Palantir and Lucid Shares Surge After Beating Estimates; ZoomInfo and Chegg Drop 16% – Earnings Update

06 Agosto 2024 - 6:47AM

IH Market News

Palantir Technologies (NYSE:PLTR) – The AI

software company reported $678 million in Q2 revenue, up 27%

year-over-year, beating the $653 million estimate. Net income was

$134 million, or 6 cents per share, compared to 1 cent the previous

year. The annual revenue forecast increased to up to $2.75 billion.

Shares rose 11.2% pre-market.

Lucid Group (NASDAQ:LCID) – The electric

vehicle company reported $200.6 million in revenue, beating the

$192.06 million estimate. The company produced 2,110 vehicles and

delivered 2,394. Lucid ended the quarter with $4.28 billion in

total liquidity. The forecast is to manufacture 9,000 vehicles in

2024. Additionally, the company will receive up to $1.5 billion

from Ayar Third Investment Company, an affiliate of the Saudi

Arabia Public Investment Fund. The investment includes $750 million

in convertible preferred stock and an equal amount loan. Shares

rose 12.3% pre-market.

ZoomInfo Technologies (NASDAQ:ZI) – The

business information software company reported adjusted earnings of

17 cents per share, below analysts’ 23 cents estimate. Revenue of

$291.5 million also missed the $307.7 million consensus estimate.

ZoomInfo lowered its annual revenue and profit forecasts, now

projecting sales between $1.19 billion and $1.205 billion and

adjusted earnings per share between 86 and 88 cents. The company

also announced board and CFO changes, with Graham O’Brien taking

over temporarily. Shares fell 15.8% pre-market.

Chegg (NYSE:CHGG) – The education technology

company focused on learning reported a $616.9 million loss,

contrasting with a $25.6 million profit the previous year. Adjusted

for non-recurring items, profit was 24 cents per share, slightly

above the 23-cent expectation. Total revenue fell 11% to $163.1

million but still beat the $160 million forecast. The subscription

services segment also saw an 11% decline to $146.8 million, and

subscribers reduced by 9% to 4.4 million. The Q3 revenue forecast

is between $133 million and $135 million, below the market

expectation of $143 million. Shares fell 15.7% pre-market.

Avis Budget Group (NASDAQ:CAR) – The car rental

company reported $3.05 billion in Q2 revenue, below analysts’ $3.14

billion forecast. Net income of $15 million also missed estimates,

while adjusted EBITDA was $214 million. Vehicle rentals increased

2% year-over-year. However, Avis issued an optimistic Q3 forecast

due to strong summer demand.

InterContinental Hotels Group (NYSE:IHG) – In

the last quarter, the global hotel chain (Holiday Inn, Crowne

Plaza, and Kimpton) saw a 3.2% growth in RevPAR (Revenue per

Available Room), driven by improvement in North America, although

China continued to decline. Total revenue increased 7% to $1.1

billion, and operating profit rose 12% to $535 million. The

dividend was raised by 10%. Shares rose 0.7% pre-market.

CSX Corp (NASDAQ:CSX) – The railway

transportation company reported Q2 earnings of 49 cents per share,

beating analysts’ 48-cent estimate from LSEG. Revenue of $3.70

billion was in line with market forecasts. Shares rose 1.4%

pre-market.

Spirit AeroSystems (NYSE:SPR) – The aerospace

components company reported a larger-than-expected loss of $2.73

per share, with revenue of $1.49 billion. Analysts expected a loss

of 90 cents per share and $1.59 billion in revenue.

Teradata (NYSE:TDC) – The data analytics

company exceeded expectations with $0.64 per share earnings,

beating the $0.48 forecast. Revenue was $436 million, below the

$447.3 million estimate, down 5.6% year-over-year. Net margin was

2.31%, and return on equity was 70.34%. Projections were $0.54-0.58

per share for next quarter and $2.20-2.26 for the fiscal year.

Shares fell 8.1% pre-market.

Simon Property Group (NYSE:SPG) – The

commercial property company reported Q2 earnings per share of

$1.51, beating the $1.45 estimate. Revenue was $1.46 billion, above

the $1.3 billion estimate. The 2024 EPS forecast is $7.37 to $7.47,

above the $6.53 expectation. Additionally, Simon Property raised

its dividend by 15 cents.

Realty Income (NYSE:O) – The real estate

investment company reported Q2 EPS of $0.29, below the $0.36

estimate. Adjusted FFO (Funds from Operations) was $1.07 per share,

beating the $1.05 expectation. Revenue increased 31.4% to $1.34

billion. The 2024 adjusted FFO forecast is $4.19 to $4.29 per

share. Shares fell 0.3% pre-market.

Hims & Hers Health (NYSE:HIMS) – The

digital health company reported Q2 revenue of $315.6 million, up

52%. Hims & Hers earned $13.3 million (6 cents per share),

beating the 4-cent estimate. The Q3 revenue forecast is $375 to

$380 million and up to $1.4 billion for 2024. The company plans to

acquire a compounding pharmacy for $31 million to produce copycat

weight loss drugs. It has been selling similar products since May,

amid a shortage of Novo Nordisk and Eli Lilly drugs. Shares rose

5.7% pre-market.

Clover Health (NASDAQ:CLOV) – The health

insurance company reported a net income of $7.2 million and

adjusted EBITDA of $36.2 million. Insurance revenue increased 11%

to $349.9 million. The medical cost ratio improved to 71.3%. Annual

revenue forecast increased to $1.35 to $1.375 billion, and

projected adjusted EBITDA is $50 to $65 million. Shares rose 3.2%

pre-market.

Yum China Holdings (NYSE:YUMC) – The fast food

operator reported a 4% increase in operating income to $266

million, but Q2 revenue of $2.68 billion slightly missed the

forecast. Net income rose 8% to $212 million, with strong

performance from KFC and Pizza Hut franchises. KFC expanded its

presence, and Pizza Hut attracted customers with new offerings.

Same-store sales fell 4%, reflecting intense competition in China’s

fast food market. Despite this, profit margin remained strong at

15.5%, exceeding expectations. Yum China announced the CFO Andy

Yeung’s departure, to be temporarily replaced by Adrian Ding.

Shares rose 8.1% pre-market.

Caterpillar (NYSE:CAT) – Caterpillar will

release its Q2 earnings on Tuesday. Investors are more interested

in how the company assesses the global economy after weak economic

data affected markets. Recently, Caterpillar shares fell due to

economic uncertainties, and the stock movement may vary up to 6%

after results. The expectation is for $5.54 EPS and $16.8 billion

in sales.

Sony Group (NYSE:SONY) – Sony Group will

release its Q1 results on Wednesday, with a forecasted 1.5% drop in

net income to 214.30 billion yen ($1.49 billion) and a 7.8%

decrease in revenue to 2.732 trillion yen. Investors will watch for

potential annual forecast adjustments and the impact of

acquisitions and performance in the gaming sector.

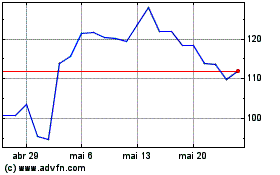

Avis Budget (NASDAQ:CAR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Avis Budget (NASDAQ:CAR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025