Nvidia (NASDAQ:NVDA) – Options traders in the

US expect Nvidia’s upcoming earnings report to cause a stock swing

of around 9.8%, representing a market impact of over $300 billion,

according to Reuters. Shares rose 0.1% in pre-market trading.

Ambarella (NASDAQ:AMBA) – Ambarella announced

Q2 2025 earnings that exceeded forecasts. Earnings per share were

-$0.13, better than the estimated -$0.19. Sales increased 2.6% to

$63.73 million, above the expected $62.1 million. The company

forecasts revenue of $77-81 million and gross margins of 62.5%-64%

for the next quarter. Shares rose 19.6% in pre-market, after

closing up 3.2% on Tuesday.

Hertz Global Holdings (NASDAQ:HTZ) – Hertz

added Francis Blake and Lucy Clark Dougherty to its board, bringing

the total to 11 members. Blake, former CEO of Home Depot, and

Dougherty, former GM, join as the company faces challenges with

demand and high maintenance costs for electric vehicles. Shares

fell 2.3% in pre-market.

Apple (NASDAQ:AAPL) – Apple laid off about 100

employees from its digital services group, with the most impact on

the Apple Books and Apple Bookstore teams. The layoffs also

affected engineering roles and the Apple News team. The layoffs are

part of an internal reorganization to focus on new priorities like

artificial intelligence. Additionally, Apple partnered with India’s

Airtel to offer its music and video streaming services for free to

premium customers of the carrier. This partnership aims to boost

Apple’s presence in India, a competitive entertainment market.

Airtel users will have access to Apple TV+ and Apple Music, while

Airtel’s Wynk app will be discontinued. Shares rose 0.1% in

pre-market.

CrowdStrike (NASDAQ:CRWD) – CrowdStrike’s

financial results on Wednesday will reveal the impact of a global

shutdown caused by a faulty software update, affecting millions of

devices and damaging its reputation. Investors are keen to see how

the incident affected customer confidence and whether it impacted

the company’s market share. Shares rose 0.1% in pre-market.

Salesforce (NYSE:CRM) – Investors are eager to

know when software companies will start seeing significant results

from investments in artificial intelligence (AI). Salesforce, which

promised AI-driven growth, saw a sharp drop in its shares after

forecasting slower sales growth. If the upcoming results do not

show progress, it may raise doubts about AI’s effectiveness in

generating quick gains.

Alphabet (NASDAQ:GOOGL) – Google was prevented

from building a data center in Dublin for failing to meet Ireland’s

sustainability requirements. The South Dublin County Council

rejected the plan due to the lack of details on the impact on the

energy supply, a growing problem with the demand for data centers

in the region.

Intel (NASDAQ:INTC) – The sudden resignation of

Lip-Bu Tan from Intel’s board resulted from disagreements with CEO

Pat Gelsinger over AI strategy, the company’s risk-averse culture,

and its excessive workforce. Tan grew frustrated with the

bureaucracy and lack of focus on effective cost-cutting,

particularly among middle managers. Shares rose 0.1% in

pre-market.

Super Micro Computer (NASDAQ:SMCI) – Hindenburg

Research revealed a short position in Super Micro Computer,

alleging “accounting manipulation” and other issues like

undisclosed transactions and non-compliance with export controls.

Shares fell -3.1% in pre-market after closing down -2.6% on

Tuesday.

Hewlett Packard Enterprise (NYSE:HPE) – The US

Commerce Department plans to grant $50 million to HP to expand and

modernize a facility in Oregon, focusing on semiconductors. The

funding will support technologies for life sciences and AI,

reflecting federal investment in semiconductors and related

components.

Meta Platforms (NASDAQ:META) – Meta Platforms

will shut down its augmented reality studio Meta Spark on January

14, removing third-party AR effects such as filters and 3D objects.

The company is prioritizing investments in AI and the metaverse.

Meta’s own effects will remain available on its platforms, but

creators will need to find alternatives like Snapchat’s Lens

Studio. Shares rose 0.2% in pre-market.

EchoStar (NASDAQ:SATS) – EchoStar may need to

sell more spectrum-backed securities to delay maturities and

improve its liquidity due to an unsustainable $22 billion debt. The

company is facing financial difficulties and may have to offer high

coupons to attract investors.

