U.S. Stocks May Lack Direction Following Yesterday’s Downturn

16 Outubro 2024 - 10:07AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Wednesday, with stocks likely to show a lack of

direction following the notable pullback seen over the course of

the previous session.

Uncertainty about the near-term outlook for the markets may keep

some traders on the sidelines on the heels of yesterday’s

pullback.

The downturn on Tuesday, which was led by tech stocks after

Dutch chipmaker ASML (NASDAQ:ASML) warned of “customer

cautiousness,” came after the Dow and the S&P 500 reached new

record closing highs on Monday.

Traders may also be reluctant to make significant moves ahead of

the release of several key economic reports on Thursday.

Reports on weekly jobless claims, retail sales and industrial

production are likely to be in focus as traders look for additional

clues about the outlook for the economy and interest rates.

Among individual stocks, shares of Morgan Stanley (NYSE:MS) are

seeing notable pre-market strength after the financial giant

reported third quarter results that exceeded analyst estimates.

J.B. Hunt Transport Services (NASDAQ:JBHT) is also likely to see

an initial jump after reporting better than expected third quarter

results.

After moving to the upside early in the session, stocks came

under considerable selling pressure over the course of the trading

day on Tuesday. The major averages all moved notably lower

following the strong gains posted during Monday’s session.

The major averages fell to new lows late in the trading day

before regaining some ground going into the close. The tech-heavy

Nasdaq slumped 187.10 points or 1.0 percent to 18,315.59, the Dow

slid 324.80 points or 0.8 percent to 42,740.42 and the S&P 500

fell 44.59 points or 0.8 percent to 5,815.26.

The pullback on Wall Street may partly have reflected profit

taking, as some traders looked to cash in on recent strength in the

markets.

The Dow and the S&P 500 reached record closing highs on

Monday, with the Dow closing above 43,000 for the first time. The

Nasdaq is also closing in on the record highs set in July.

A steep drop by shares of UnitedHealth (NYSE:UNH) weighed on the

Dow, as the health insurance giant plunged by 8.1 percent.

The nosedive by UnitedHealth came after the company reported

third quarter results that beat expectations but lowered the top

end of its full-year earnings guidance.

Financial giant Citigroup (NYSE:C) also showed notable move to

the downside despite reporting better than expected third quarter

results.

Meanwhile, shares of Walgreens Boots Alliance (NASDAQ:WBA)

skyrocketed by 15.8 percent after the drugstore chain reported

fiscal fourth quarter results that exceeded estimates and announced

plans to close roughly 1,200 stores over the next three years.

On the U.S. economic front, the Federal Reserve Bank of New York

released a report showing regional manufacturing activity has

returned to contraction in the month of October.

The New York Fed said its general business conditions index

tumbled to a negative 11.9 in October from a positive 11.5 in

September, with a negative reading indicating contraction.

Economists had expected the index to decrease to a positive

2.3.

Despite the downturn in October, the New York Fed said optimism

about the six-month outlook grew strongly, with the index for

future business activity jumping to a multi-year high of 38.7 in

October from 30.6 in September.

Semiconductor stocks moved sharply lower over the course of the

session, dragging the Philadelphia Semiconductor Index down by 5.3

percent.

The sell-off by semiconductor stocks came as ASML CEO Christophe

Fouquet said market segments other than AI are recovering more

gradually than previously expected, leading to customer

cautiousness.

A steep drop by the price of crude oil also contributed to

substantial weakness among energy stocks, with the Philadelphia Oil

Service Index and the NYSE Arca Oil Index both plunging by 3.8

percent.

Steel, healthcare and natural gas stocks also saw considerable

weakness, while telecom stocks showed a strong move to the upside,

resulting in a 1.8 percent jump by the NYSE Arca North American

Telecom Index.

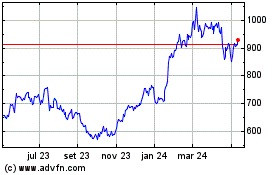

ASML Holding NV (NASDAQ:ASML)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

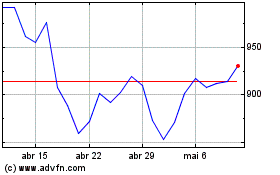

ASML Holding NV (NASDAQ:ASML)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024