Stocks Fall On Geopolitical Tensions; Major Averages Close Notably Lower

07 Outubro 2024 - 5:57PM

IH Market News

U.S. stocks fell on Monday amid easing prospects of aggressive

rate cuts by the Federal Reserve following a much higher than

expected addition in U.S. non-payroll employment in the month of

September.

Investors also awaited earnings announcements from major banks,

and some crucial economic data, including readings on consumer

price and producer price inflation.

The major averages all closed notably lower. The Dow (DOWI:DJI)

tumbled 398.51 points or 0.94 percent to 41,954.24, the S&P 500

(SPI:SP500) closed down 55.13 points or 0.96 percent at 5,695.94,

while the Nasdaq (NASDAQI:COMP) recorded a more pronounced drop,

falling by 213.95 points or 1.18 percent to settle at

17,923.90.

After Friday’s upbeat jobs data, traders now expect only a

quarter-point cut in interest rates at the Federal Reserve’s next

policy announcement on Nov. 7, with a small chance that the policy

rate stays unchanged.

On the geopolitical front, Israeli defense forces intensified

air strikes targeting Gaza and the Lebanese capital of Beirut

simultaneously on the first anniversary of Hamas’ cross-border

attack in Israel, which triggered the Middle East war.

Dozens were killed in air strikes on a mosque and a now defunct

school, which were converted as refugee relief shelters Sunday,

according to Gaza’s Hamas-run health ministry. The Israeli military

says Hamas militants were hiding there.

Apple Inc., Microsoft Corporation, Alphabet, Amazon, Meta

Platform, Berkshire Hathaway, Tesla, Walmart, Visa, Procter &

Gamble, Netflix, Coca-Cola, Salesforce, Merck, Accenture, Walt

Disney, Nike, KKR and ADP lost 1 to 4 percent.

Pfizer (NYSE:PFE) climbed more than 2 percent. Abott, IBM, Eli

Lilly & Co., NVIDIA Corporation and Exxon Mobil also closed

higher.

Asian stocks rallied on Monday and the dollar hit a fresh

seven-week peak on the yen after robust U.S. jobs data signaled

economic resilience but prompted trades to pare bets on aggressive

Federal Reserve interest-rate cuts.

The major European markets closed higher higher on Monday as

largely firm Asian markets and the recent upbeat jobs data from the

U.S. helped keep investor sentiment fairly positive. Worries about

rising tensions in the Middle East and caution ahead of some

crucial economic data, including readings on U.S. consumer price

inflation, limited markets’ upside.

SOURCE: RTTNEWS

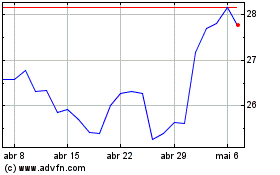

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024