Dell Technologies (NYSE:DELL), Palantir

Technologies (NYSE:PLTR), Erie Indemnity

(NASDAQ:ERIE), American Airlines (NASDAQ:AAL),

Etsy (NASDAQ:ETSY), Bio-Rad

Laboratories (NYSE:BIO) – S&P Dow Jones Indices

announced that Dell Technologies, Palantir Technologies, and Erie

Indemnity will be added to the S&P 500 on September 23. They

will replace American Airlines, Etsy, and Bio-Rad Laboratories in

the index. In pre-market trading, Dell shares rose 5.7%, and

Palantir shares rose 7.5%. American Airlines shares fell 0.9%, and

Etsy shares dropped 1.3%.

Boeing (NYSE:BA) – Boeing reached a tentative

agreement with its 32,000 workers’ union, avoiding an imminent

strike. The four-year contract includes a 25% wage increase and

commitments to build new planes in Seattle. The deal also improves

benefits and gives the union more influence over production.

Workers still need to approve it through voting. Additionally,

Boeing’s Starliner capsule returned without a crew after a mission

plagued by technical issues and delays. The six-hour flight landed

successfully, though thruster problems raised safety concerns,

prompting NASA to delay astronaut returns until 2025. Separately,

seven people were injured, one hospitalized, when a Scoot flight

encountered turbulence approaching Guangzhou, China. The Boeing

787-9 Dreamliner landed safely, and the injured received medical

assistance. Boeing shares rose 3.0% pre-market, after closing down

2.8% on Friday.

Apple (NASDAQ:AAPL), Arm

Holdings (NASDAQ:ARM) – Apple is gearing up for the iPhone

16 launch event today at 2 p.m. Brasília time, with the slogan

“It’s Glowtime.” High expectations surround the new pricing and

innovations, particularly in AI. The new iPhone with the A18 chip

is expected to be unveiled, utilizing Arm’s V9 design, which Apple

licensed until 2040. Arm, a long-time Apple partner since 1990,

dominates smartphone chip technology. Apple shares rose 1% in

pre-market, while Arm shares rose 2.6%.

Alphabet (NASDAQ:GOOGL) – Federal Judge Amit

Mehta, who ruled that Google illegally monopolized the search

market, plans to announce remedies by August. He rejected the

government’s request for more time and ordered the Department of

Justice to propose solutions for Google to respond. The government

may seek to break up Google or take other steps to restore

competition. According to Reuters, the DOJ intends to submit a

proposal by December to address online search market competition.

Alphabet shares rose 0.9% pre-market after closing down 4.0% on

Friday.

ASML (NASDAQ:ASML) – China expressed

dissatisfaction with the Netherlands’ decision to extend export

controls on ASML’s equipment, aligning with U.S. restrictions on

lithography technology. China’s Ministry of Commerce criticized the

U.S. for pressuring allies and hindering Sino-Dutch cooperation.

ASML shares rose 2.6% in pre-market, after closing down 5.4% on

Friday.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC achieved production yields at its Arizona plant

comparable to those in Taiwan, marking progress in its U.S.

project. Production of 4-nanometer wafers began in April, with

stable margin expectations. Full production is set to start in 2025

after delays. TSMC shares rose 1.7% pre-market, after closing down

4.2% on Friday.

Roblox (NYSE:RBLX) – Roblox will allow

developers to sell paid games and physical products through their

games. Initially, real-money pricing will be for PCs, with future

expansion to other devices. Roblox will increase creator revenue

shares up to 70% and partner with companies to integrate virtual

product stores. Roblox shares rose 0.8% pre-market, after closing

down 0.2% on Friday.

Walt Disney (NYSE:DIS) – DirecTV accused Disney

of anti-competitive behavior and imposing irregular conditions for

renewing its distribution agreement. DirecTV alleges that Disney is

forcing large channel bundles and illegal impositions, compelling

the operator to include less popular channels. Disney stated it is

negotiating to resolve the situation swiftly. Disney shares rose

0.5% pre-market after closing down 0.8% on Friday.

