Lucid Group (NASDAQ:LCID) – Lucid Group

announced it expects a larger loss in Q3 and launched a public

offering of 262 million shares. The Saudi Public Investment Fund,

Lucid’s largest shareholder, will buy 374.7 million shares,

maintaining around 59% ownership of the company. Lucid shares fell

14.6% pre-market after closing up 0.3% on Wednesday.

Phunware (NASDAQ:PHUN) – Phunware Inc. shares

surged 17.6% on Wednesday after the company announced the

development of a new generative AI platform. CEO Mike Snavely said

the platform, expected in 2025, will streamline app design and

content creation, significantly reducing development costs and

time. Phunware shares rose 13.4% pre-market.

Meta Platforms (NASDAQ:META) – Meta is laying

off employees in units like Instagram, WhatsApp, and Reality Labs,

according to The Verge. The company stated these changes are aimed

at aligning teams with long-term goals. While the number of layoffs

is small, Meta has already cut about 21,000 jobs since November

2022. Shares rose 0.7% pre-market after closing down 1.6% on

Wednesday.

Deere & Co. (NYSE:DE) – Deere is laying off

around 300 employees in Iowa and Illinois due to decreased demand

for agricultural equipment. This is the latest round of layoffs

after the company reduced its annual profit forecast. The decision

is not related to the relocation of production to Mexico.

Apple (NASDAQ:AAPL) – Apple collaborated with

Chinese automaker BYD since 2017 on long-range batteries for its

now-canceled car project. Although the partnership ended, it helped

develop BYD’s Blade battery technology, now used in its electric

vehicles, and brought technical advancements to Apple. Apple shares

rose 0.5% pre-market after closing down 0.9% on Wednesday.

Nvidia (NASDAQ:NVDA) – Nvidia shares closed

3.1% higher on Wednesday at $ 35.72, after a 4.7% drop the previous

day following ASML’s disappointing earnings. ASML fell 16%, with an

additional 6.4% drop on Wednesday. Nvidia remains behind Apple in

market value, at $3.23 trillion. Nvidia shares rose 2.6%

pre-market.

Trump Media and Technology Group (NASDAQ:DJT) –

Gerald Shvartsman was sentenced to 22 months in prison for trading

shares of Digital World Acquisition Corp. using insider information

about its merger with Donald Trump’s media company before it was

announced. He earned more than $4.6 million from the trades, being

part of a group of three investors charged with fraud. Trump Media

shares rose 3.2% pre-market after closing up 15.5% on

Wednesday.

ASML (NASDAQ:ASML) – ASML Holding NV is in

talks with the Dutch regulator after it published its financial

results a day early due to a technical error. The AFM regulator

confirmed discussions but did not comment on potential

repercussions. ASML shares fell after the results, with investors

and analysts cautious after the company lowered its financial

outlook for 2025, citing weakness outside the AI market and delayed

orders. Despite its essential role in the chip sector, doubts have

arisen over short-term sales. Shares rose 0.3% pre-market after

closing down 6.4% on Wednesday.

BlackBerry (NYSE:BB) – BlackBerry forecasted

higher-than-expected profits for the next fiscal year and is

exploring options for its Cylance division. The company plans to

increase investments in high-growth areas such as IoT and secure

communications while seeking to separate its cybersecurity and IoT

divisions. BlackBerry expects EBITDA between $50 million and $60

million for fiscal 2026, above the forecast of $47.8 million.

Annual revenue remains projected between $ 91 million and $616

million, with EBITDA of up to $10 million. The IoT division’s

revenue is expected to reach between $225 million and $235 million

in 2025. Cylance, however, will record an adjusted loss of $51

million this fiscal year. BlackBerry shares closed 4.4% higher on

Wednesday.

America Movil (NYSE:AMX) – America Movil will

focus on expanding 5G technology in 2024, particularly in Latin

America, according to its CEO, Daniel Hajj. The company, controlled

by Carlos Slim, had already planned this expansion within its $7

billion budget for 2023. The company is also considering

partnerships with SpaceX and debt refinancing.

Uber Technologies (NYSE:UBER), Expedia

Group (NASDAQ:EXPE) – Autonomous food delivery robots from

Serve Robotics, backed by Nvidia, will be launched by Uber Eats in

2025. These third-generation robots are faster, have greater load

capacity, and are more efficient. The company plans to operate

2,000 robots by 2025, starting with 250 in the first quarter.

Additionally, the Financial Times reported that Uber Technologies

was considering acquiring Expedia. Although Uber’s interest is in

the early stages, and no negotiations are ongoing, the acquisition

would bolster Uber’s plans to become a “super app.” Uber shares

fell 2.4% pre-market, while Expedia shares rose 6.5%.

Instacart (NASDAQ:CART) – Instacart has

appointed Anirban Kundu, former head of engineering at Uber, as

chief technology officer, after the position was vacant for eight

months. Kundu, who led the development of Uber Eats, will start on

October 28. His experience in scalable technical systems will help

drive Instacart’s growth in advertising and e-commerce.

Walt Disney (NYSE:DIS) – Disney is launching

the Lightning Lane Premier Pass, which offers direct access to

popular attractions at its theme parks, priced between $129 and

$449, depending on the park and date. The new pass, available in

October, provides a VIP option while visitors choose between paying

for the privilege or sticking with the more affordable and

traditional options.

Comcast (NASDAQ:CMCSA) – Comcast’s NBCUniversal

plans to add its regional sports channels to the Peacock streaming

service in 2025, including broadcasts of games from teams like the

Warriors, Celtics, and Phillies. The games will still air on TV,

but the channels may be offered as paid add-ons. The launch could

be delayed. Comcast shares fell 0.3% pre-market after closing up

0.3% on Wednesday.

