trading after a two-month delay, distributing 150 million tokens

(15% of the total) to Season 1 users. Trading began on Friday on

exchanges like Binance, Bybit, and Bitget. However, players were

disappointed when token allocations were reduced before the

airdrop, with 9% diverted to the Binance Launchpool. Catizen has

over 39 million users and significant revenue, contributing to TON

blockchain’s rapid growth in users and transaction volume.

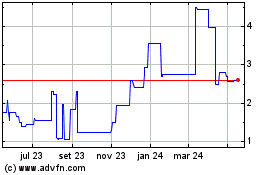

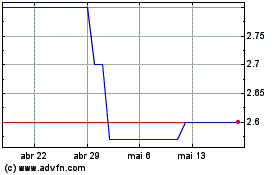

PancakeSwap Token (COIN:CAKEUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

PancakeSwap Token (COIN:CAKEUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024