News Corp (NASDAQ:NWS) – Hedge fund Starboard

Value called for the elimination of News Corp’s dual-class share

structure, which gives Rupert Murdoch more control than his stake

suggests. This comes as Murdoch, 93, faces family disputes over

succession. While the proposal may not be binding, it challenges

Murdoch’s control. News Corp shares rose 2.9% pre-market, after

closing down 1.4% on Friday.

Faraday Future Intelligent Electric

(NASDAQ:FFIE) – Faraday Future secured $30 million in investments

from the Middle East, U.S., and Asia through convertible notes and

warrants. Faraday is expanding into the Middle East despite

challenges in the electric vehicle market. The notes’ conversion

price is $5.24 per share, and the warrants’ price is $6.29 per

share. Shares faced high volatility on Friday. After an initial 39%

rise, shares closed down 7.9%. Shares fell 2.9% pre-market.

Tesla (NASDAQ:TSLA) – Elon Musk denied that his

xAI startup negotiated any stake in Tesla in exchange for xAI

technology and resources. Reports suggested Tesla could license xAI

technologies to improve autonomous driving and other features, but

Musk said this is inaccurate. Tesla shares rose 1.8% pre-market

after closing down 8.5% on Friday.

NIO (NYSE:NIO) – NIO reported

better-than-expected Q2 results, with a smaller-than-expected loss

per share and improved gross profit margins. The company expects to

deliver 62,000 cars and generate $2.7 billion in revenue in Q3.

Analysts have upgraded their ratings and price targets, with most

rating the stock as “Buy.” NIO shares fell 2.0% pre-market after

closing up 3.5% on Friday.

Stellantis (NYSE:STLA) – Stellantis recalled

1.46 million vehicles globally due to a software defect in the

anti-lock brake system that could compromise stability and increase

the risk of accidents. The recall includes Ram trucks and Jeep

vehicles. No injuries or accidents have been reported. Stellantis

shares rose 0.2% pre-market, after closing down 2.1% on Friday.

AutoZone (NYSE:AZO), O’Reilly Auto

Parts (NASDAQ:ORLY), Genuine Parts

Company (NYSE:GPC), Advance Auto Parts

(NYSE:AAP) – U.S. lawmakers questioned CEOs of major auto parts

retailers about potential purchases from Qingdao Sunsong, a Chinese

company suspected of avoiding U.S. tariffs by routing products

through Thailand. They requested clarifications on compliance with

trade laws and procurement practices.

Norfolk Southern (NYSE:NSC) – Norfolk Southern

is investigating misconduct allegations against CEO Alan Shaw,

related to an inappropriate workplace relationship, according to

Reuters. The company’s audit committee is conducting the

investigation with a law firm.

Wynn Resorts (NASDAQ:WYNN) – Wynn Resorts

agreed to pay $130.1 million to settle a U.S. lawsuit over

unregistered customer money transfers at its casinos. Between 2014

and 2018, the company used unauthorized methods to move large sums,

violating regulations. Wynn stated it has implemented corrective

measures and resolved a related dispute with its former CEO.

Starbucks (NASDAQ:SBUX) – Starbucks is facing

challenges with sales and operations, hoping that new CEO Brian

Niccol will bring innovation and efficiency. Niccol, former CEO of

Chipotle, helped that brand recover and expand. Analysts believe he

can revitalize Starbucks by focusing on premium branding,

simplifying the menu, and improving operations.

Chewy (NYSE:CHWY) – Morgan Stanley estimates

Chewy’s stock could double in the next 12 months. Analyst Nathan

Feather raised his price target from $49 to $53, highlighting the

company’s potential profitability improvement. Chewy is considered

the top pick among mid-sized e-commerce stocks. Shares rose 0.4%

pre-market, after closing up 0.1% on Friday.

GameStop (NYSE:GME) – GameStop shares closed up

6.8% on Friday after an enigmatic post by “Roaring Kitty” (Keith

Gill) on X, showing an altered image from the movie “Toy Story 2.”

Before the post, a trader bought call options on GameStop,

profiting about 30%. The company will release its quarterly report

after the market closes on Tuesday. Shares fell 1.3%

pre-market.

