Microsoft (NASDAQ:MSFT) – A widespread failure

in Microsoft’s services affects many large companies globally. The

outage, which extended from the U.S. to Asia, impacted the

operations of many companies, causing issues from customer service

to banking and airline operations, including McDonald’s, the London

Stock Exchange, Bank of Israel. American, Delta, United, and

Allegiant Air suspended flights due to communication problems.

Zurich Airport and others also had to conduct manual check-ins due

to the issue. Players faced difficulties accessing services in

Nintendo’s online store. Banks, media, and telecommunications

companies were also affected. The problem, related to Crowdstrike’s

“Falcon Sensor” software, caused failures in Microsoft Windows.

Shares fell 2.47% pre-market.

CrowdStrike (NASDAQ:CRWD) – Currently,

CrowdStrike is working to roll back this update worldwide,

following numerous reports of technical failures globally. Shares

fell 14.56% pre-market.

OpenAI, Broadcom (NASDAQ:AVGO)

– OpenAI is in talks with chip designers, including Broadcom, to

create a new artificial intelligence chip, aiming to overcome the

shortage of graphics processing units needed to develop models like

ChatGPT, GPT-4, and DALL-E3. OpenAI seeks to expand access to AI

infrastructure more affordably. Additionally, OpenAI launched

GPT-4o mini, a more affordable and simpler version of its advanced

AI model, targeting developers and businesses. Available to users

and corporate clients, GPT-4o mini offers similar functionalities

to the larger model but at a reduced cost. Broadcom’s shares fell

0.02% pre-market.

McDonald’s Corp. (NYSE:MCD) – On Friday,

McDonald’s in Japan closed about 30% of its stores due to a system

failure, mainly affecting cash registers early in the day. The

cause and resolution timeframe are still under investigation. The

failure caused great disappointment among customers and became a

popular topic on the social network X in Japan.

Apple (NASDAQ:AAPL) – Apple is negotiating to

license more Hollywood films to expand its streaming portfolio.

Following the success of a recent deal for 50 films, Apple TV+ aims

to increase its content, diversifying beyond its original

productions to attract more subscribers in a competitive market.

Shares fell 0.70% pre-market.

Alphabet (NASDAQ:GOOGL),

Comcast (NASDAQ:CMCSA) – Google, NBCUniversal, and

the U.S. Olympic Committee will use AI to enhance coverage of the

Paris Olympics in the U.S. The technology will provide automated

explanations and summaries of competitions, with sports

commentators using AI to offer detailed insights. This is the first

AI partnership with the sports organization. Alphabet shares rose

0.68% pre-market, while Comcast shares remained stable.

Meta Platforms (NASDAQ:META),

EssilorLuxottica (EU:EL) – Meta Platforms is

negotiating to buy about 5% of EssilorLuxottica, its partner in the

manufacture of Ray-Ban smart glasses. The stake could be worth

about $4.73 billion, giving Meta more influence in the development

of these products. Meta shares rose 0.14% pre-market.

Amazon (NASDAQ:AMZN) – Consumers spent a record

$14.2 billion online during the 48-hour Amazon Prime Day. The

increase in sales was driven by back-to-school purchases and

electronics deals. The event turned July, traditionally slow for

retailers, into a busy season. In other news, a British union sued

Amazon, alleging the company unduly influenced its workers to vote

against unionization. The vote in Coventry failed by a few votes,

and the GMB union accuses Amazon of pressuring employees and

promoting the cancellation of union memberships with posters.

Shares rose 0.44% pre-market.

Amphenol (NYSE:APH), CommScope Holding

Co. (NASDAQ:COMM) – Amphenol agreed to acquire CommScope’s

wireless network and distributed antenna systems businesses for

$2.1 billion. The transaction represents the largest acquisition

ever made by Amphenol, consolidating its position in the electrical

equipment and connectivity market. CommScope shares fell 1.71%

pre-market.

SunPower (NASDAQ:SPWR) – SunPower saw its

shares plummet on Thursday after announcing a pause in several

operations, including leasing contracts and power purchases. The

company faces financial and market difficulties, exacerbated by

regulatory reforms in California that affected the demand for

residential solar energy. Shares fell 10.60% pre-market.

