Novo Nordisk (NYSE:NVO) – In the second

quarter, Novo Nordisk reported a net profit of DKK 20.05 billion

($2.93 billion), below the forecast of DKK 20.9 billion. The

company reduced its operating profit growth projection to 20%-28%

for 2024, from 22%-30%. Sales growth forecasts were increased to

22%-28%. Competition in the weight-loss market is intensifying.

Shares fell 4.5% pre-market.

Airbnb (NASDAQ:ABNB) – The online accommodation

booking platform reported earnings of 86 cents per share, while

LSEG analysts expected 92 cents. The company also noted signs of

declining demand from US customers. Revenue was $2.75 billion,

slightly above the estimate of $2.74 billion. Revenue grew 11% year

over year, but the company predicts moderate growth of 8%-10% next

quarter, with expected revenue between $3.67 billion and $3.73

billion. Shares fell 16.1% pre-market.

Lumen Technologies (NYSE:LUMN) – The

telecommunications and digital services company raised its free

cash flow forecast to $1.0 to $1.2 billion due to new partnerships,

surpassing the previous estimate of $100 to $300 million. Revenue

fell from $3.66 billion to $3.27 billion, while analysts expected

$3.25 billion. The net loss was $49 million, with an adjusted loss

of 13 cents per share, higher than expected. Shares jumped 48%

pre-market.

Illumina (NASDAQ:ILMN) – Illumina expects its

core revenue to decline by 2%-3% in 2024 due to reduced demand for

genetic sequencing instruments. For the second quarter, revenue was

$1.11 billion, above the estimate of $1.08 billion. Adjusted

earnings were $0.36 per share, below the forecast of $0.90.

Amgen (NASDAQ:AMGN) – The biotechnology and

pharmaceutical company reported earnings per share (EPS) of $4.97

in the second quarter, slightly below the estimate of $4.98.

Revenue was $8.39 billion, beating the forecast of $8.35 billion.

Amgen reported a 1% decline in second-quarter profit due to rising

costs, including the development of MariTide, despite a 20%

increase in revenue. For fiscal 2024, Amgen expects EPS between

$19.10 and $20.10 and revenue between $32.8 billion and $33.8

billion, above the consensus of $17.87 and $30.3 billion,

respectively. Shares fell 1.9% pre-market.

DaVita (NYSE:DVA) – DaVita increased its

earnings forecast for 2024, now estimating between $9.25 and $10.05

per share, above the previous estimate. Quarterly revenue was $3.19

billion, surpassing the estimate of $3.15 billion. Adjusted

earnings were $2.59 per share, higher than the forecast of

$2.54.

Reddit (NYSE:RDDT) – The social media platform

reported a loss of 6 cents per share, better than the expected 33

cents. Revenue was $281 million, surpassing the estimate of $254

million. Sales increased by 54%, and the net loss decreased to

$10.1 million. Advertising revenue rose by 41%, and data licensing

grew by 691%. Revenue expectations for the third quarter are

between $290 million and $310 million. Shares fell 1.6%

pre-market.

Tripadvisor (NASDAQ:TRIP) – The travel review

and booking platform reported revenue of $497 million, while LSEG

analysts predicted $505 million. Adjusted earnings of 39 cents per

share beat estimates of 37 cents. Shares fell 13.4% pre-market.

Instacart (NASDAQ:CART) – The grocery delivery

service reported earnings of 20 cents per share and revenue of $823

million, beating LSEG estimates of 13 cents per share and $807

million in revenue. Shares rose 8.8% pre-market.

Coupang (NYSE:CPNG) – Coupang reported a net

loss of $77 million in the second quarter, larger than the $11.7

million loss due to the Farfetch acquisition and a regulatory fine.

Excluding these items, net income was about $124 million. Net

revenue grew by 25%, reaching $7.3 billion. Shares fell 2.6%

pre-market.

Wynn Resorts (NASDAQ:WYNN) – The resort and

casino operator reported adjusted earnings of $1.12 per share on

revenue of $1.73 billion, below LSEG analysts’ expectations of

$1.14 per share and $1.75 billion in revenue.

Sony Group (NYSE:SONY) – Sony raised its

revenue and profit forecasts after a strong quarter, with operating

profit of ¥279.1 billion ($1.9 billion), above expectations. Annual

sales are expected to reach ¥12.6 trillion (about $85.7 billion),

and operating profit is estimated at ¥1.3 trillion (about $8.8

billion). The popularity of games and growth in the music sector

boosted results. Shares rose 1.1% pre-market.

GigaCloud Technology (NASDAQ:GCT) – The cloud

technology solutions provider reported record revenue of $561.9

million in the first half of 2024, a 100% increase year over year.

In the second quarter, revenue rose 103.1% to $310.9 million. Gross

profit grew by 89.1%, but the margin fell to 24.6%. Net income

increased by 46.7% to $27 million, with the margin falling to 8.7%.

