U.S. Index Futures Rise Slightly as Market Eyes Fed, Earnings; Oil Prices Dip

22 Agosto 2024 - 6:38AM

IH Market News

U.S. index futures edged higher in pre-market trading on

Thursday as investors eagerly await remarks from Federal Reserve

Chairman Jerome Powell, scheduled for Friday. With the upcoming

release of jobless claims and earnings from Intuit and Ross, the

market remains cautious, especially after significant pre-market

declines in Snowflake (NYSE:SNOW) and

Urban Outfitters (NASDAQ:URBN) stocks, reflecting

the complexity of corporate results.

At 4:47 AM ET, Dow Jones (DOWI:DJI) futures rose 47 points or

0.11%. S&P 500 futures gained 0.08%, and Nasdaq-100 futures

advanced 0.06%. The yield on the 10-year U.S. Treasury note stood

at 3.822%.

On Thursday, the U.S. economic calendar includes initial jobless

claims for the week of August 17, expected at 230,000 claims

compared to the previous week’s 227,000, at 8:30 AM ET. At 9:45 AM,

U.S. services and manufacturing PMI data for August will be

released. Later, at 10:00 AM, existing home sales for July will be

announced, with a forecast of 3.95 million units, up from the

previously reported 3.89 million.

In the commodities market, wheat prices fell due to a railway

strike in Canada, affecting grain transportation.

Oil prices declined on concerns about global demand, despite

U.S. crude stock drawdowns. Revised employment reports and weak

economic data from China contributed to the drop, while the market

fears that OPEC+ might reverse its production cuts.

West Texas Intermediate crude for October fell 0.22% to $71.77

per barrel, while Brent for October dropped 0.03% to $76.03 per

barrel.

Asia-Pacific markets were mixed on Thursday. Japan’s Nikkei 225

rose 0.68%, and the Topix advanced 0.25%, driven by business

expansion in August. South Korea’s Kospi grew 0.24%, but the Kosdaq

fell 0.82%. China’s CSI 300 declined 0.26%. Australia’s S&P/ASX

200 gained 0.21%, supported by improved services activity. In Hong

Kong, the Hang Seng was up 1.33% in the final hour of trading.

The Bank of Korea kept its interest rate at 3.50% for the 13th

consecutive meeting, prioritizing inflation control. Despite

growing calls for rate cuts, the decision was in line with

economists’ expectations.

In Japan, the industry shrank in August due to weak demand, but

the decline was smaller, while the services sector grew, indicating

optimism. The manufacturing PMI rose to 49.5, still below 50, and

the services PMI increased to 54.0. Price pressures and labor

constraints persist.

In China, offshore creditors of Evergrande may recover funds if

they prove the company owes money to its onshore subsidiaries,

according to Reuters. Although they rank lower, they might have a

better chance of receiving payments if the restructuring reveals

outstanding debts.

European markets started Thursday slightly higher as investors

await signals from the Federal Reserve on future interest rate

moves. Additionally, UK and EU Purchasing Managers’ Index data will

be released, along with financial results from insurers

Swiss Re (TG:SR9) and Aegon

(EU:AGN), (NYSE:AEG). Bavarian Nordic (TG:BV3)

reported better-than-expected profits and announced a record mpox

vaccine order from an unidentified European country. Second-quarter

revenue was $213 million, with an operating profit of $60

million.

U.S. stocks rose on Wednesday, with the Nasdaq and S&P 500

recording their ninth gain in ten sessions. The Dow Jones advanced

55.52 points, or 0.14%, to 40,890.49 points, while the S&P 500

gained 23.73 points, or 0.42%, to 5,620.85. The Nasdaq added 102.05

points, or 0.57%, to 17,918.99.

The positive close followed the release of the Fed’s minutes,

which reinforced expectations of a rate cut in September. The

minutes revealed that most members support a cut, provided

inflation remains as expected. Labor market data showed the U.S.

economy created 818,000 fewer jobs than initially reported between

March 2023 and March 2024, reflecting 0.5% weaker growth.

In the upcoming quarterly earnings reports,

Baidu (NASDAQ:BIDU), OSI

Systems (NASDAQ:OSIS), Peloton (NASDAQ:PTON), Advance

Auto Parts (NYSE:AAP), BJ’s Wholesale

Club (NYSE:BJ), Williams-Sonoma (NYSE:WSM), Canadian

Solar (NASDAQ:CSIQ), NetEase

Games (NASDAQ:NTES), TD

Bank (NYSE:TD), Viking

Holdings (NYSE:VIK), and others will report before

the market opens.

After the close,

CAVA (NYSE:CAVA), Workday (NASDAQ:WDAY), Bill.com (NYSE:BILL), Intuit (NASDAQ:INTU), Ross

Stores (NASDAQ:ROST), Red

Robin (NASDAQ:RRGB), Macro

Bank (NYSE:BMA), American

Software (NASDAQ:AMSWA), and more are expected to

report numbers.

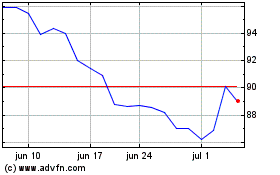

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025