ConocoPhillips (NYSE:COP) – The Supreme Court

of Trinidad and Tobago confirmed that ConocoPhillips can execute

arbitration against Venezuela, blocking payments related to joint

gas projects. The decision allows ConocoPhillips to collect $1.33

billion for past expropriations, affecting shared gas projects

between the countries. Shares rose 1.19% pre-market.

Johnson Controls International (NYSE:JCI),

Robert Bosch GmbH (TG:A351UK) – Robert Bosch GmbH

is leading negotiations to acquire Johnson Controls International

Plc’s heating and ventilation assets in a potential deal that could

be worth billions of dollars. Bosch competed with other companies

like Lennox International Inc. and Samsung Electronics Co., but a

final agreement is yet to be confirmed.

Plug Power (NASDAQ:PLUG) – The company launched

a public offering of $200 million in common stock, with a 30-day

option to sell up to an additional $30 million. The money raised

will be used for general corporate purposes, with Morgan Stanley

acting as the sole book-running manager of the offering, which is

subject to market conditions. Plug Power shares fell 9.25%

pre-market, trading below $3 per share, set to register its fourth

consecutive year of losses.

Allegiant Travel (NASDAQ:ALGT) – Allegiant

Travel shares plummeted on Thursday after the company announced the

immediate suspension of its dividends and the change of CEO on the

same day. The decision to cut the 60-cent-per-share payment

reflects capital needs for fleet investments. The CEO change will

occur in September, with Gregory Anderson taking over from Maury

Gallagher.

Boeing (NYSE:BA) – The U.S. Department of

Justice announced it is significantly advancing a final agreement

with Boeing, expecting to finalize it by July 24. Boeing agreed to

plead guilty to criminal conspiracy, paying a $243.6 million fine

related to the 737 MAX failures following fatal accidents. Shares

rose 0.34% pre-market.

Embraer (NYSE:ERJ) – Embraer announced the

delivery of 47 aircraft in the second quarter of 2024, an 88%

increase compared to the previous year, reaffirming its forecasts

for the whole year despite supply chain challenges. With a firm

order backlog of $21.1 billion, the company expects growing demand

for its E2 and executive jets.

Tesla (NASDAQ:TSLA) – Tesla’s sales in

California fell 24% between April and June, marking the third

consecutive quarterly decline. Rising interest rates and strong

competition weakened demand for electric vehicles. The brand also

faces challenges due to controversies surrounding CEO Elon Musk.

Additionally, British builder Harmony Energy is constructing the

largest battery storage center in France. This 100-megawatt system,

located in Nantes, will be equipped with Tesla’s Megapack products

and will have the capacity to provide energy to 170,000 homes for

two hours. Shares fell 0.29% pre-market.

Ford Motor (NYSE:F) – Ford announced plans to

use its Canadian factory dedicated to electric vehicles to produce

larger gasoline versions of the F-Series pickup truck. This comes

after delaying electric SUVs and facing challenges in EV

profitability. The expansion focuses on meeting global demand for

Super Duty pickups while maintaining its commitment to future

electric vehicles. Shares fell 0.62% pre-market.

Stellantis (NYSE:STLA) – Stellantis issued a

global recall for approximately 24,000 Chrysler Pacifica plug-in

hybrid minivans due to the risk of battery fires. Owners were

advised to park outdoors and not recharge the vehicles until a

software update is installed, following reports of incidents

involving vehicle shutdowns and recharging. Shares fell 1.22%

pre-market.

Block (NYSE:SQ) – Block announced that its

payment service, Cash App, will cease operations in the United

Kingdom on September 15, after six years in the country. The

company decided to focus on the United States, discontinuing global

expansion. This decision affects customers, partners, and employees

involved in the project in the UK.

Citigroup (NYSE:C) – Citigroup agreed to pay a

fine of $138,000 to the Montreal Exchange for failing to properly

report positions in options contracts that exceeded established

limits. This penalty follows previous fines in the U.S. of $136

million for data management deficiencies. In other news, former

Citigroup director Kathleen Martin accused COO Anand Selva of

deliberately attempting to misreport the bank’s metrics to deceive

federal regulators. She claims this could benefit the bank but also

mislead shareholders and the public. Citigroup denies the

allegations and plans to contest them legally.

