Dow Extends Losing Streak To Nine Days, Nasdaq Pulls Back Off Record High

17 Dezembro 2024 - 6:38PM

IH Market News

After coming under pressure early in the session, stocks saw

continued weakness throughout the trading day on Tuesday. The

tech-heavy pulled back off yesterday’s record closing high, while

the Dow closed lower for the ninth straight session for the first

time since 1978.

The major averages climbed off their worst levels going into the

close but remained in the red. The Dow slid 267.58 points or 0.6

percent to 43,449.90, the Nasdaq dipped 64.83 points or 0.3 percent

to 20,109.06 and the S&P 500 (SPI:SP500) fell 23.47 points or

0.4 percent to 6,050.61.

The weakness on Wall Street partly reflected a pullback by

technology stocks, which helped lead the way higher in the previous

session.

Networking stocks showed a significant pullback, with the NYSE

Arca Networking Index tumbling by 2.2 percent after surging to a

record closing high on Monday.

Considerable weakness is also visible among semiconductor

stocks, as reflected by the 1.6 percent loss posted by the

Philadelphia Semiconductor Index.

Shares of Broadcom (NASDAQ:AVGO) gave back ground following a

recent spike, while shares of Nvidia (NASDAQ:NVDA) saw further

downside after entering contraction territory on Monday.

Outside the tech sector, financial stocks saw notable weakness,

dragging both the NYSE Arca Broker/Dealer Index and the KBW Bank

Index down by 1.5 percent.

Telecom, housing and steel stocks also moved to the downside,

while pharmaceutical stocks bucked the downtrend amid a surge by

shares of Pfizer (NYSE:PFE). Pfizer shot up by 4.7 percent after

forecasting 2025 revenues in line with estimates.

Meanwhile, traders continued to look ahead to the Federal

Reserve’s highly anticipated monetary policy announcement on

Wednesday.

While the Fed is widely expected to lower rates by another

quarter point, traders are likely to pay close attention to the

accompanying statement as well as officials’ latest economic

projections, including their forecasts for rates.

Recent data showing inflation remains sticky has led to some

worries the Fed will lower rates slower than previously anticipated

next year.

Potentially adding to the concerns about the outlook for rates,

the Commerce Department released a report this morning showing

stronger than expected retail sales growth in the month of

November.

“This report will likely add to the Fed’s debate about the

policy path for 2025,” said Jeffrey Roach, Chief Economist for LPL

Financial. “Unless the labor market materially weakens, investors

should expect the Fed to ease rates next year but not as much as

originally hoped.”

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Tuesday. Japan’s Nikkei 225

Index dipped by 0.2 percent and China’s Shanghai Composite Index

slid by 0.7 percent, while Australia’s S&P/ASX 200 Index

advanced by 0.8 percent.

Meanwhile, European stocks moved mostly lower on the day. The

U.K.’s FTSE 100 Index slumped by 0.8 percent and the German DAX

Index fell by 0.3 percent, although the French CAC 40 Index bucked

the downtrend and inched up by 0.1 percent.

In the bond market, treasuries saw modest strength after ending

the previous session roughly flat. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, edged

down by 1.2 basis points to 4.385 percent.

Looking Ahead

Trading on Wednesday is likely to be driven by reaction to the

Fed’s monetary policy decision and updated economic

projections.

SOURCE: RTTNEWS

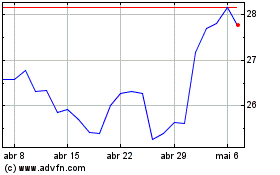

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024