Dexcom Shares Drop 37% on Weak Revenue and Forecast; Coursera Rises 24% After Beating Q2 Revenue Estimates

26 Julho 2024 - 6:57AM

IH Market News

Dexcom (NASDAQ:DXCM) – The continuous glucose

monitor company reported second-quarter revenue of $1 billion,

below the estimate of $1.04 billion, according to LSEG. Adjusted

earnings per share of 43 cents were better than the estimated 39

cents. However, Dexcom issued a reduced annual revenue forecast of

$4 billion to $4.05 billion. Dexcom shares plummeted 36.90%

pre-market.

Coursera (NYSE:COUR) – The online course

company reported second-quarter revenue of $170.337 million,

surpassing analysts’ estimate of $164.413 million, according to

LSEG. However, Coursera posted a loss of 15 cents per share, while

analysts expected a profit of 1 cent per share. Additionally,

Coursera announced that it surpassed 2 million enrollments in its

generative AI catalog and launched a record number of entry-level

Professional Certificates in partnership with industry leaders. The

shares jumped 23.75% pre-market.

Juniper Networks (NYSE:JNPR) – The networking

and cybersecurity solutions company reported adjusted earnings of

31 cents per share and revenue of $1.19 billion in the second

quarter. These results fell short of analysts’ estimates, which

predicted 44 cents per share in earnings and $1.25 billion in

revenue, according to LSEG. Non-GAAP net income fell 46% to $101.6

million. Despite the below-expected results, Juniper reported an

increase in orders, driven by AI initiatives and strong demand in

data centers. The $14 billion merger with Hewlett Packard

Enterprise is expected by the end of 2024 or early 2025.

L3Harris Technologies (NYSE:LHX) – The advanced

defense and technology company reported adjusted second-quarter

earnings of $3.24 per share, above the expected $3.18. Sales grew

13% to $5.3 billion. L3Harris raised its 2024 earnings forecast to

$12.85 to $13.15 per share. The projected revenue for 2024 is $21.0

billion to $21.3 billion. The shares fell 0.93% pre-market.

Lazard (NYSE:LAZ) – The investment bank more

than doubled its second-quarter profit compared to last year, with

revenue of $685 million, exceeding expectations. Financial advisory

revenue grew 19%, while asset management revenue fell 1%. The

shares rose 12% on Thursday, the best performance in four years,

driven by cost reductions and increased investment banking

activity.

LPL Financial (NASDAQ:LHX) – LPL Financial

reported adjusted earnings per share of $3.88, surpassing the

estimate of $3.71, but missed the GAAP earnings expectations of

$3.43, reaching $3.23. Revenue was $2.93 billion, slightly above

the expected $2.89 billion.

NatWest (NYSE:NWG) – NatWest Group reported

pre-tax revenue of £1.7 billion in the quarter, a decline of 4.1%,

but still above analysts’ expectations of £1.29 billion. The bank’s

net interest margin decreased by 10 basis points to 2.1%. Net

interest and fee income exceeded expectations, helping to boost the

bank’s shares. NatWest raised its annual revenue forecast to around

£14 billion ($18 billion), exceeding the previous estimate of £13

to £13.5 billion, after a strong quarter driven by high-interest

rates. The company also acquired a £2.5 billion mortgage portfolio

and expects to keep expenses stable compared to 2023 despite

inflation. The shares rose 6.80% pre-market.

Boston Beer Company (NYSE:SAM) – The renowned

craft beer company reported earnings of $4.39 per share on revenue

of $579 million, while analysts expected $5.02 per share in

earnings and $597 million in revenue, according to LSEG. Net income

fell 9.8% to $52.3 million. Boston Beer maintained its 2024

earnings per share projection of $7.00 to $11.00 but revised its

volume forecast downward.

Deckers Outdoor (NYSE:DECK) – The footwear and

sportswear company reported first fiscal quarter earnings of $4.52

per share, surpassing analysts’ forecasts of $3.48 per share.

Revenue reached $825 million, above the expectation of $808

million. Deckers raised its fiscal 2025 earnings per share forecast

to a range of $29.75 to $30.65, up from a previous range of $29.50

to $30.00. The shares rose 10.64% pre-market.

Skechers USA (NYSE:SKX) – The footwear and

apparel company announced a $1 billion share repurchase and raised

its annual profit and revenue projections, forecasting sales

between $8.875 billion and $8.975 billion, and earnings per share

between $4.08 and $4.18. In the second quarter, revenue rose 7.2%

to $2.16 billion, with net income of $164.5 million.

Mohawk Industries (NYSE:MHK) – The flooring and

coverings company reported adjusted earnings of $3 per share,

excluding items, on revenue of $2.8 billion in the second quarter.

Analysts polled by FactSet predicted earnings of $2.75 per share on

revenue of $2.84 billion. Mohawk announced further restructuring

measures to save $100 million annually, aiming to cut costs due to

weak market conditions.

Norfolk Southern (NYSE:NSC) – The US rail

operator exceeded second-quarter earnings estimates, with $3.06 per

share versus the expected $2.86, thanks to strong pricing and

intermodal volumes. Operating revenue rose 2% to $3 billion,

slightly below forecasts. The adjusted operating ratio improved to

65.1%, reflecting more efficient cost control.

3M (NYSE:MMM) – 3M reports second-quarter

results on Friday, while analysts expect earnings per share of

$1.68 and sales of $5.9 billion for the second quarter. Sales

growth and margins improved in the first quarter. For 2024, the

company expects 1% sales growth and earnings between $6.80 and

$7.30 per share. The shares fell 0.14% pre-market.

Bristol Myers (NYSE:BMY) – The pharmaceutical

company is scheduled to report before the market opens on Friday.

Analysts project Bristol Myers will report adjusted earnings of

$1.62 per share and revenue of $11.54 billion in the second

quarter.

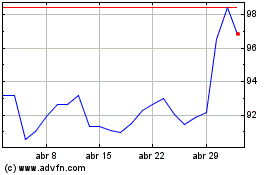

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024