Abbott Laboratories (NYSE:ABT) – Abbott

Laboratories is considering discontinuing its special infant

formula for premature babies after legal concerns about the

product’s safety. CEO Robert Ford indicated that lawsuits and

criticism over failing to communicate risks to parents could lead

to the product’s withdrawal. The formula, intended for premature

babies under medical care, is under scrutiny for possibly

increasing the risk of severe intestinal damage.

Hasbro (NASDAQ:HAS) – Hasbro appointed John

Hight, a veteran video game executive known for his leadership in

Microsoft’s World of Warcraft franchise, as president of Wizards of

the Coast and the digital gaming division. He will oversee game

studios and digital agreements, in addition to strategies for

Magic: The Gathering and Dungeons & Dragons, while digital

games represent a significant portion of Hasbro’s revenue.

Vista Outdoor (NYSE:VSTO) – Glass Lewis

recommended Vista Outdoor shareholders vote in favor of merging the

ammunition unit with the Czechoslovak Group (CSG), highlighting an

increase in CSG’s offer as a reason to support the deal, despite

objections from other proxy advisory firms.

Enhabit (NYSE:EHAB) – Glass Lewis recommended

Enhabit shareholders choose three AREX Capital Management

candidates for the company’s board due to Enhabit’s poor financial

performance and strategic errors. The decision will be made on July

25, and AREX seeks to replace seven of the current nine

directors.

LATAM Airlines – LATAM Airlines plans to list

its shares on the New York Stock Exchange, potentially reaching a

valuation of $8.5 billion. The Chilean-based company aims to raise

over $533 million from the stock sale, which would be listed as

ADSs under the symbol “LTM.” The company, which emerged from

bankruptcy in 2022, will not receive proceeds from the sale.

Ardent Health Partners (NYSE:ARDT) – Ardent

Health Partners’ shares saw little change on the first trading day

on Thursday, closing at $16.06, almost equal to the IPO price of

$16. The healthcare services provider raised $192 million after

reducing the offering size and pricing below the expected range.

This was its second IPO attempt, succeeding after withdrawing the

first in 2020.

TWFG Insurance (NASDAQ:TWFG) – TWFG Insurance

shares, a Texas-based insurance brokerage, rose about 30% on its

first day on the Nasdaq, closing at $22.10, after being priced at

$17 each. The company, a Texas-based insurance brokerage, expected

to raise $170 million from the IPO.

Earnings

Netflix (NASDAQ:NFLX) – Netflix reported a net

profit of $2.15 billion, or $4.88 per share, with revenue of $9.56

billion, exceeding analysts’ forecasts of $4.74 per share and $9.53

billion in revenue. Netflix saw a 16.5% increase in global paid

subscriptions, reaching 278 million, surpassing the expected 274.4

million. Ad-supported subscriptions grew 34% compared to the same

quarter last year. The company now expects annual revenue growth

between 14% and 15%, compared to the previous forecast of 13% to

15%. Shares fell 1.45% pre-market.

PPG Industries (NYSE:PPG) – In the second

quarter, PPG Industries reported a decline in profit and revenue

due to lower global automobile production. The company posted a

profit of $528 million, or $2.24 per share, exceeding adjusted

expectations of $2.48. Revenue fell 2% to $4.79 billion, below the

expected $4.93 billion. PPG reduced its 2024 profit forecast to

$8.15 to $8.30 per share, previously estimated between $8.34 and

$8.59. Shares fell 2.82% pre-market.

Intuitive Surgical (NASDAQ:ISRG) – The medical

technology, robotics, and surgical innovation company announced

adjusted earnings of $1.78 per share with revenue of $2.01 billion.

Analysts polled by LSEG had forecast earnings of $1.54 per share

and revenue of $1.97 billion. Shares rose 6.69% pre-market.

Western Alliance (NYSE:WAL) – Western Alliance

reported earnings of $1.75 per share with revenue of $772 million.

Analysts expected earnings of $1.71 per share and revenue of $738

million, according to LSEG.

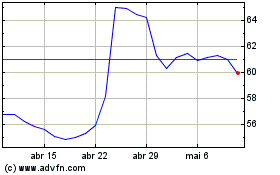

Hasbro (NASDAQ:HAS)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

Hasbro (NASDAQ:HAS)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024