Berkshire Hathaway (NYSE:BRK.B), Bank

of America (NYSE:BAC) – Berkshire Hathaway sold a total of

14 million shares of Bank of America in recent days, reducing its

stake to 12%. The sale, which raised about $550 million, was made

last Thursday, Friday, and Monday, at an average price of $39.50

per share. Berkshire now owns 928 million shares of the bank. Bank

of America shares fell 0.1% in pre-market trading.

Paramount Global (NASDAQ:PARA) – Edgar Bronfman

Jr. made a bid of approximately $4.3 billion to acquire National

Amusements, which controls Paramount. His proposal includes $2.4

billion in debt and equity and $1.5 billion for Paramount. This

offer competes with Paramount’s agreement with Skydance, valuing

Paramount at $4.75 billion. Paramount has 45 days to explore other

offers, extendable until September 5. Bronfman believes his offer

is superior as it does not involve acquiring Skydance and directly

improves Paramount’s financial situation. Shares fell 0.2% in

pre-market trading.

Morgan Stanley (NYSE:MS) – Jonathan Bloomer,

chairman of Morgan Stanley International, is missing after the

luxury yacht “Bayesian” sank off the coast of Sicily due to a

storm, with 10 crew members and 12 passengers on board. The storm

left six people missing, including Bloomer, and resulted in the

confirmed death of the cook, Ricardo Thomas. Also missing are Chris

Morvillo, a lawyer at Clifford Chance, and businessman Mike Lynch

with his daughter.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is preparing to face Elliott Investment Management, which

is seeking drastic changes in the company’s leadership. CEO Bob

Jordan has been rallying support from investors and employees,

arguing that Elliott’s approach is predatory. Elliott wants to

replace the current leadership, citing Southwest’s unsatisfactory

performance.

Alaska Air Group (NYSE:ALK), Hawaiian

Airlines (NASDAQ:HA) – Alaska Airlines overcame a

regulatory hurdle for the $1.9 billion merger with Hawaiian

Airlines after the DOJ review period expired. The deal now awaits

review by the U.S. Department of Transportation. The merger will

expand destinations for Hawaiian residents and maintain the value

of HawaiianMiles. Alaska Air Group shares rose 0.1% in pre-market

trading, while Hawaiian Airlines shares jumped 9.6%.

Boeing (NYSE:BA) – The Saudi Arabian Public

Investment Fund is in talks to purchase Boeing 777 and Airbus 350

jets to establish a new cargo airline. The operation will serve

Saudia and the new startup Riyadh Air, according to Bloomberg News.

Additionally, the U.S. Federal Aviation Administration (FAA)

ordered inspections of 787 Dreamliners following a March incident

where a LATAM Airlines plane plunged due to uncommanded seat

movement, disconnecting the autopilot. The directive affects 158

aircraft in the U.S. and 737 globally, requiring inspections and

fixes within 30 days. Meanwhile, Boeing is halting 777X flight

tests after an inspection revealed flaws in a structure connecting

the engine to the aircraft, as reported by The Air Current on

Monday. Shares fell 0.9% in pre-market trading.

General Motors (NYSE:GM) – General Motors

announced on Monday that it is laying off more than 1,000 employees

from its software and services units globally. The layoffs, which

include around 600 positions at the tech campus near Detroit,

follow an operational review after the departure of software and

services VP Mike Abbott. GM states these layoffs are not for

cost-cutting but to streamline operations and focus on strategic

investments. Shares fell 0.2% in pre-market trading.

Stellantis (NYSE:STLA) – The United Auto

Workers (UAW) union warned that Stellantis workers might go on a

nationwide strike due to the automaker’s failure to fulfill 2023

production promises. Stellantis committed to investing in new

factories and creating jobs in the U.S., but delays in Illinois

investments have sparked the dispute. Shares rose 1.5% in

pre-market trading.

Tesla (NASDAQ:TSLA) – Donald Trump claimed that

if elected, he could eliminate the $7,500 tax credit for electric

vehicles and consider appointing Elon Musk to an advisory or

cabinet role. While a fan of electric cars, Trump expressed

concerns about the EV market due to costs and range issues. He also

plans to discourage exports from Mexico and impose tariffs to

incentivize U.S. automotive production. Shares rose 0.5% in

pre-market trading.

Harley-Davidson (NYSE:HOG) – Harley-Davidson

ended diversity, equity, and inclusion (DEI) initiatives following

pressure from an anti-DEI activist. The Milwaukee-based company

eliminated minority supplier targets, social training, and

participation in LGBTQ rankings, joining other firms re-evaluating

diversity policies due to criticism.

