U.S. index futures fell in pre-market trading on Wednesday as

investors await the August inflation report and assess the

presidential debate between Donald Trump and Kamala Harris.

At 5:24 AM, Dow Jones futures (DOWI:DJI) fell by 199 points, or

0.49%. S&P 500 futures lost 0.41%, and Nasdaq-100 futures

dropped 0.46%. The 10-year Treasury yield stood at 3.609%.

On the U.S. economic agenda, the August Consumer Price Index

(CPI) data will be released at 8:30 AM, with a monthly increase

forecasted at 0.2%, repeating the previous figure. The annual CPI

is expected to show a 2.6% rise compared to the previous 2.9%. The

core CPI, excluding volatile items, is also projected to rise 0.2%

in August and 3.2% annually, in line with the previous report.

In commodities, oil prices rose as concerns over Hurricane

Francine disrupting U.S. production outweighed Tuesday’s sharp drop

and OPEC+ demand revisions. The U.S. crude oil inventory decline

and rising Chinese imports helped boost prices.

West Texas Intermediate crude for October rose 2.33% to $67.28

per barrel, while Brent for November rose 2.05% to $70.61 per

barrel.

Gold (PM:XAUUSD) rose for the third consecutive day, trading at

around $2,5253.97 an ounce, as U.S. inflation data awaited could

signal the size of future Federal Reserve rate cuts. Investors are

closely watching labor market weakness, which could lead to rate

cuts and benefit gold.

Iron ore is testing support at $90 per ton after falling to its

lowest level in almost two years. The decline is driven by a

slowdown in China’s steel sector, saturating the market. While

major miners like BHP and Vale can withstand low prices, smaller

producers may be forced to close.

Asia-Pacific markets retreated on Wednesday. Japan’s Nikkei 225

fell 1.49% to 35,619.77, marking its eighth consecutive day of

losses, while the Topix dropped 1.8%. South Korea’s Kospi fell

0.4%, but the Kosdaq rose 0.46%. In Australia, the S&P/ASX 200

fell 0.3%. Hong Kong’s Hang Seng dropped 0.65% in final trading,

and China’s CSI 300 fell 0.3%.

Shares of Asian lithium producers surged after rumors that CATL

halted production at a major mine in China, alleviating concerns

over excess supply. The stoppage could reduce monthly lithium

carbonate output, pushing prices up as much as 23% by year-end,

according to Bloomberg. Among the companies, Tianqi

Lithium shares jumped in Hong Kong, while Pilbara

Minerals (ASX:PLS) shares rose 14.5% in Sydney.

Shares of Star Plus Legend Holdings, backed by

pop star Jay Chou’s mother, plunged 73% on Wednesday for no clear

reason. The price fell below IPO levels for the first time since

listing in July 2023. Trading volume was 43 times the daily

average. The company, known for products associated with Chou, saw

its market cap drastically shrink in three days.

In Japan, business confidence among large manufacturers fell to

a seven-month low in September, impacted by weak demand in China,

according to a Reuters survey. Additionally, the services sector

also saw a decline in optimism, although there are signs of

recovery in some segments, like semiconductors.

The Bank of Japan may raise interest rates if inflation

continues as projected, despite the recent market downturn.

Monetary authority Junko Nakagawa highlighted the bank’s need to

consider market volatility when making decisions. With core

inflation at 2.7% and economic data showing growth, the yen

strengthened, and further rate hikes may occur by year-end.

Mitsui announced it would double its share

buyback spending to 400 billion yen ($2.84 billion), aiming to

acquire and cancel up to 6% of its outstanding shares. The company

has already repurchased 2.64% of its shares and plans to continue

until February 2025.

In India, Prime Minister Narendra Modi highlighted the ambition

to expand its electronics sector to $500 billion by the end of the

decade. At a semiconductor event, he praised the country’s

potential, which currently has a $155 billion electronics

market.

India faces a challenge to become a reliable alternative to

China as an industrial hub, due to bilateral tensions, according to

Reuters. Since the 2020 conflict, the Indian government imposed

restrictions on Chinese investments but is now looking to ease

these barriers to attract more capital and technology, crucial for

high-tech sectors.

Additionally, Ford (NYSE:F) is in discussions

with the Indian state of Tamil Nadu to resume vehicle production

with a focus on exports. The automaker halted manufacturing in

India three years ago due to low sales but is now considering using

its Chennai plant to produce electric cars for export.

