Jobless Claims Data May Lead To Initial Strength On Wall Street

08 Agosto 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to move back to the upside

following the downturn seen over the course of the previous

session.

The advance by the futures came after the Labor Department

released a report showing first-time claims for U.S. unemployment

benefits pulled back by more than expected in the week ended August

3rd.

The report said initial jobless claims fell to 233,000, a

decrease of 17,000 from the previous week’s revised level of to

250,000.

Economists had expected jobless claims to edge down to 240,000

from the 249,000 originally reported for the previous week.

The bigger than expected decline came a week after jobless

claims reached their highest level since hitting 258,000 in the

week ended August 5, 2023.

The data may help ease concerns about the strength of the labor

market, which have contributed to recent selling on Wall

Street.

Among individual stocks, shares of Eli Lilly (NYSE:LLY) are

moving sharply higher in pre-market trading after the drug maker

reported better than expected second quarter results and raised its

full-year revenue guidance.

Athletic apparel company Under Armour (NYSE:UAA) is also likely

to see initial strength after reporting an unexpected fiscal third

quarter profit.

On the other hand, shares of Warner Bros. Discovery (NASDAQ:WBD)

is seeing significant pre-market weakness after reporting

disappointing second quarter results and announcing a $9.1 billion

write down tied to its TV networks.

After extending yesterday’s rebound early in the session, stocks

gave back ground over the course of the trading day on Wednesday.

The major averages pulled back well off their early highs and into

negative territory.

The major averages ended the day just off their lows of the

session. The Nasdaq slumped 171.05 points or 1.1 percent to

16,195.81, the S&P 500 slid 40.53 points or 0.8 percent to

5,199.50 and the Dow fell 234.21 points or 0.6 percent to

38,763.45.

Stocks initially continued to benefit from bargain hunting, as

traders picked up stocks at relatively reduced levels following the

recent sell-off.

Buying interest waned shortly after the start of trading,

however, as concerns about the outlook for the U.S. economy

continued to hang over the markets.

“We expect further volatility in the near-term and look to the

5,000 range as important support for the Index, as it represents

key retracement levels and the 200-DMA,” John Lynch, Chief

Investment Officer for Comerica Wealth Management said of the

S&P 500. “We continue to view the S&P 500 to be fairly

valued in the 5,250 range by yearend.”

Among individual stocks, shares of Super Micro Computer

(NASDAQ:SMCI) plunged by 20.1 percent after the technology company

reported weaker than expected fiscal fourth quarter earnings.

Disney (NYSE:DIS) also showed a significant move to the downside

even though the entertainment giant reported better than expected

fiscal third quarter earnings.

Meanwhile, grocery delivery company Instacart (NASDAQ:CART)

surged after reporting second quarter results that exceeded analyst

estimates on both the top and bottom lines.

Gold stocks moved sharply lower over the course of the session,

dragging the NYSE Arca Gold Bugs Index down by 3.2 percent to its

lowest closing level in a month. The weakness among gold stocks

came despite a modest increase by the price of the precious

metal.

Substantial weakness also emerged among semiconductor stocks, as

reflected by the 3.1 percent slump by the Philadelphia

Semiconductor Index.

Computer hardware stocks also showed a considerable move to the

downside on the day, with the NYSE Arca Computer Hardware Index

tumbling by 2.8 percent.

Housing, airline and pharmaceutical stocks also showed notable

moves to the downside, while significant strength remained visible

among telecom stocks.

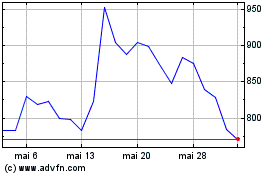

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024