Nutrien (NYSE:NTR), CH

Robinson (NASDAQ:CHRW) – A potential labor dispute at

major Canadian railways is unlikely to significantly impact U.S.

oil exports due to extra pipeline capacity like Trans Mountain.

Companies, including Nutrien and CH Robinson, are preparing for

disruptions, but the impact on oil exports should be minimal, as

rail crude imports from Canada to the U.S. have declined in recent

years.

US Steel (NYSE:X) – Donald Trump pledged to

repeal a pollution rule for power plants imposed by the Biden

administration and block Nippon Steel’s purchase of US Steel. He

also vowed to restrict foreign access to U.S. markets and ensure a

100% American supply chain if elected. Shares dropped 6% in

Monday’s regular trading session.

Apple (NASDAQ:AAPL) – Apple will begin

manufacturing the iPhone Pro and Pro Max in India this year, a

significant milestone for the company and the local industry. The

local production aims to reduce costs and risks associated with

manufacturing in China. Local assembly could reduce Pro models’

prices by up to 10% in India and boost sales in the region.

Advanced Micro Devices (NASDAQ:AMD) – AMD

announced on Monday plans to acquire server maker ZT Systems for

$4.9 billion to strengthen its chip and AI hardware portfolio,

challenging Nvidia. AMD will pay 75% in cash and the rest in stock.

The acquisition will enable AMD to deploy its AI GPUs faster,

especially for major cloud computing firms like Microsoft and Meta.

AMD plans to sell the server manufacturing business after closing

the deal, expected in the first half of 2025. AMD intends to retain

about 1,000 of ZT Systems’ 2,500 employees, resulting in

approximately $150 million in annualized operating expenses. Shares

rose 0.2% in pre-market trading, following a 4.5% gain on

Monday.

Nvidia (NASDAQ:NVDA) – Nvidia shares have

posted a weekly gain of over 15%, driven by the longest winning

streak in five months. Expectations of positive earnings and

increased AI demand are exciting investors, despite potential

delays in the company’s new chip lineup. Shares fell 0.6% in

pre-market trading, following a 4.4% rise on Monday.

HP Inc. (NYSE:HPQ) – HP Inc. shares closed down

3.65% on Monday after Morgan Stanley downgraded the stock from

“Overweight” to “Equal-Weight,” citing that many positive factors

have already been priced in, and high inflation and interest rates

are impacting HP’s revenue, limiting immediate growth.

Uber Technologies (NYSE:UBER) – In Kenya, a

price war between Uber, Bolt, and local startups is leading drivers

to increase their own fares due to low commissions and high costs.

Uber, with low fares, prohibits higher price agreements, but

drivers are defying this by negotiating directly with customers,

claiming current prices do not cover high costs. The dispute is

causing frustration among passengers and drivers. Shares fell 0.2%

in pre-market trading, following a 3% gain on Monday.

Sonder Holdings (NASDAQ:SOND),

Marriott (NASDAQ:MAR) – Sonder Holdings shares

soared 130.53% on Monday after the company announced capital

agreements and a partnership with Marriott. With $43 million in

preferred shares and $83 million in liquidity, Sonder will

integrate its properties into Marriott’s system, enabling

reservations through the Marriott Bonvoy loyalty program. Sonder

shares fell 13.9% in pre-market trading.

Walt Disney (NYSE:DIS) – Walt Disney decided to

take to court a wrongful death lawsuit filed by the widower of a

woman who died after an allergic reaction at a Disney Springs

restaurant. Initially, Disney claimed the case should be resolved

through arbitration as the plaintiff had signed up for Disney+ and

used the company’s services. However, Disney now opted to waive

arbitration to settle the case in court, seeking a sensitive

resolution for the affected family. Additionally, Disney appointed

veteran producer Almin Karamehmedovic as president of ABC News.

Karamehmedovic started at ABC News as a freelance video editor in

1998 and was the executive producer of shows like “World News

Tonight with David Muir” and “Nightline.” Shares rose 0.1% in

pre-market trading, following a 1.7% gain on Monday.

Live Nation Entertainment (NYSE:LYV) –

Attorneys general from about 26 U.S. states are seeking treble

damages against Live Nation Entertainment and its subsidiary

Ticketmaster, accusing them of monopolizing the live concert market

and illegally inflating ticket prices. Ten additional states joined

the original lawsuit, bringing the total to 39 states and the

District of Columbia.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – Kroger sued the U.S. Federal Trade Commission (FTC),

seeking to block the $25 billion merger with Albertsons from being

reviewed in the FTC’s internal court, which Kroger deems

unconstitutional. The company wants the case decided in federal

court, arguing that the FTC’s internal process is illegal and could

delay the merger for years.