Mattel (NASDAQ:MAT), Nokia

(NYSE:NOK) – HMD Global, the maker of Nokia phones, launched the

HMD Barbie Phone in partnership with Mattel. This pink flip phone,

with a retro design and illuminated keyboard, costs $131.24 (£99)

and allows calls and texts, without access to social media. The

launch celebrates Barbie’s 65th anniversary and follows the success

of the “Barbie” movie. HMD expects to sell over 400,000 units in

the UK.

Walmart (NYSE:WMT) – Walmart launched new

services to facilitate the transportation and management of

products for sellers, especially from Asia, to its warehouses in

the US. The retailer will also waive storage fees and offer

advances for sellers who send inventory before September 30, aiming

to boost their holiday sales. Additionally, Walmart is expanding

its online marketplace, including used watches and collectible

cards, to compete with eBay and Amazon. The goal is to diversify

the offering and attract new customers, increasing e-commerce

growth. Shares rose 0.3% in pre-market.

Costco Wholesale (NASDAQ:COST) – Costco, with

shares up nearly 40% this year, is seen as a candidate for a stock

split due to the current high price of over $900. Several other

retail companies, such as Walmart and Chipotle, have also conducted

splits, reflecting their strong performance.

JD.com (NASDAQ:JD) – JD.com announced a $5

billion stock buyback program on Tuesday, valid for 36 months

starting in September. The move follows a $3 billion buyback in

March and aims to ease investor concerns about the Chinese retail

market. Shares rose 0.5% in pre-market after rising 2.3% on

Tuesday.

Alibaba (NYSE:BABA) – Alibaba’s inclusion in

Stock Connect could release up to $3.2 billion into global markets,

according to Bloomberg. Chinese institutional funds could buy

Alibaba shares directly, freeing up foreign investment quotas for

other stocks, such as those in the US and Japan. This could benefit

foreign stocks and adjust the balance of international investment.

Shares fell 0.4% in pre-market.

Nordstrom (NYSE:JWN) – Nordstrom exceeded

expectations in the second quarter, with adjusted earnings of 96

cents per share, above the expected 71 cents. Revenue increased

3.2% to $3.89 billion. Sales were boosted by the anniversary sale

event and the expansion of Rack stores.

Abercrombie & Fitch Co. (NYSE:ANF) –

Abercrombie & Fitch plans to re-enter Hong Kong after eight

years, renting two large stores in central locations. The brand is

betting on the city’s retail market recovery, which is facing lower

property prices and stronger purchasing power. Shares rose 0.8% in

pre-market.

PVH Corp. (NYSE:PVH) – PVH Corp. reported $158

million in Q2 earnings ($3.01 per share), beating expectations of

$2.29 per share. Revenue fell 6% to $2.074 billion. Despite strong

performance from the Calvin Klein and Tommy Hilfiger brands and

significant gross margin expansion, the company faced challenges in

the Asia-Pacific region. PVH maintained its annual adjusted

earnings forecast of $11.55 to $11.80 per share and projected a 6%

to 7% sales decline for Q3. Shares fell 8.7% in pre-market.

Philip Morris International (NYSE:PM) – Philip

Morris will invest $232 million to expand production of ZYN

nicotine pouches in Owensboro, Kentucky, to meet high demand. The

investment will be made by Swedish Match, following a previous $600

million announcement for a new plant in Colorado. The expansion is

expected to be completed by Q2 2025.

Canopy Growth (NASDAQ:CGC), Tilray

Brands (NASDAQ:TLRY) – Cannabis company shares plummeted

after the DEA postponed the rescheduling of marijuana to December

2. Attorney General Merrick Garland had recommended the change to

Schedule three, but the prolonged wait continues to create

uncertainty in the sector. Canopy shares fell 2.7% in pre-market

after closing down 9.6% on Tuesday. Tilray shares rose 1.1% in

pre-market after a 5.9% drop the day before.

General Motors (NYSE:GM) – Samsung SDI and

General Motors finalized an agreement to build an electric vehicle

battery plant in Indiana, with an initial investment of $3.5

billion and a capacity of 27 GWh, potentially reaching 36 GWh. Mass

production is expected to begin in 2027, increasing efficiency and

reducing costs. Additionally, GM hired Tim Twerdahl, a former Apple

executive, as vice president of product management for its software

unit. He joins other former Apple leaders at GM, which is

bolstering its software team while making cuts to accelerate

development and compete with rivals like Tesla. Shares fell 0.1% in

pre-market.

