UBS Group AG (NYSE:UBS) – UBS reported a net

profit of $1.136 billion in Q2, exceeding the $528 million

forecast. Revenue also surpassed expectations, reaching $11.904

billion. Despite lower profits compared to Q1, the bank highlights

progress in cost reduction and Credit Suisse integration, expecting

$7 billion in gross savings by year-end. The bank is advancing

integration efforts, already saving $0.9 billion in costs. Future

expectations include additional $1.1 billion in integration

expenses. UBS agreed on Tuesday to sell Credit Suisse’s U.S.

mortgage servicing business, with completion expected by Q1 next

year. Shares rose 2.3% in pre-market trading.

Intel (NASDAQ:INTC), Arm

Holdings (NASDAQ:ARM) – Intel sold its 1.18 million shares

stake in Arm Holdings for approximately $146.7 million in Q2. This

move is part of Intel’s restructuring, which includes cutting 15%

of jobs and focusing on AI chips to recover its technological edge.

Intel shares rose 0.1% pre-market, while Arm shares gained

0.5%.

Flutter Entertainment (NYSE:FLUT) – Flutter

raised its annual profit forecast after a better-than-expected Q2

and decided not to impose surcharges in U.S. states with high

taxes. Adjusted Q2 earnings reached $2.61 per share (up 56%),

beating the $1.47 estimate. Q2 revenue was $3.61 billion (up 20%),

above the $3.4 billion forecast. The company now projects U.S.

revenue of $6.2 billion for the year and forecasts profits between

$680 million and $800 million for FanDuel, surpassing the previous

estimate. Shares rose 8.5% pre-market.

DraftKings (NASDAQ:DKNG) – DraftKings also

canceled its proposed surcharge for bettors in high-tax states

after receiving negative customer feedback. The measure aimed to

offset higher fees in states like New York and Illinois. Shares

fell 0.5% pre-market.

Alphabet (NASDAQ:GOOGL),

Peloton (NASDAQ:PTON) – Google launched new Pixel

smartphones, such as the Pixel 9, starting at $799, featuring

advanced AI capabilities like information search in screenshots and

Gemini chatbot integration that can overlay other apps. The event

also introduced the Pixel Watch 3 and a partnership with Peloton to

offer fitness content. Additionally, the U.S. Department of Justice

is considering breaking up Alphabet due to allegations of Google’s

monopoly in the search market, with possible measures including the

sale of parts of the business, such as AdWords and the Chrome

browser, or data-sharing mandates. Alphabet shares fell 1%

pre-market, while Peloton shares rose 1%.

Nvidia (NASDAQ:NVDA) – After six tough weeks,

Nvidia saw its shares rise 17% over the past four sessions, adding

$424 billion in market value. This significantly contributed to the

S&P 500’s gain. The recovery comes after a historic drop and

intense volatility, driven by positive news and more attractive

valuations. Shares rose 0.6% in pre-market trading.

Foxconn (USOTC:FXCOF) – Foxconn reported 6%

growth in Q2 net profit, reaching T$35.05 billion ($1.09 billion),

beating analysts’ forecast of T$34.29 billion, thanks to strong

demand for AI servers. Additionally, Hon Hai will begin shipping a

limited volume of servers with Nvidia’s latest chips in Q4.

Significant shipments are only expected in 2025 due to challenges

with Nvidia’s Blackwell chip innovation. The Taiwanese company aims

for a 40% share of the AI server market.

Viasat (NASDAQ:VSAT) – Viasat shares fell 22.6%

on Tuesday after major investors, including Canadian pension funds,

announced the sale of about 11.2 million shares. Although the

company isn’t issuing new shares or receiving money from the sale,

the additional supply pressured the stock price.

DigitalBridge (NYSE:DBRG),

Jtower (USOTC:JTWRF) – DigitalBridge is offering a

152% premium to acquire Jtower, valuing it at about $630 million.

The ¥3,600 per share offer includes the sale of 26% stakes held by

Atsushi Tanaka and Nippon Telegraph & Telephone. Jtower, listed

since 2019, specializes in telecommunications towers.

Bank of America (NYSE:BAC) – In August,

investors reduced their stock positions and increased their cash

allocation due to declining global growth expectations. BofA’s

survey revealed the proportion of investors overweight in stocks

fell from 51% to 31%, while cash allocation rose from 4.1% to 4.3%.

Market volatility and weak U.S. employment data contributed to the

shift.

Berkshire Hathaway (NYSE:BRK.B),

Chubb (NYSE:CB) – Berkshire Hathaway is expected

to soon reveal whether it continued buying Chubb shares after

accumulating about $7 billion in late 2023 and early 2024.

Berkshire currently owns approximately 6% of Chubb.

