U.S. Index Futures Mixed After Tech Sell-Off, Oil Prices Drop on Weak China Demand and Ceasefire Expectations

25 Julho 2024 - 7:21AM

IH Market News

U.S. index futures are mixed in pre-market trading on Thursday

following a sharp tech sector sell-off the previous day.

At 5:17 AM, Dow Jones futures (DOWI:DJI) rose 85 points, or

0.21%. S&P 500 futures lost 0.01%, and Nasdaq-100 futures fell

0.10%. The 10-year Treasury yield stood at 4.228%.

In commodities, West Texas Intermediate crude for September fell

1.46% to $76.46 per barrel. Brent crude for September dropped 1.41%

to around $80.56 per barrel. Oil prices declined due to weak demand

in China and the expectation of a Middle East ceasefire, despite

falling U.S. oil and gasoline inventories. Global economic

uncertainty and peace efforts are adding pressure to prices. Iron

ore prices fell nearly 1% on China concerns, and copper dropped

1.2%.

On Thursday’s economic agenda, weekly jobless claims for the

week ending last Saturday will be published at 8:30 AM by the Labor

Department. Simultaneously, June durable goods orders and the

preliminary Q2 GDP reading will be published by the Commerce

Department. At 10:00 AM, June pending home sales data will be

released.

Asia-Pacific markets faced a broad sell-off, reflecting the

impact of Wall Street’s decline. Japan’s Nikkei 225 fell 3.28%,

closing at 37,869.51, the lowest level since April, with notable

losses in companies like SoftBank and

Renesas Electronics. The yen strengthened for the

fourth consecutive day, reaching 152.28 per dollar, and the Bank of

Japan is expected to consider a rate hike.

In South Korea, GDP grew 2.3% annually, below expectations, with

the Kospi down 1.74% and the Kosdaq falling 2.08%, led by declines

in SK Hynix (KOSPI:000660) shares. Hong Kong’s

Hang Seng Index dropped 1.67%. The Shanghai Composite Index fell

0.52% as China cut the medium-term loan rate from 2.5% to 2.3% to

stimulate the economy. Australia’s S&P/ASX 200 also fell 1.29%,

while Taiwan’s market remained closed for a second day due to

Typhoon Gaemi.

European markets are down, with investors closely watching the

earnings season, and the tech sector leading losses, reflecting the

previous day’s sell-off on Wall Street. Economically, focus is on

German consumer confidence and business activity in the eurozone

and the UK, anticipating the eurozone GDP release next week.

On Wednesday, U.S. stocks deepened their decline, with the

Nasdaq experiencing a drastic drop, reaching its lowest closing

level in over a month. The Dow Jones fell 1.25%, while the S&P

500 and Nasdaq declined 2.31% and 3.64%, respectively. The sharp

drop reflects disappointments in corporate earnings, particularly

from giants like Tesla (NASDAQ:TSLA) and

Alphabet (NASDAQ:GOOGL), and adverse reactions to

the economic report on U.S. new home sales.

The U.S. Commerce Department’s report showed an unexpected drop

in new home sales in June, with a 0.6% reduction to an annual rate

of 617,000. This result contradicted expectations of a 3.4%

increase and marked the lowest sales level since November 2023,

when sales reached 611,000.

For Thursday’s quarterly reports, American

Airlines (NASDAQ:AAL), Southwest

Airlines (NYSE:LUV), Royal

Caribbean (NYSE:RCL), Honeywell (NASDAQ:HON), Hasbro (NASDAQ:HAS), RTX (NYSE:RTX), AstraZeneca (NASDAQ:AZN), Keurig

Dr Pepper (NASDAQ:KDP), New York

Community

Bancorp (NYSE:NYCB), Abbvie (NYSE:ABBV),

and more will report before the market opens.

After the close, numbers from

Dexcom (NASDAQ:DXCM), Deckers

Brands (NYSE:DECK), Boston

Beer (NYSE:SAM), Skechers (NYSE:SKX), Lendingtree (NASDAQ:TREE), Comfort

Systems (NYSE:FIX), Juniper

Network (NYSE:JNPR), Appfolio (NASDAQ:APPF), Texas

Roadhouse (NASDAQ:TXRH), among others, are

awaited.

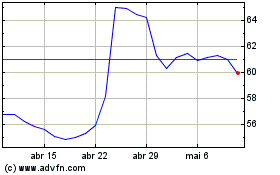

Hasbro (NASDAQ:HAS)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

Hasbro (NASDAQ:HAS)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024