Ferrari NV (NYSE:RACE) – Ferrari stands out for

its brand loyalty and low dependence on the Chinese market,

contributing to its superior performance compared to luxury and

automotive rivals. With shares up 43% this year and a solid base of

loyal customers, Ferrari outperforms competitors like Renault and

LVMH.

Tesla (NASDAQ:TSLA) – Tesla shares fell 1.9% on

Tuesday, closing at $209.21, in contrast to the slight gain in the

S&P 500. Stock volatility has been high since the Q2 earnings

report. So far in 2024, Tesla shares have fallen about 15%, with

declining vehicle sales. Shares fell 0.3% in pre-market.

Li Auto (NASDAQ:LI) – Investors expect Li Auto,

a Chinese electric vehicle leader, to report Q2 earnings. An

adjusted earnings per share of $0.09 and sales of $4.4 billion are

expected, with 10% sales growth. The company faces high competition

and lower prices. Li shares have fallen about 43% this year. Shares

fell 1% in pre-market after rising 2.4% on Tuesday.

Xpeng (NYSE:XPEV) – Xpeng launched its budget

MONA M03 model starting at $16,813, targeting the affordable

electric vehicle market in China. With two versions—a basic and an

advanced tech one—the MONA M03 will compete in a segment with cars

priced between $14,035 and $21,052. Deliveries start early next

year. Shares rose 0.5% in pre-market after closing up 6.5% on

Tuesday.

TuSimple (NASDAQ:TSP) – TuSimple agreed to pay

$189 million to settle a lawsuit over alleged fraud against

shareholders, who accuse the company of overstating the safety of

its autonomous truck technology and hiding ties to a Chinese rival.

The settlement awaits court approval. According to court documents,

TuSimple paid $174 million, and its insurers paid $15 million.

Boeing (NYSE:BA) – Ethiopian Airlines leased

aircraft due to Boeing’s delays in delivering 737 Max jets and 777

freighters. Waiting since April, the carrier faces challenges in

meeting its expansion plans. Boeing has not provided new delivery

timelines, impacting the growth of Ethiopian and other

airlines.

Ryanair (NASDAQ:RYAAY) – Michael O’Leary,

Ryanair’s CEO, criticized Boeing’s new management for delays in

delivering 737 MAX aircraft, which may drop to 20-25 planes instead

of the promised 29. He expressed frustration with production and

deadline compliance, highlighting ongoing problems at Boeing. The

airline plans to increase capacity by 8%. Ryanair expects lower

fares and promotions from December to February to attract

passengers affected by high interest rates. Shares rose 0.9% in

pre-market.

Delta Air Lines (NYSE:DAL) – The US

Occupational Safety and Health Administration is investigating the

death of two workers and the severe injury of a third in a Delta

aircraft maintenance accident at Atlanta airport. The accident

occurred during the disassembly of wheel components, with no

aircraft involved.

Vale (NYSE:VALE) – Brazilian mining company

Vale announced Gustavo Pimenta as its new CEO to avoid speculation

about other candidates. The early decision, ahead of the December

deadline, was well-received by the market, reflected in a 2.6% rise

in the company’s shares on Tuesday. Pimenta, the current CFO, will

take over later this year. Analysts see the appointment as a win

for governance and expect it to reduce uncertainty about the

company’s strategy. Shares fell 0.4% in pre-market.

Exxon Mobil (NYSE:XOM) – Exxon Mobil is selling

conventional oil assets in the Permian Basin to focus on shale

production after acquiring Pioneer Natural Resources. The package,

which includes older wells, could fetch about $1 billion, depending

on oil prices. Exxon says the sale aligns with its portfolio review

strategy. Shares rose 0.1% in pre-market.

Equinor ASA (NYSE:EQNR) – Equinor is

reassessing oil and gas resources on the Norwegian continental

shelf with new seismic data. The company aims to drill up to 30

wells per year until 2035. With investment plans of up to $5.7

billion annually, production in 2035 is expected to remain at 1.2

million barrels per day. Shares fell 0.8% in pre-market.