Blackstone (NYSE:BX) – Blackstone is

considering selling Clarion Events, valued at up to $2.6 billion,

as the events market recovers. Blackstone bought Clarion in 2017

for $600 million, and after the pandemic’s impact, the company saw

a significant revenue increase. The sale could begin early next

year.

Riot Platforms (NASDAQ:RIOT),

Bitfarms (NASDAQ:BITF) – Riot Platforms increased

its stake in Bitfarms to 18.9%, acquiring 1 million shares.

Bitfarms announced the departure of co-founder Nicolas Bonta, who

was on the board Riot sought to replace. The two companies have

been in conflict since Riot’s hostile $950 million bid. Riot shares

rose 0.3% pre-market, while Bitfarms shares rose 0.9%.

Coinbase Global (NASDAQ:COIN) – Coinbase will

resume operations in Hawaii after seven years, now allowing

cryptocurrency trading and staking. The decision followed the

removal of a local regulatory requirement that forced crypto

companies to maintain fiat reserves. Shares rose 0.4%

pre-market.

Tesla (NASDAQ:TSLA) – The United Auto Workers

sued the National Labor Relations Board, alleging that Donald Trump

and Elon Musk threatened workers with termination for unionizing or

striking. This followed Trump’s praise for Musk handling strikes

and cutting costs. According to Reuters, the UAW is using the

lawsuit to support Kamala Harris and criticize Trump. Federal Judge

Reed O’Connor recused himself from a case brought by X, another

Musk company, against advertisers, after it was revealed that he

owned Tesla shares. The case will now be handled by Judge Ed

Kinkeade. X accuses advertisers of boycott and revenue loss. Tesla

shares fell 0.7% pre-market.

General Motors (NYSE:GM) – General Motors is

being sued by Texas for allegedly collecting and selling driver

data from more than 14 million vehicles without consent. The state

claims the data, used to assess driving behaviors, helped insurers

adjust premiums and coverage. GM is reviewing the complaint and

seeking consumer privacy protection. Additionally, GM is recalling

21,469 Cadillac Lyriq electric SUVs in the U.S. due to an issue

with the anti-lock brake system. The defect can cause unexpected

brake activation. The fix will be done through a remote update,

following an NHTSA review in April.

WeRide – Chinese autonomous driving startup

WeRide received permission from California to test autonomous

vehicles with passengers, without charging fares. The three-year

CPUC authorization allows tests in San Jose. This comes as WeRide

seeks a valuation of up to $5 billion in its New York IPO.

Boeing (NYSE:BA) – In July, Boeing delivered 43

commercial jets, maintaining last year’s pace. Under new CEO Kelly

Ortberg, the company faces supply chain challenges and has

increased production. Boeing also recorded 72 new orders and

resumed 737 MAX deliveries to China after a pause. The goal of

producing 38 737 MAX jets per month in 2024 may not be met due to

strikes and quality issues. Analysts expect production to reach 32

jets per month in 2024, with the target of 38 only being met in

2025. Shares rose 0.1% pre-market.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management seeks to replace 10 of Southwest Airlines’ 15

directors and push for the dismissal of CEO Robert Jordan due to

the company’s poor performance. Southwest, whose shares have fallen

24% over the past year, is trying to recover with new measures and

a shareholder rights plan to prevent takeovers. Shares rose 1%

pre-market.

LATAM Airlines (NYSE:LTM),

Embraer (NYSE:ERJ) – LATAM Airlines may purchase

up to 30 aircraft from Embraer to expand its operations in Brazil,

as stated by Brazil’s Minister of Ports and Airports. The Chilean

airline is considering smaller models like Embraer’s E2 due to long

delivery times for narrowbody aircraft. The Brazilian government

encourages the purchase to support Embraer and strengthen regional

aviation.

Lockheed Martin (NYSE:LMT), General

Dynamics (NYSE:GD) – Lockheed Martin has reached an

agreement with General Dynamics to produce solid rocket motors,

driven by high global missile demand due to conflicts in Ukraine

and the Middle East. Production will begin in 2025 at General

Dynamics’ Arkansas plant, with Lockheed increasing deliveries from

10,000 to 14,000 units.

Intuitive Machines (NASDAQ:LUNR) – Intuitive

Machines plans to launch its next lunar mission in early 2025,

following its historic 2023 landing success. The company expects to

ship the module for launch in Q4 2024. The company reported Q2 2024

revenue of $41.4 million, more than doubling from the previous

year. In the first half of the year, total revenue reached $114.5

million, surpassing all of 2023’s revenue. The full-year forecast

is $210 million to $240 million.