In South Korea, the unemployment rate fell to a record 2.4% in

August, seasonally adjusted, from 2.5% in July. This is the lowest

rate since the series began in June 1999, according to Statistics

Korea.

The Reserve Bank of Australia (RBA) reported that the labor

market is adjusting, with a moderate slowdown in demand due to high

interest rates. While unemployment rose to 4.2%, there are still

signs of a tight market and recovery in migration and labor force

participation, according to Sarah Hunter of the RBA.

European markets are trading higher, driven by anticipation of

U.S. inflation data due later. In July, the UK economy remained

flat, with lower-than-expected growth of 0.2%. GDP did not grow in

June and saw a slight 0.5% increase over the last three months. The

services sector grew by 0.1%, while production and construction

fell by 0.8% and 0.4%, respectively.

Amazon Web Services (AWS) revealed plans to

invest £8 billion in the UK over the next five years to increase

data center capacity. The initiative is expected to contribute £14

billion to the UK’s GDP and create more than 14,000 jobs.

Shares of Inditex, Zara’s parent company, rose

as sales rebounded, while Rentokil (LSE:RTO)

shares fell more than 18% due to lower-than-expected sales in North

America.

Shares of Commerzbank (TG:CBK) jumped 17% after

UniCredit (BIT:UCG) acquired a 9% stake, fueling

speculation about a potential merger. UniCredit bought 4.5% of

Commerzbank from the German government and the remainder on the

market. Meanwhile, UniCredit shares rose 1.7%. Germany still owns

12% of Commerzbank.

Abu Dhabi National Oil Company (ADNOC) plans to

offer approximately $15.90 billion to acquire

Covestro (TG:1COV), including debt. After a year

of monitoring, ADNOC made an improved offer, leading Covestro to

open its data for negotiations.

LVMH (EU:MC) is in talks to become a principal

sponsor of Formula 1, promoting its brands like Tag Heuer and Moët

& Chandon. LVMH plans to announce the deal before year-end. The

agreement, potentially worth $150 million annually, represents

direct competition with current sponsor Rolex.

In August, Germany saw a 10.7% increase in insolvencies compared

to the previous year, according to statistics office data. Since

June 2023, insolvencies have risen at a double-digit rate, except

for a slight dip in June 2024. In the first half of 2024, corporate

insolvencies rose by 24.9%, with transportation, construction, and

business services sectors being the most affected.

On Tuesday, U.S. stocks had a volatile session, driven by

anticipation of inflation data. The Nasdaq rose 0.84%, closing at

17,025.88, while the S&P 500 gained 0.45%, reaching 5,495.52.

However, the Dow Jones dropped 92.63 points (-0.23%), closing at

40,736.96. Banking stocks saw sharp declines, with the KBW Bank

Index falling 1.8%.

CME Group’s FedWatch tool estimated a 69% chance of a

25-basis-point rate cut and a 31% chance of a 50-basis-point cut at

the Federal Reserve’s next meeting.

The debate between Donald Trump and Kamala Harris was heated and

contentious. It began cordially with Trump and Harris exchanging

greetings but ended with each going in opposite directions. During

the second half, Harris spoke more than Trump, but he continued to

dominate the conversation, discussing topics such as immigration

and border policies. Harris also attacked Trump on his legal issues

and his positions on Israel.

Following the debate, Taylor Swift expressed her support for

Harris, praising her commitment to important causes. Although the

race remains close, Harris’s performance could positively influence

her electoral chances in the coming days.

The debate brought little clarity on key political issues like

tariffs and taxes. Despite Harris gaining slightly in election

forecasts, the impact on markets was modest. Investors remain

primarily concerned about the U.S. economy and potential Federal

Reserve actions, reflecting reduced short-term volatility.

Before the market opens, quarterly reports from

Manchester

United (NYSE:MANU), Hepsiburada (NASDAQ:HEPS), Designer

Brands (NYSE:DBI), Vera

Bradley (NASDAQ:VRA), and Tsakos Energy

Navigation (NYSE:TEN) will be released.

After the close, numbers from Oxford

Industries (NYSE:OXM), Lesaka

Technologies (NASDAQ:LSAK), and more are

expected.

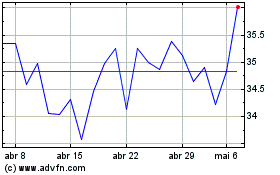

Unicredit (BIT:UCG)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Unicredit (BIT:UCG)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025