Berkshire Hathaway (NYSE:BRK.B), Bank

of America (NYSE:BAC) – According to a regulatory filing

on Tuesday night, Warren Buffett sold another $982 million in Bank

of America shares, reducing his stake by nearly 13% since July.

Berkshire Hathaway has generated $5.4 billion from these sales.

Berkshire is still the bank’s largest shareholder, with 903.8

million shares worth $35.9 billion.

Bank of America (NYSE:BAC) – Bank of America

clients withdrew $4.6 billion from US stocks last week, ending

three weeks of continuous buying. Outflows occurred across several

sectors, primarily technology and energy. Despite this, ETFs,

especially in technology, continued to attract investments,

reflecting a shift in investor preferences. Shares fell 0.2% in

pre-market.

JPMorgan Chase (NYSE:JPM) – Dollar bond

offerings from Indian companies are expected to accelerate, with at

least $4 billion anticipated by the end of 2024, as the Federal

Reserve signals lower interest rates, according to JPMorgan Chase.

Issuances this year could more than double from last year, driven

by higher returns and better liquidity conditions.

HSBC Holdings (NYSE:HSBC) – HSBC’s new CEO,

Georges Elhedery, is considering cutting layers of middle

management, similar to actions taken by Citigroup and Standard

Chartered. He may reduce the number of country heads and make

changes to the executive structure to streamline operations and cut

costs, starting in September. Shares fell 0.6% in pre-market.

UBS Group AG (NYSE:UBS) – UBS Global Wealth

Management raised the probability of a US recession from 20% to 25%

due to a slowdown in the labor market and weak unemployment data.

Despite maintaining a forecast of soft growth, the economic outlook

is considered uncertain, especially after employment revisions and

an increase in the unemployment rate. Shares fell 0.3% in

pre-market.

Banco Bilbao Vizcaya Argentaria (NYSE:BBVA) –

BBVA’s Colombian unit issued common stock worth $218 million. 3.24

billion shares were released at 270 pesos each, with a second

issuance of 152.7 million shares planned for a future date. The aim

is to strengthen capital and support growth in Colombia.

Nasdaq (NASDAQ:NDAQ) – Nasdaq is seeking

regulatory approval to launch options based on a bitcoin index.

These options would allow investors to amplify and hedge their

bitcoin exposure more affordably. The SEC has not yet approved

options for individual bitcoin funds, and Nasdaq is awaiting the

decision.

Toronto-Dominion Bank (NYSE:TD) – The rising

cost of a US money-laundering investigation into the

Toronto-Dominion Bank is affecting its credit rating, one of the

highest in the world. Moody’s has now placed a negative outlook on

the bank, reflecting concerns over potential penalties and the

impact on the rating.

Moody’s (NYSE:MCO) – Moody’s warned that a

full-blown conflict with Hezbollah or Iran could significantly

damage Israel’s credit rating. While the agency expects current

tensions not to escalate into a full-scale war, an expanded

conflict would negatively impact Israel’s debt.

Prudential Plc (NYSE:PUK) – Prudential Plc saw

a 1.4% drop in new business profit in the first half, totaling

$1.47 billion, impacted by weak sales in China, Hong Kong, and

Indonesia. The company is facing challenges in meeting its growth

targets, and shares have fallen 22% this year. Shares rose 2.1% in

pre-market.

Eli Lilly (NYSE:LLY) – Eli Lilly launched

single-dose vials of 2.5 mg and 5 mg of Zepbound for weight loss at

a 50% discount compared to similar medications. Available via

LillyDirect, prices are $399 and $549, respectively. The move aims

to increase access to treatment and meet high demand. Lilly shares

are up 64% this year.

GSK (NYSE:GSK) – The Delaware Supreme Court

agreed to review whether the evidence regarding GSK’s drug Zantac,

allegedly linked to cancer, is scientifically sound. The court’s

decision could affect litigation involving over 70,000 consumers

and impact the company’s stock value. Shares fell 1.3% in

pre-market trading after closing up 3.8% on Tuesday.

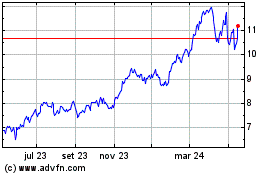

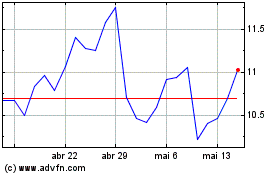

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024