Tech-Led Decline in U.S. Index Futures Pre-Market, Oil Prices Steady After U.S. Inventory Drop

17 Julho 2024 - 7:30AM

IH Market News

U.S. index futures are registering a significant drop in

pre-market trading this Wednesday, with the technology sector being

the most affected.

At 5:50 AM, Dow Jones futures (DOWI:DJI) fell 78 points, or

0.19%. S&P 500 futures lost 0.74%, and Nasdaq-100 futures

retreated 1.23%. The 10-year Treasury yield stood at 4.17%.

In the commodities market, oil prices are showing small

variations after a drop in previous sessions, influenced by a

reduction of 4.4 million barrels in U.S. oil inventories. This

decline helped offset concerns about weakened demand in China,

which recorded the slowest economic growth since the first quarter

of 2023. West Texas Intermediate crude for August rose 0.05% to

$80.80 per barrel. Brent crude for September fell 0.06%, near

$83.68 per barrel.

Futures prices of iron ore on the Dalian exchange registered a

decline for the second consecutive day, influenced by the seasonal

reduction in demand from China, its main consumer, and the growth

in global supply. The most traded iron ore contract on the Dalian

Commodity Exchange fell 0.5% to $113.23 per metric ton.

On the U.S. economic agenda for this Wednesday, the June housing

starts will be released at 8:30 AM by the Commerce Department.

Industrial production and capacity utilization for June will be

released at 9:15 AM by the Federal Reserve. The position of oil

inventories up to last Friday will be published at 10:30 AM by the

Department of Energy (DoE). At 2:00 PM, the Beige Book will be

released by the Federal Reserve.

Asia-Pacific markets showed mixed results. In Australia, the

S&P/ASX 200 index reached a historic milestone, reflecting an

advance of 0.73%, driven mainly by gold miners such as

Northern Star Resources (ASX:NST) and

Bellevue Gold (ASX:BGL). In Japan, the Nikkei 225

fell 0.43%, and the Topix gained 0.37%. Hong Kong’s Hang Seng rose

0.15%, while China’s Shanghai Composite fell 0.45%. South Korea’s

Kospi and Kosdaq fell 0.8% and 1.21%, respectively.

In Japan, the Reuters Tankan manufacturing index showed an

increase in optimism among large manufacturers, rising from +6 to

+11. On the other hand, confidence among non-manufacturers

decreased, falling from +31 to +26.

In Taiwan, Prime Minister Cho Jung-tai highlighted an increase

in defense spending, reflecting a more active stance on military

responsibility.

Simultaneously, in Singapore, there was a larger-than-expected

decline in non-oil domestic exports, marking the fifth consecutive

month of decline, with an annual reduction of 8.7%, while non-oil

domestic consumption fell 0.4% monthly, contrary to growth

expectations of 4.1%.

European markets are down, with the technology sector also

facing a significant decline. Meanwhile, the banking sector showed

a slight increase. Inflation in the United Kingdom reached 2% on an

annual basis in June, according to data from the Office for

National Statistics, slightly above the forecast of 1.9% but

consistent with the May rate and aligned with the Bank of England’s

target.

On Tuesday, U.S. stocks surged, extending the upward movement of

the previous two sessions. The Dow Jones led the way, soaring

742.76 points (1.85%) to a new record of 40,954.48 points. The

S&P 500 increased by 35.98 points (0.64%) to 5,667.20, and the

Nasdaq rose 36.77 points (0.20%) to 18,509.34. The Russell 2000

also saw a gain of 3.50%.

Among individual stocks, UnitedHealth

(NYSE:UNH), Bank of America (NYSE:BAC), and

Morgan Stanley (NYSE:MS) all rose after

better-than-expected earnings reports.

Tuesday’s economic indicators showed stability in June retail

sales. Sales were unchanged after a revised 0.3% increase in May,

while sales excluding automobiles rose 0.4%. Additionally, import

prices remained stable in June, and export prices fell 0.5%,

according to the Department of Labor.

On the earnings front for Wednesday, companies reporting before

the market opens include

ASML (NASDAQ:ASML), Johnson

& Johnson (NYSE:JNJ), US

Bancorp (NYSE:USB), Ally

Financial (NYSE:ALLY), Elevance

Health (NYSE:ELV), Prologis (NYSE:PLD), First

Horizon Corporation (NYSE:FHN), First

Community Corp (NASDAQ:FCCO), Northern

Trust (NASDAQ:NTRS), Synchrony

Financial (NYSE:SYF), among others.

After the close, reports are expected from United

Airlines (NASDAQ:UAL), Kinder

Morgan (NYSE:KMI), Alcoa (NYSE:AA), Discover

Financial Services (NYSE:DFS), Crown

Castle (NYSE:CCI), SL Green Realty

Corp (NYSE:SLG), First National

Bank (NYSE:FNB), First Industrial Realty

Trust (NYSE:FR), Home

Bancorp (NASDAQ:HBCP).

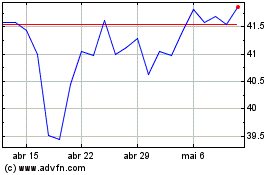

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024