Shares rose 3.8% pre-market.

Fortinet (NASDAQ:FTNT) – Fortinet exceeded

expectations in the second quarter, with revenue of $1.43 billion,

above the expected $1.40 billion. Billing was $1.54 billion,

beating the projection of $1.52 billion. Net income was $379.8

million (49 cents per share), compared to $266.3 million (33 cents)

in the previous year. Adjusted earnings were 57 cents per share,

compared to the expected 41 cents. For the third quarter, the

company expects revenue of $1.445-$1.505 billion and adjusted

earnings of 56-58 cents per share, above the expected 43 cents.

Shares rose 15.3% pre-market.

Axon Enterprise (NASDAQ:AXON) – The developer

of security equipment and software reported diluted earnings per

share of $0.53 in the second quarter, with non-GAAP earnings of

$1.20 per diluted share. Net income was $41 million, with non-GAAP

net income of $93 million and adjusted EBITDA of $123 million.

Axon’s quarterly revenue was $504 million, growing 34.6% year over

year, exceeding expectations. The annual revenue forecast was

raised to $2.00 to $2.05 billion.

Upstart Holdings (NASDAQ:UPST) – The AI lending

platform expects revenue of around $150 million and a loss of $5

million in EBITDA, beating analysts’ expectations of $135 million

and a loss of $13 million. Upstart expects a positive adjusted

EBITDA in the fourth quarter. In the second quarter, it reported a

net loss of $55 million (62 cents per share) and revenue of $128

million. Shares soared 22.1% pre-market.

Super Micro Computer (NASDAQ:SMCI) – The server

and hardware provider reported fourth fiscal quarter adjusted

earnings of $6.25 per share, below LSEG analysts’ forecast of $8.07

per share. Super Micro reported a 10-for-1 stock split. Revenue for

2025 is expected to be between $26 billion and $30 billion,

exceeding expectations. However, the gross margin was 11.2%, a

significant decline compared to 15.5% in the third quarter and

17.0% in the same period last year. This is the lowest gross margin

recorded by the company since it began reporting quarterly results

in 2007. Shares fell 11.7% pre-market.

Honda Motor (NYSE:HMC) – In the first quarter,

Honda reported a record operating profit of ¥484.7 billion ($3.3

billion), beating estimates of ¥442 billion and marking a 23%

year-over-year increase. This positive result was driven by strong

sales in the US and a weaker yen, although the annual profit

forecast was maintained at ¥1.42 trillion. Demand for hybrids is

robust, but the automaker faces challenges in China, where sales

fell 40%, and it is reducing gasoline vehicle production by 19%.

Honda also plans to invest ¥10 trillion by 2030 to expand its

electric vehicle production capacity.

Rivian Automotive (NASDAQ:RIVN) – The electric

vehicle manufacturer reported a smaller-than-expected adjusted loss

of $1.13 per share and revenue of $1.16 billion, beating LSEG

expectations of a $1.21 per share loss and $1.14 billion in

revenue. Rivian reaffirmed its forecast of a $2.7 billion loss in

adjusted EBITDA for 2024. Shares fell 5.9% pre-market.

Devon Energy (NYSE:DVN) – The oil and natural

gas producer reported quarterly earnings of $1.41 per share,

beating the estimate of $1.26. Revenue was $3.917 billion, up 13.4%

year over year. Oil production reached a record 335,000 barrels per

day, and the share buyback program was expanded to $5 billion. The

annual production forecast increased by 5%.

Itaú Unibanco (NYSE:ITUB) – Itaú Unibanco

reported recurring net income of R$10.07 billion ($1.8 billion) in

the second quarter, a 15.2% increase year over year and slightly

above estimates of R$9.99 billion. Return on equity rose to 22.4%.

Net interest income increased by 6.4%, and the credit portfolio

grew by almost 6%.

VF Corp (NYSE:VFC) – VF Corp reported an 8.6%

drop in revenue, totaling $1.91 billion, less than the estimated

11.5% decline. The adjusted loss was 33 cents per share, better

than the expected 37 cents loss. Improvement in China and reduced

inventories helped performance. Shares rose 7.9% pre-market.

Shopify (NYSE:SHOP) – Shopify’s second-quarter

report will be crucial after a 30% drop in shares this year.

Investors are looking to see if the company can maintain

double-digit sales growth and cut costs to improve profitability.

An 18% increase in sales is expected, with adjusted earnings of 20

cents per share. Shares rose 1% pre-market.

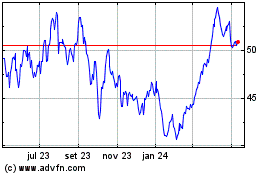

Devon Energy (NYSE:DVN)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

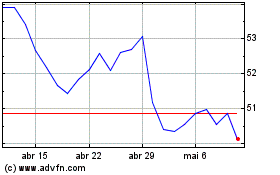

Devon Energy (NYSE:DVN)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024