U.S. index futures showed moderate changes in pre-market trading

on Tuesday after the S&P 500 and Nasdaq Composite achieved

their longest winning streaks in 2024. Market volatility has

decreased, and investors are awaiting the Jackson Hole Economic

Symposium for potential hints about future interest rate cuts.

At 5:00 AM ET, Dow Jones futures (DOWI:DJI) were up 12 points,

or 0.03%. S&P 500 futures gained 0.06%, and Nasdaq-100 futures

rose 0.10%. The 10-year Treasury yield stood at 3.867%.

In commodities, oil prices fell after Israel accepted a

ceasefire proposal for Gaza, easing concerns about supply

disruptions. Additionally, increased oil production in Libya and

weak demand data from China put downward pressure on prices.

West Texas Intermediate crude for September dropped 1.17% to

$73.50 per barrel, while Brent for October declined 0.63% to $77.17

per barrel.

Iron ore prices are expected to fall to around $80 per ton due

to reduced steel production in China, according to Citigroup.

Analysts indicate the market is imbalanced, and prices below $100,

previously attractive for purchases, now reflect different

dynamics, with lower steel demand in China. Reduced demand and

increased exports have created a market surplus. The bank revised

its price forecast from $95 to $85 per ton.

Gold surpassed the $2,500 per ounce record, driven by

expectations of Federal Reserve interest rate cuts. The 21%

increase year-to-date makes gold one of the best-performing

commodities of 2024. Analysts from UBS Group AG and ANZ Group

Holdings expect the price to reach $2,700 by mid-2025, supported by

central bank purchases and demand for hedges.

Tuesday’s U.S. economic calendar includes two key speeches that

could influence market perceptions of U.S. monetary policy. At 1:35

PM ET, Atlanta Fed President Raphael Bostic will speak. Later, at

2:45 PM ET, Fed Vice Chair for Supervision Michael Barr will also

deliver remarks.

Asia-Pacific markets had mixed results on Tuesday. Japan’s

Nikkei 225 advanced 1.8%, driven by utility and healthcare stocks.

South Korea’s Kospi rose 0.83%, while Australia’s S&P/ASX 200

edged up 0.22%. In contrast, China’s CSI 300 fell 0.72%, and Hong

Kong’s Hang Seng Index was down 0.50% in late trading.

In China, new home prices are plummeting in cities like Beijing

and Shenzhen, with cuts of up to 29%. This decline is attributed to

reduced government controls and efforts to correct market

distortions while trying to stimulate demand amid the property

crisis.

China’s property developer Kaisa Group Holdings has reached a

restructuring deal with a major creditor involving the issuance of

new bonds, potentially exceeding $10 billion. The company will use

these bonds to partially pay off its debts and avoid liquidation.

The agreement includes the issuance of convertible bonds, which can

be converted into company shares in the future.

In August, Chinese banks kept interest rates unchanged, with the

one-year loan rate at 3.35% and the five-year rate at 3.85%.

Keeping rates steady reflects concerns over banks’ profit margins

after last month’s rate cuts to boost the economy. This comes as

the People’s Bank of China (PBOC) seeks to balance economic growth

and financial health, avoiding drastic cuts. Further reductions are

expected if the Federal Reserve cuts rates in September.

The Reserve Bank of Australia (RBA) decided to keep interest

rates at 4.35%, considering high inflation and market recovery.

While it debated a possible hike, it opted not to cut rates in the

short term and may maintain restrictive policy for longer,

rejecting expectations of cuts in December, according to minutes

from the August 5-6 board meeting released on Tuesday.

According to a Reuters poll, the Bank of Korea will keep the

interest rate at 3.50% on Thursday. High inflation and the won’s

depreciation are expected to limit immediate cuts, with a possible

reduction to 3.25% by year-end.

European markets are mostly up, with sectors showing mixed

performance as investors await German producer price index data and

the final annual inflation rate for the EU. In Sweden, the Riksbank

cut interest rates by 25 basis points from 3.75% to 3.50% and

signaled two or three more rate cuts this year. Among individual

stocks, Zealand Pharma AS (TG:22Z) saw its shares rise nearly 4%

after news about seeking a pharmaceutical partner.

U.S. stocks rose on Monday, boosted by economic data that

increased expectations of Federal Reserve interest rate cuts. The

Nasdaq and S&P 500 posted their eighth consecutive gains. The

Dow Jones added 0.58% to 40,896.53, the S&P 500 climbed 0.97%

to 5,608.26, and the Nasdaq advanced 1.39% to 17,876.77.

The chances of a Federal Reserve rate cut next month have risen

significantly, with the CME Group’s FedWatch tool indicating a

75.5% probability of a 0.25 percentage point cut. Additionally,

there’s a 24.5% chance of a more aggressive 0.5 percentage point

cut.

On the earnings front, pre-market reports are expected from

Lowe’s (NYSE:LOW), Medtronic (NYSE:MDT), Vip.com (NYSE:VIPS), Workhorse

Group (NASDAQ:WKHS), NANO-X

Imaging (NASDAQ:NNOX), XPeng (NYSE:XPEV), H

World Group (NASDAQ:HTHT), Kingsway

Cloud (NASDAQ:KC), Navios Maritime

Partners (NYSE:NMM), Futu

Holdings (NASDAQ:FUTU), among others.

After the close, reports are expected from Toll

Brothers (NYSE:TOL), PagSeguro (NYSE:PAGS), Jack

Henry &

Associates (NASDAQ:JKHY), La-Z-Boy (NYSE:LZB), DADA

Nexus (NASDAQ:DADA), Keysight

Technologies (NYSE:KEYS), Coty (NYSE:COTY), ZTO

Express (NYSE:ZTO), Emeren

Group (NYSE:SOL), Sociedad Quimica y

Minera de Chile (NYSE:SQM), and more.

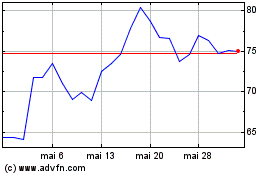

Futu (NASDAQ:FUTU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Futu (NASDAQ:FUTU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025