Kroger (NYSE:KR) – Kroger, which will release

its quarterly results before the market opens Thursday, faces

scrutiny over its $24.6 billion merger with Albertsons and

allegations of price gouging. Attention is focused on the company’s

future pricing strategy and competitive impact as it seeks to

balance profit and competition in an inflationary environment.

Instil Bio (NASDAQ:TIL) – Instil Bio announced

the closure of its Manchester unit and plans to lay off its UK

workforce. The restructuring plan will cost an estimated $5.5

million, including severance payments and contract terminations.

The company aims to cut costs and improve efficiency while its lead

asset, SYN-2510, continues development for cancer treatment. Shares

rose 10.2% pre-market after closing up 0.7% on Friday.

Big Lots (NYSE:BIG) – Home goods retailer Big

Lots filed for bankruptcy under Chapter 11 and secured $707.5

million in a sale to Nexus Capital. Its assets and liabilities

range between $1 billion and $10 billion. Nexus will be the lead

bidder in the auction, expected to close in Q4 2024. Shares are

steady pre-market after closing up 9.1% on Friday.

BlackRock (NYSE:BLK) – The U.S. Federal Energy

Regulatory Commission approved BlackRock’s $12.5 billion

acquisition of Global Infrastructure Partners. The deal includes $3

billion in cash and 12 million BlackRock shares. Global

Infrastructure Partners invests in infrastructure across various

sectors.

Coinbase Global (NASDAQ:COIN) – A federal judge

rejected Coinbase’s bid to dismiss a shareholder class-action

lawsuit alleging the company understated the risk of SEC action.

The judge stated there is evidence that Coinbase and its executives

may have misled investors about regulatory risks and asset safety.

Coinbase shares rose 3.3% pre-market after closing down 7.7% on

Friday.

Goldman Sachs (NYSE:GS) – Goldman Sachs

arranged a bridge loan of about $389 million to support Almaviva

SpA’s acquisition of Iteris Inc. The loan will be replaced by

high-yield bonds. The $335 million deal is expected to close this

year, pending approval.

Vale (NYSE:VALE), BHP Group

(NYSE:BHP) – Mining companies Vale and BHP, along with Samarco, may

finalize a deal with Brazilian authorities to pay approximately 100

billion reais ($17.87 billion) for the 2015 Mariana disaster. The

amount exceeds the previous 82 billion reais proposal. The deal is

expected to be completed in October. Vale shares rose 0.1%

pre-market, while BHP shares rose 0.6%.

Petrobras (NYSE:PBR) – Petrobras is

accelerating its return to the fertilizer sector, planning to

invest $800 million to complete the UFN-III plant. The goal is to

reduce import dependence and strengthen domestic production,

especially after import disruptions due to the Ukraine war.

Petrobras shares rose 0.7% pre-market after closing down 1.7% on

Friday.

IPO

Nium Pte – Nium Pte, a Singapore-based payments

company, has postponed its U.S. IPO to 2026, focusing on

strengthening its team and expanding revenue. The company, valued

at $1.4 billion, has hired a new CFO and aims to reach $200 million

in revenue by 2025. Nium also plans to acquire payment

startups.

StandardAero – StandardAero, an aircraft

maintenance services provider, along with its investors Carlyle

Group and GIC, has filed for a U.S. IPO. The aircraft maintenance

sector is growing due to long-term demand and post-pandemic

recovery. The IPO is expected to list on the New York Stock

Exchange under the symbol “SARO.”

KinderCare Learning Companies – KinderCare

Learning Companies is restarting its U.S. IPO after a three-year

pause. Under the leadership of new CEO Paul Thompson, the childcare

education company plans to list its shares on the New York Stock

Exchange under the symbol “KLC.” Partners Group will remain the

majority shareholder.

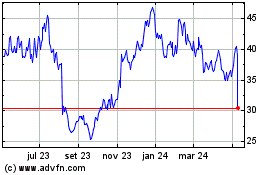

Roblox (NYSE:RBLX)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

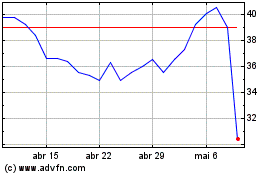

Roblox (NYSE:RBLX)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024