BHP Group (NYSE:BHP) – Union No. 1 at the

Escondida mine began a strike aiming for a larger share of the

profits from the world’s largest copper producer. The union, which

represents the majority of workers and has strong financial

backing, has previously caused significant production halts. The

strike could influence global copper prices, depending on its

duration and impact on BHP’s operations. Shares fell 2.4%

pre-market.

Kellanova (NYSE:K) – Mars, owner of brands like

M&M’s and Snickers, is nearing a deal to buy Kellanova, maker

of snacks like Cheez-It and Pringles, for about $30 billion. The

deal, to be announced soon, will be all-cash, paying $83.50 per

Kellanova share. Shares rose 7% pre-market.

Starbucks (NASDAQ:SBUX), Chipotle

Mexican Grill (NYSE:CMG) – Starbucks has appointed Brian

Niccol, former CEO of Chipotle, as its new leader, replacing Laxman

Narasimhan. Niccol, known for revitalizing Chipotle, faces

challenges at Starbucks, which has struggled with declining sales

and investor pressure. Starbucks stated that Niccol will focus on

innovation and improving employee morale, assuming the role on

September 9. Starbucks shares closed up 24.5% on Tuesday with the

news of the appointment, while Chipotle shares fell 7.5%.

Additionally, Starbucks plans to double its stores in India by

2028, exploring new store formats and adapting its menu to local

tastes. The company, facing challenges in other markets like the

U.S. and China, plans to expand with smaller stores and beverage

and food options tailored to Indian preferences. In pre-market

trading, Starbucks shares fell 0.8%, while Chipotle shares fell

0.7%.

McDonald’s (NYSE:MCD) – McDonald’s in France is

considering removing curry sauce from its menus ahead of the next

Olympics in a humorous protest against Stephen Curry, who helped

the U.S. defeat France in basketball in Paris. The chain posted the

idea on Instagram, joking about the sauce’s “return in four

years.”

DoorDash (NASDAQ:DASH) – DoorDash now offers

free access to the Max streaming service for subscribers of its

DashPass program in the U.S. This partnership follows the trend of

combining streaming services with delivery platforms, aiming to

attract customers looking for value deals. Warner Bros Discovery’s

Max can be accessed with or without ads for an additional cost.

Paramount Global (NASDAQ:PARA) – Paramount

Global will begin laying off 15% of its U.S. staff and close its

Paramount Television studio as part of a restructuring effort. The

company aims to cut costs by $500 million and prepare for a merger

with Skydance Media. Approximately 2,000 employees will be affected

by the end of 2024. Shares fell 0.3% pre-market.

Sea Limited (NYSE:SE) – Sea Ltd. improved its

sales forecasts for Shopee, its e-commerce arm. The company is

outpacing rivals like TikTok and Lazada and expects to become

profitable next quarter. Increased commissions for merchants and a

forecast of 20% growth in gross merchandise value highlight its

confidence in the market. In Q2, Sea Ltd. reported net profit of

$80 million, above the $60 million forecast, with a 23% increase in

sales, totaling $3.8 billion. Gross merchandise volume reached

$23.3 billion, 29% above the estimate. Gaming segment revenue fell

18% to $435.6 million, while financial services revenue grew

21%.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – The Kroger-Albertsons merger spent over $800 million

on legal fees and consulting due to legal challenges and antitrust

lawsuits. The merger faces obstacles in several courts and

regulatory bodies. Kroger spent $535 million, and Albertsons $329

million, totaling about $864 million.

Tilray Brands (NASDAQ:TLRY), Molson

Coors (NYSE:TAP) – Tilray Brands will acquire four Molson

Coors breweries to diversify its business beyond cannabis. With the

acquisition of Hop Valley, Terrapin Beer, Revolver Brewing, and

Atwater Brewery, Tilray aims to increase its beer customer base by

30%. Tilray shares rose 0.3% pre-market.

Amneal Pharmaceuticals (NYSE:AMRX) – Amneal

Pharmaceuticals will reformulate its private-label Mucinex to

remove an ingredient made with benzene, a carcinogen. The new

formula, which is expected to be submitted to the FDA by the end of

the year, should be on the market before August 2025. The company

is following the trend of eliminating hazardous substances from

medications.

Darling Ingredients (NYSE:DAR) – California

suggested limiting the use of seed oils in green diesel. The

proposal could benefit Darling Ingredients, which uses used cooking

oil, if approved. The change is not expected to take effect before

2028.

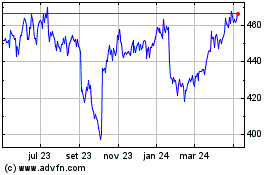

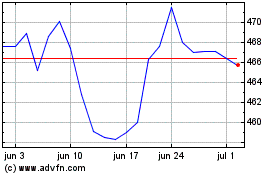

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024