Boeing (NYSE:BA) – Boeing plans to raise $15

billion through stock and mandatory convertible notes to strengthen

its finances, impacted by a strike. The company is also considering

a transaction to raise an additional $5 billion. The capital raise

could occur after the strike to protect its credit rating,

preventing it from being downgraded to “junk” status. Boeing faces

$11 billion in debt through 2026, and the issuance of convertible

notes could attract investors as it is more favorable to current

shareholders. Boeing shares fell 0.5% pre-market after closing up

1.7% on Wednesday.

Ryanair (NASDAQ:RYAAY) – Ryanair will lower its

traffic estimates for next year due to delays in Boeing aircraft

deliveries, impacted by a strike and supply chain issues. CEO

Michael O’Leary stated that the airline expects fewer planes than

anticipated, affecting its planned growth.

American Airlines Group (NASDAQ:AAL),

Delta Air Lines (NYSE:DAL) – American Airlines and

Delta were provisionally selected for new long-haul flights at

Ronald Reagan National Airport, excluding low-cost carriers such as

Spirit and JetBlue. Other approved routes include Southwest,

Alaska, and United. Spirit and Frontier expressed disappointment

with the decision. American Airlines shares fell 0.2% pre-market

after closing up 7.2% on Wednesday. Delta shares are down 0.6%

after rising 6.8% yesterday.

Tesla (NASDAQ:TSLA) – Amid declining shares and

demand for electric vehicles, Elon Musk appointed Omead Afshar to

lead Tesla’s operations in North America and Europe. Afshar,

Tesla’s vice president since 2017 and a close confidant of Musk,

will take over responsibilities previously held by Tom Zhu,

reporting directly to Musk. Tesla shares rose 0.4% pre-market after

closing up 0.8% on Wednesday.

Stellantis (NYSE:STLA) – The White House urged

Stellantis to fulfill commitments to the UAW union and the

communities affected by U.S. factory closures. The automaker faces

pressure over delayed investments and strike threats. Stellantis

reiterated its commitment to creating jobs and investing in the

U.S. Stellantis shares rose 0.7% pre-market after closing up 0.9%

on Wednesday.

General Motors (NYSE:GM) – General Motors and

Foxconn plan to replace imports with production in Mexico, with an

announcement expected by the end of the month. The government is

also negotiating with companies like DHL and Stellantis to expand

local production.

Windrose Technology – Chinese startup Windrose

Technology plans to expand its electric truck production to France

and Belgium and is considering listing in Brussels. The company,

seeking to raise $400 million in New York, plans to use the funds

for research, development, and production of zero-emission

autonomous trucks.

Pony.ai – Autonomous driving startup Pony.ai

plans to hold a U.S. IPO, aiming to raise up to $300 million,

according to sources. Guangzhou Automobile Group, an investor in

another autonomous vehicle company, WeRide, is considering

participating in the IPO. Founded in 2016, Pony.ai operates

autonomous fleets in the U.S. and China.

BHP (NYSE:BHP) – BHP exceeded iron ore

production estimates in the first quarter, driven by operational

improvements in Western Australia and a recovery in China’s real

estate market. Production reached 71.6 million metric tons,

surpassing the forecast of 70.7 Mt. BHP also recorded a 4% increase

in copper production during the quarter. Shares fell 0.2%

pre-market after closing down 2.5% on Wednesday.

Goldman Sachs (NYSE:GS) – Goldman Sachs expects

the Federal Reserve to consecutively cut interest rates by 25 basis

points from November 2024 to June 2025, reaching 3.25%-3.5%. The

current rate is 4.75%-5.00%. The bank also anticipates similar cuts

at the European Central Bank, reaching 2% by June 2025.

Additionally, Goldman Sachs’ investment arm, the second-largest

shareholder in Northvolt AB, is considering participating in a

financial bailout for the battery manufacturer, which is facing a

liquidity crisis. Northvolt is seeking to raise $218 million, with

Goldman involved in negotiations to find a solution, encouraging

other investors to join. Shares fell 0.9% pre-market after closing

up 1.4% on Wednesday.

Morgan Stanley (NYSE:MS) – Traders and bankers

at Morgan Stanley drove a 32% increase in third-quarter earnings,

beating expectations and boosting the stock by 6.5% on Wednesday.

Revenue of $15.4 billion was driven by a 13% increase in trading

and record performance in the wealth management unit.

Robinhood (NASDAQ:HOOD) – Robinhood launched

its desktop platform, “Robinhood Legend,” and added options,

futures, and index trading to its mobile app. The fintech, known

for commission-free trading, now aims to serve experienced

investors and compete with traditional brokerages like Schwab and

Fidelity. The platform offers advanced tools and competitive

commissions. Shares rose 2.5% pre-market after closing up 0.5% on

Wednesday.

Nike (NYSE:NKE) – Nike is betting on its All

Conditions Gear (ACG) line, which makes hiking and outdoor gear

like boots and waterproof jackets, to drive global growth. Angela

Dong will lead ACG, initially focusing on China, while Scott

LeClair will take over as vice president and general manager of the

division. Shares are nearly flat in pre-market trading after

closing up 2.2% on Wednesday.

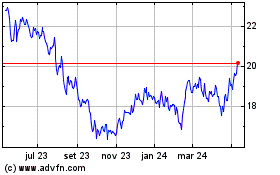

America Movil SAB de CV (NYSE:AMX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

America Movil SAB de CV (NYSE:AMX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025