GoPro (NASDAQ:GPRO) – GoPro announced it will

cut 15% of its workforce, about 139 employees, as part of a

restructuring plan to reduce operating expenses. The company

expects to incur charges between $5 million and $7 million, with

layoffs occurring by the end of 2024. Shares closed up 5.7% on

Monday.

Amer Sports (NYSE:AS) – Since its February

debut, Amer Sports shares have fallen to be the worst among IPOs

over $1 billion in the U.S. since 2022. With a slowdown in China

impacting sales, Wall Street expects Tuesday’s financial results to

show improvement, with analysts optimistic about demand for its

Arc’teryx brand. Shares rose 3.6% in pre-market trading, following

a 7.8% gain on Monday.

Pilgrim’s Pride (NASDAQ:PPC) – The U.S. poultry

processor agreed to pay $100 million to settle allegations of

conspiring with competitors to reduce payments to chicken

producers. This settlement, the largest in a seven-year antitrust

case, still requires court approval. Pilgrim’s Pride denies

wrongdoing.

JPMorgan Chase (NYSE:JPM) – According to

JPMorgan, European companies that relist in New York tend to have

better valuations, partly due to the large number of passive

investments in the U.S. Companies like CRH, Ferguson, and Linde

have reduced their discounts relative to American competitors by an

average of 15% after the move, benefiting from a deeper market and

a broader investor base.

Goldman Sachs (NYSE:GS) – Goldman Sachs hired

Matt Beitzel, former head of bank coverage at Citigroup, for its

financial institutions group. Beitzel, who will start in November

after a sabbatical, will lead deals involving banks and financial

services firms in the Americas. He has over 20 years of experience

in the field.

Icahn Enterprises LP (NASDAQ:IEP) – Carl Icahn

and his firm, Icahn Enterprises, agreed to pay a $2 million fine to

resolve allegations that they failed for years to disclose that

most of the firm’s bonds were pledged as collateral for personal

margin loans. The SEC investigation was triggered by accusations

from Hindenburg Research, which Icahn denies.

Deutsche Bank (NYSE:DB) – Gavin Black, a former

Deutsche Bank trader, settled a $30 million lawsuit against the

bank, claiming his career was ruined after being falsely implicated

in the manipulation of the London Interbank Offered Rate (Libor).

Black, whose conviction was overturned in 2022, accused the bank of

scapegoating him to reduce its legal liabilities. Shares fell 0.1%

in pre-market trading.

American Express (NYSE:AXP) – American Express

is trying to expand its presence in Africa, where cash still

dominates payments. The company is persuading hotels, restaurants,

and tourist destinations to accept its cards. Recently, Amex

partnered with local banks and processors, aiming to have 75% of

merchants accept its cards.

Electra Battery Materials (NASDAQ:ELBM) –

Canada’s Electra Battery Materials received $20 million from the

U.S. to build a cobalt refinery in Ontario, the only one in North

America dedicated to electric vehicle batteries. With a total cost

of $250 million, the project in Temiskaming Shores aims to

strengthen the EV supply chain and reduce dependence on Chinese

production. The company, with a market value of about $28 million,

had paused the project due to rising costs and falling cobalt

prices, predominantly processed in China. Electra has already

received C$ 5 million ($3.7 million) from the Canadian government

and is seeking more financial support. Shares fell 15.2% in

pre-market trading, following a 48.8% gain on Monday.

BHP Group (NYSE:BHP) – The recent six-day

strike at the Escondida copper mine in Chile resulted in a

favorable agreement for workers, who received a bonus larger than

initially offered by BHP. This outcome could influence future

negotiations, especially at other Chilean mines where unions are

also pushing for better wages due to high copper prices. Shares

rose 0.2% in pre-market trading.

Andersons (NASDAQ:ANDE) – Andersons appointed

Bill Krueger as CEO to lead the company through a period of weak

agricultural markets. Krueger, former COO and CEO of Lansing Trade

Group, will succeed Pat Bowe, who will become chairman. The move

aims to expand the company’s grain and commodities business, which

faced a 30% revenue decline in the second quarter.

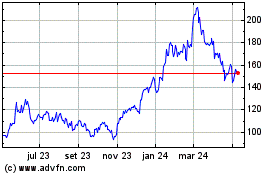

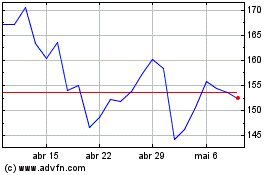

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024